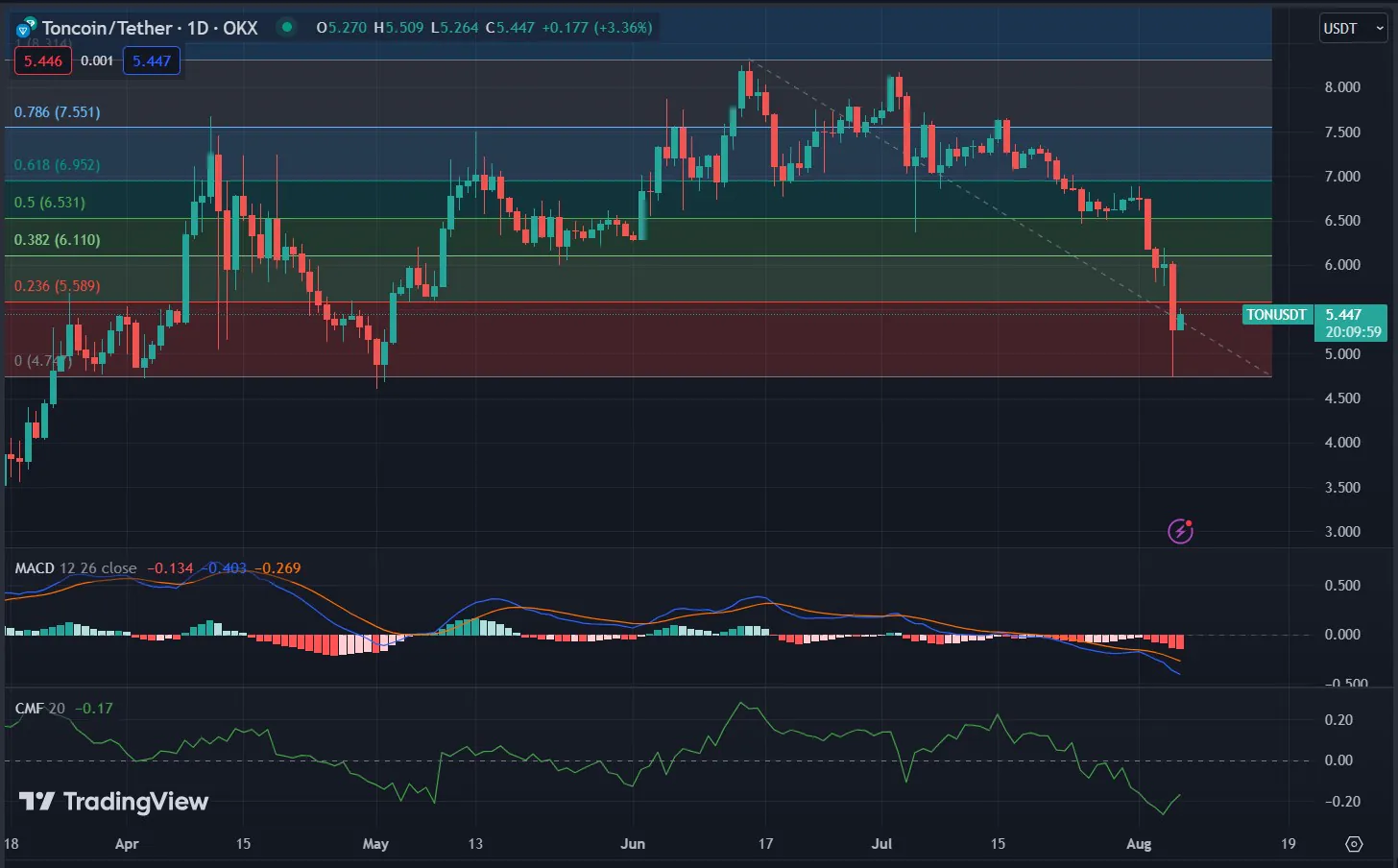

Technical indicators currently point to strong selling pressure. Although Fibonacci retracement levels could support a bullish recovery, the overall outlook remains cautious.

With Bitcoin (BTC) struggling around the $60,000 threshold, the general sentiment in the cryptocurrency market appears pessimistic in the short term. A potential price rebound to clear short-sell liquidations might occur, providing temporary relief before the downtrend resumes.

Key support levels to watch: $5.8 and $5.36

TON’s daily market structure remains bearish, with a significant value gap around $6.5. Any price recovery attempting to clear liquidation levels is likely to face rejection at this point. The downward movement of the MACD throughout July and the four-month low in the CMF indicate persistent selling pressure and bearish momentum since the rejection at $7.7. Consequently, trend-following traders are eyeing the 78.6% retracement level at $5.36, hoping the downtrend will fade, thereby creating a potential buying opportunity.

Despite the recent price decline, the average age of Toncoin (TON) continues to rise, indicating network-wide accumulation. However, the MVRV ratio has plummeted to levels not seen since early May, suggesting that short-term holders are experiencing significant losses, which could imply the coin is undervalued. Previously positive social sentiment has also decreased, raising doubts about the reliability of the $5.86 support level. Buying at the current level carries inherent risks due to prevailing market conditions.

In summary, Toncoin is facing substantial selling pressure, with key support levels at $5.8 and $5.36 being closely monitored. While the accumulation trend shows some investor confidence, the overall market sentiment remains pessimistic. Traders should exercise caution and consider the possibility of further price declines. As always, due diligence and market condition analysis are essential before making any investment decisions.