With Toncoin still fluctuating within this range, the likelihood of a correction is high. Despite the recent slight increase in price, a deeper analysis of technical indicators paints a different picture.

Toncoin is at Risk of a Price Drop

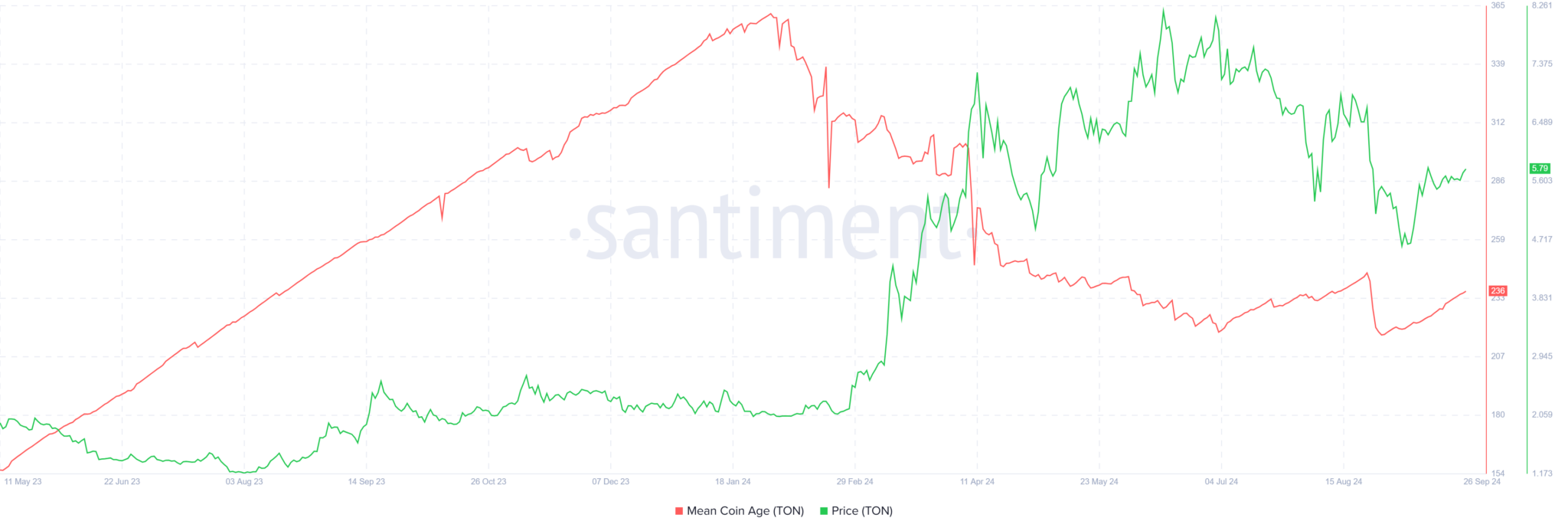

Toncoin’s long-term (LTH) investors have shown strong confidence by holding onto the asset without many transactions over the past month. This is further reinforced by the increase in Mean Coin Age (MCA), a measure of how long a coin has been in the same wallet. An increase in MCA typically indicates greater confidence from investors, as they decide not to sell despite market volatility.

However, Toncoin’s history shows that the rise in Mean Coin Age (MCA) has often preceded price declines. The lack of activity among long-term investors could be a sign of weakening market momentum, a familiar signal for price corrections. If this trend continues, the likelihood of a repeat of previous price declines is high, making Toncoin vulnerable to a correction in the near term.

In terms of the macro landscape, technical indicators are warning of a potential downturn for Toncoin. The Moving Average Convergence Divergence (MACD) indicator is approaching a double top divergence, which is often a sign of an impending reversal. This pattern, combined with the price making higher highs, suggests that the upward momentum may be slowing down.

A test of the $5.96 resistance level will be crucial to confirm this double top pattern. If Toncoin fails to break above this level, the bearish trend will be further reinforced. The divergence between the price action and the MACD indicator further increases the possibility of a correction in the coming days, with the risk of a sharp decline increasing.

TON Price Prediction: Watch the Volatility Pattern

Toncoin is currently trading around $5.80, close to the $5.96 resistance. Although there is a possibility of testing this resistance, the possibility of a breakthrough is not considered high based on current technical factors. If the price is rejected at this level, Toncoin could fall back to the $5.37 support zone.

Although the signal indicates a correction, Toncoin could hold above $5.37 if the bearish pressure does not become too strong. However, if the selling pressure increases, the price could fall further to $4.86. The market is watching Toncoin’s every move as it approaches these important levels.

Conversely, if the positive sentiment surrounding the start of Q4 increases, Toncoin could break out of its current consolidation range. If the resistance level of $5.96 is overcome, the price could rise to $6.36, thereby invalidating the bearish scenario. In this case, an uptrend could emerge, opening up new opportunities for investors.