The daily trading volume of TONcoin has surged to an unprecedented level, reaching an astonishing $314 million. Despite the recent increase, TONcoin’s EMA indicators signal a continued upward trend, suggesting further potential for price appreciation.

The Majority of Holders Are Now Profitable

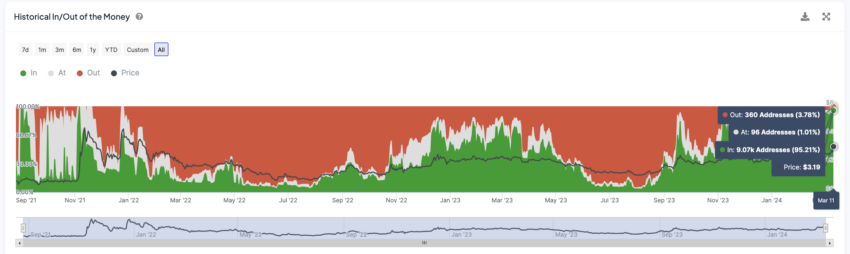

However, a concerning underlying factor is the elevated profit-holding ratio, currently at 95%, the highest since 2021. Historically, this indicates the possibility of impending selling pressure.

TON Daily Trading Volume (USD). Source: Santiment.

TON Daily Trading Volume (USD). Source: Santiment.

Recent daily trading volumes for TONcoin have skyrocketed to an all-time high, hitting an impressive $314 million. This notable milestone has surpassed the previous record set just two weeks ago on February 28th, with a trading volume of $295 million. Notably, a significant and consistent correlation has been observed between TON price fluctuations and its trading volume, highlighting a tight connection between these two trends. As trading volume increases, the price of TONcoin tends to follow suit. Consequently, investors are growing increasingly optimistic that the upward trends in both trading volume and token price may persist in the near future.

TON Historical In/Out of the Money. Source: IntoTheBlock.

A substantial majority of Toncoin holders currently find themselves in a profitable position. Analyzing the distribution of Toncoin holders based on their profit and loss positions paints an intriguing picture. Over 95% of Toncoin holders are currently in profit, marking the highest profit level since 2021. This statistic, derived from the “money in, money out” index, provides a valuable insight into investor sentiment.

TON Price Prediction: Can It Reach $4?

TON 4H Price Chart. Source: TradingView.

TON 4H Price Chart. Source: TradingView.

Toncoin still has significant room for growth before reaching its all-time high. The price needs to increase by an additional 22% to revisit those peaks. This suggests that the market may still be in an accumulation phase, and investors may maintain their positions with the anticipation of further price increases.

Related: What is Toncoin and How Does It Work?

However, caution is warranted in acknowledging the potential for selling pressure. The recent 37% price surge undoubtedly has put many owners in a profitable position. Some may choose to realize their gains by liquidating a portion of their holdings. This potential selling pressure needs close monitoring, especially if it coincides with the weakening of current upward trend signals identified through technical analysis.

On the flip side, positive developments could continue to drive Toncoin’s price upward. A recent revelation states that Telegram, with Toncoin channel owners, is a case in point:

"The company (@telegram) will pay out rewards using Toncoin on the TON Blockchain. Channel owners will start receiving 50% of all revenue that the company makes from displaying ads in their channels." #TONxTelegram

Via @TechCrunch 👇https://t.co/1Tmbw4zbsW

— TON 💎 (@ton_blockchain) March 8, 2024

Telegram will reward channel owners using Toncoin on the TON Blockchain. Channel owners will begin receiving 50% of the total revenue the company earns from displaying ads on their channels.

If the current upward trend persists, Toncoin may experience a substantial price increase. Surpassing the $4 milestone would signify a breakthrough to unseen levels since 2021, opening up the possibility of even higher price points.

swesome..

Kbeasy35@gmail.com. This is amazing.

Already at $4

Ton growing from $4 to $20 in this bullrun