Technical indicators suggest that Toncoin could head to a 30-day low, with bearish sentiment fueling the possibility of further price declines.

Toncoin Struggling as Demand Weakens

Toncoin’s price is currently below the Ichimoku Cloud, an indicator that measures market trends, momentum, and support/resistance levels.

When an asset’s price falls below the Cloud, it indicates that the asset is in a downtrend. This reinforces the negative sentiment in the market, indicating that sellers are in control and prices could continue to fall. In this scenario, the Cloud acts as a resistance level, making it difficult for the price to break through without a strong increase in buying pressure.

Additionally, TON’s Aroon Up Line is at 0%, indicating that its price has not made a new high recently. The Aroon indicator measures the strength and direction of a trend.

When the Aroon Up Line is at 0%, this means that the asset’s price has not made a new high over the observation period (usually 14 days). The lack of new highs indicates negative sentiment in the market, as bullish momentum is weakening, implying that buyers are losing strength.

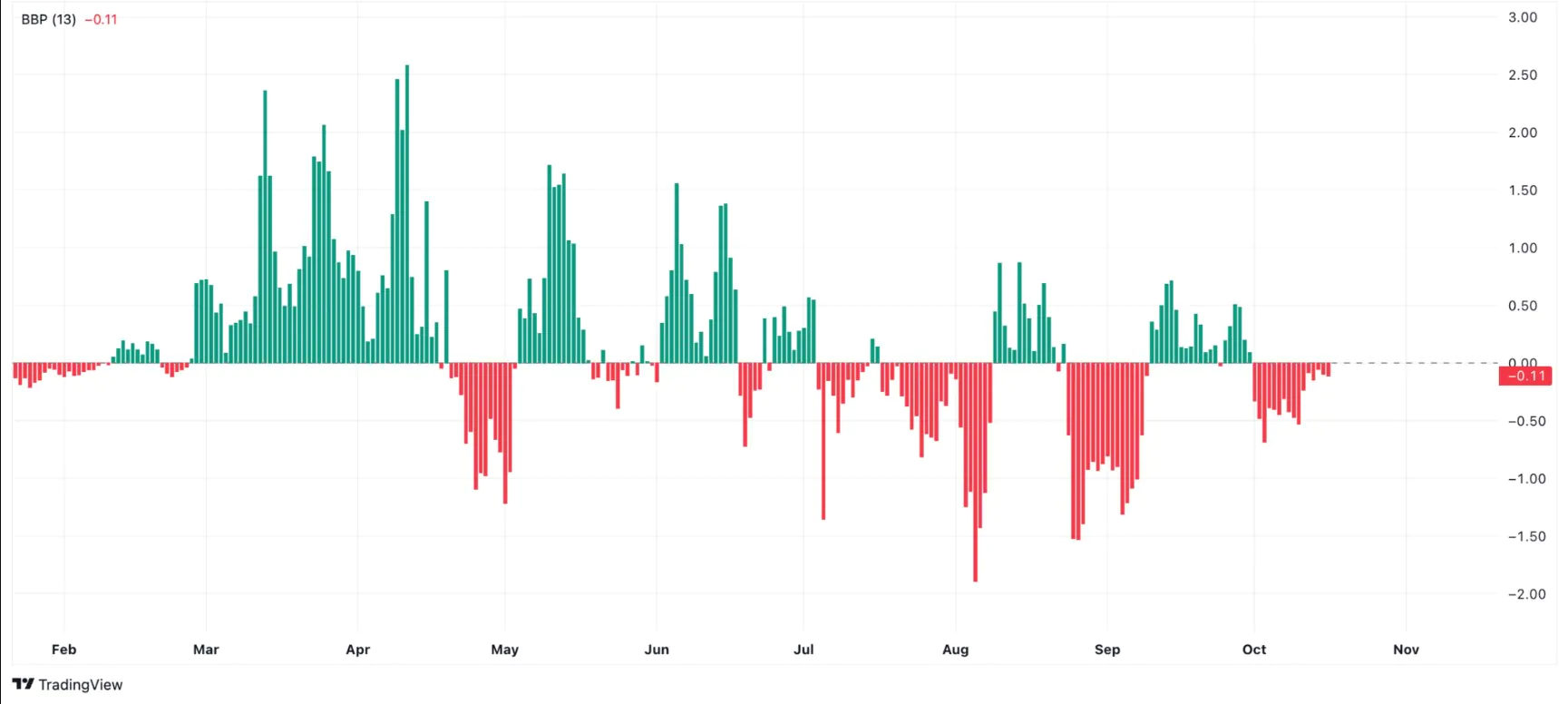

Toncoin’s Elder-Ray index also confirms this negative signal. At the moment, the index, which measures the buying and selling pressure in the market, is at -0.11. When an asset’s Elder-Ray index is negative, it indicates that sellers are dominating the market.

TON Price Forecast: Double-Digit Drop Ahead

If selling pressure spikes, Toncoin could see a further 15% drop, possibly trading as low as September 4 at $4.45. According to the Fibonacci Retracement tool, this represents its next major support level.

However, this bearish outlook could be refuted if demand for the altcoin picks up again. If buying pressure increases, Toncoin could break above the resistance established by the Ichimoku Cloud, opening the door for a rally to $7.46.