Bitcoin has posted a double-digit rebound and briefly traded above $72,000, prompting some to believe the $60,000 zone marked a short-term bottom. However, market data shows that top traders and market makers are still reluctant to turn bullish.

Over the past four days, Bitcoin has moved within a tight 8% range, consolidating near $69,000 after an abrupt drop to $60,130 last Friday. The correction comes as traditional assets remain strong, with the S&P 500 hovering near record highs and gold gaining about 20% in just two months.

The current caution is largely rooted in Bitcoin’s previous drawdown, when the asset plunged as much as 52% from its October 2025 all-time high of $126,220. That shock has pushed professional traders into a defensive stance, with many still concerned that downside risks have not fully disappeared.

Whales and market makers reduce long exposure

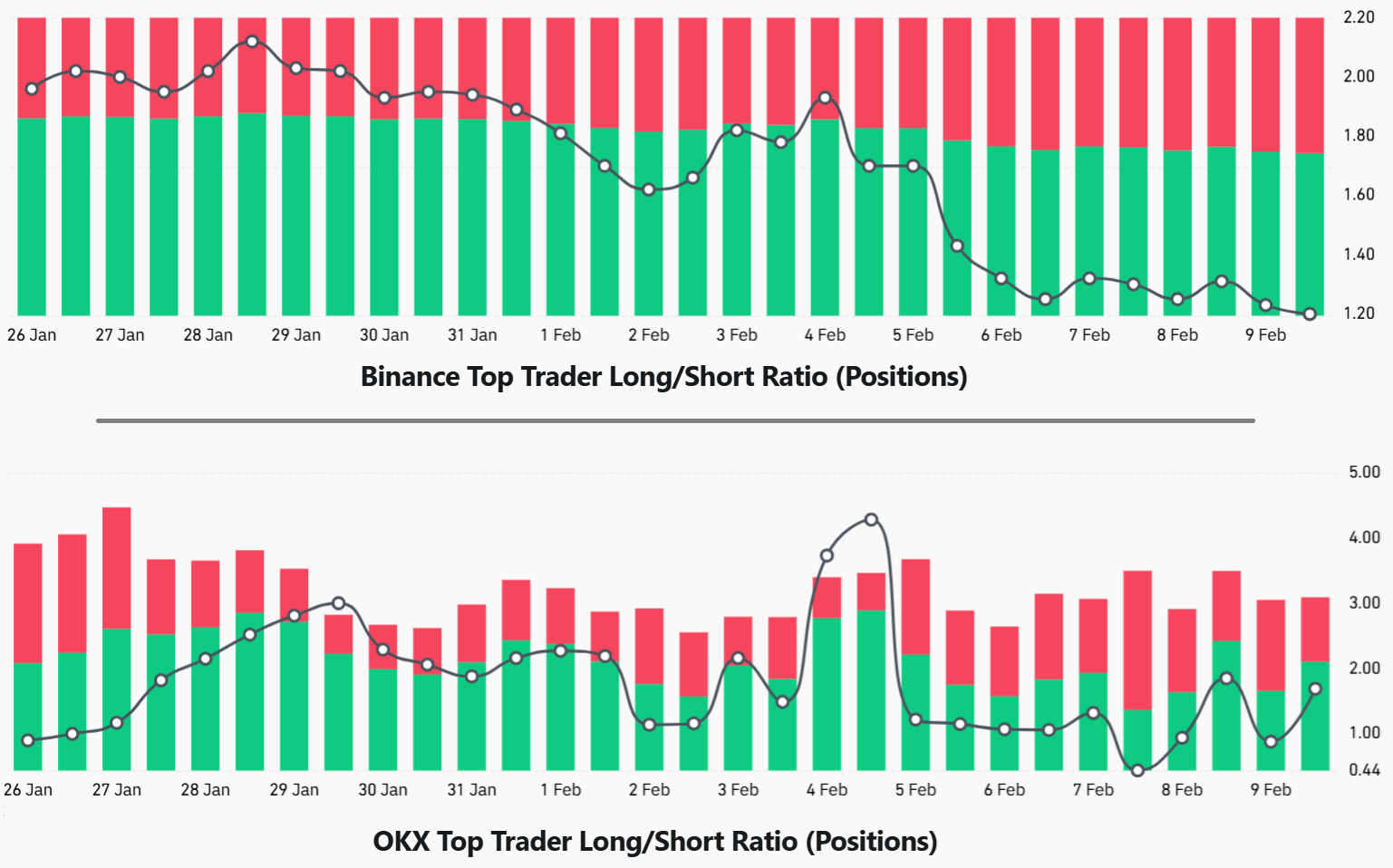

On Binance, whales and market makers have steadily trimmed bullish positions since mid-week. The long-to-short ratio fell sharply from 1.93 to 1.20, the lowest level in 30 days. This indicates cooling demand for leveraged long positions in futures and margin markets, even as BTC recently traded near its lowest levels in 15 months.

At OKX, the long-to-short ratio among top traders also dropped from 4.3 to 1.7 within days. This move coincided with roughly $1 billion in Bitcoin futures liquidations, where many long positions were forcibly closed due to insufficient margin. Importantly, these exits reflect forced deleveraging rather than a clear directional bet that prices will continue to fall.

ETF inflows show whales are still bullish

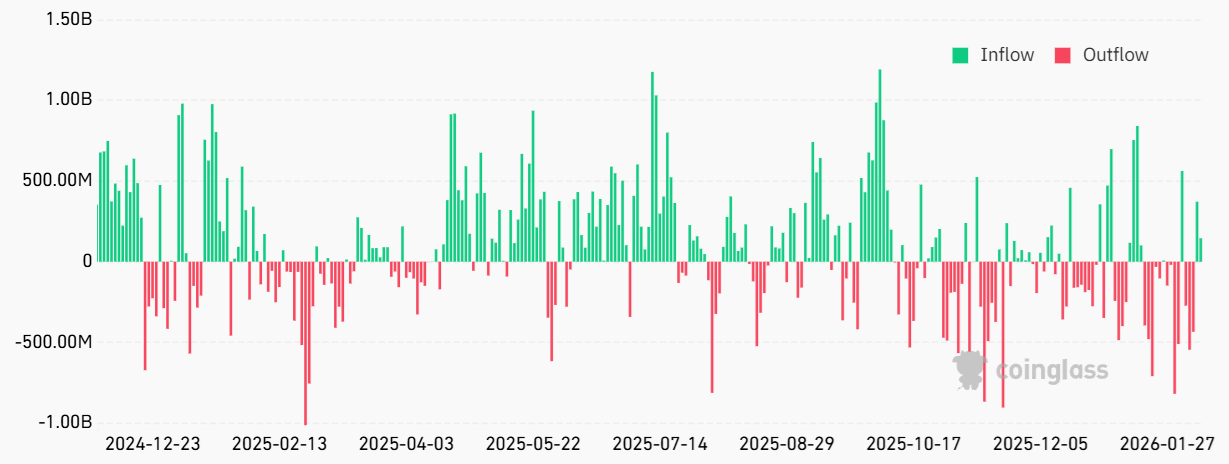

In contrast to caution in derivatives markets, spot Bitcoin ETFs in the US are sending a more constructive signal. Since Friday, US-listed Bitcoin ETFs have attracted around $516 million in net inflows, reversing the trend seen in the prior three sessions.

This suggests the factors that drove $2.2 billion in net outflows between Jan. 27 and Feb. 5 have begun to fade. One theory points to the collapse of an Asian fund that used leverage through ETF options funded by cheap Japanese yen borrowing.

Franklin Bi, a general partner at Pantera Capital, believes the pressure likely came from a non-crypto-native trading firm caught in a broader cross-asset margin unwind. At the same time, precious metals also sold off sharply. Silver, for example, plunged about 45% in just seven days, erasing two months of gains.

Options market leans defensive

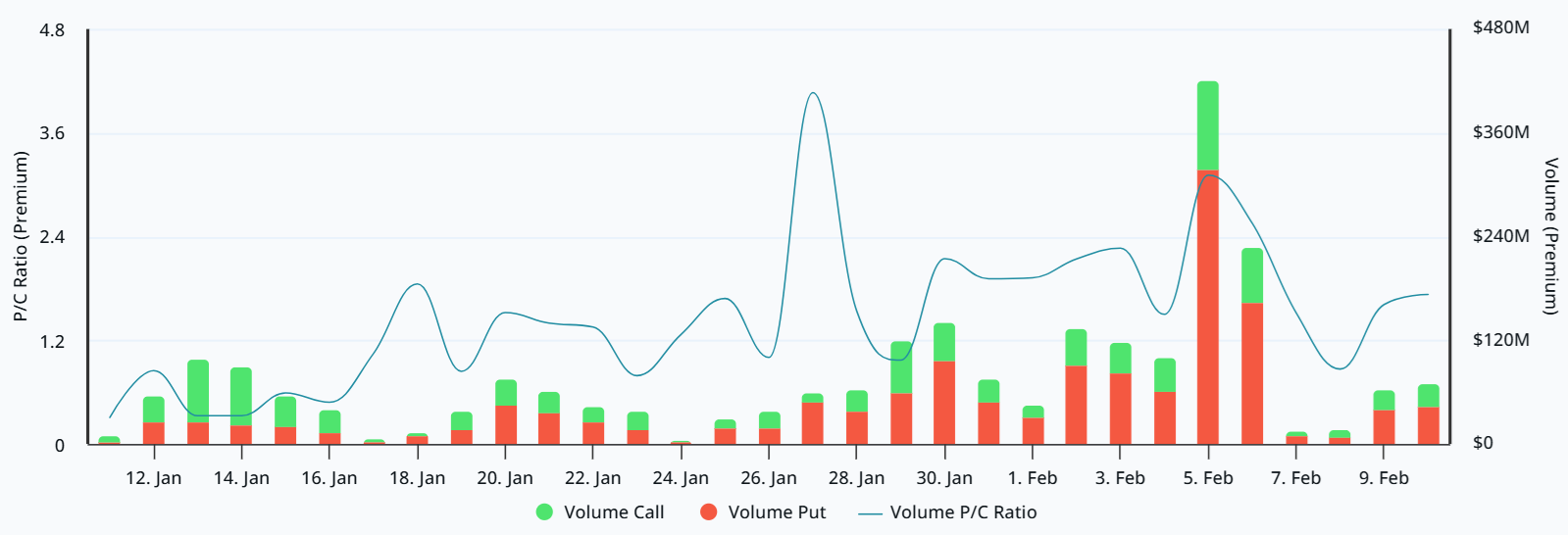

The Bitcoin options market has also reflected a shift toward neutral-to-bearish positioning after BTC slipped below $72,000. The put-to-call ratio on Deribit spiked to 3.1, showing strong demand for downside protection, before easing back to around 1.7.

Overall, the past two weeks have seen weak demand for outright bullish strategies through Bitcoin derivatives. While sentiment has deteriorated, the reduction in leverage is considered healthy, as it creates a more sustainable base for future upside once market conditions improve.

For now, it remains unclear what catalyst could push investors back into aggressive Bitcoin positioning. Core fundamentals such as censorship resistance and fixed monetary policy remain unchanged, but uncertainty following the crash has left traders waiting for confirmation that exchanges and market makers were not structurally damaged by the sell-off.

In other words, the lack of derivatives demand does not necessarily signal lost confidence. Instead, it reflects a period of hesitation, as the market looks for proof that the recent shock has truly passed.