However, what is interesting is that while the coin’s price volatility has remained erratic, Toncoin’s adoption in the market has skyrocketed. So the question is – Will this be enough to push the coin’s price even higher?

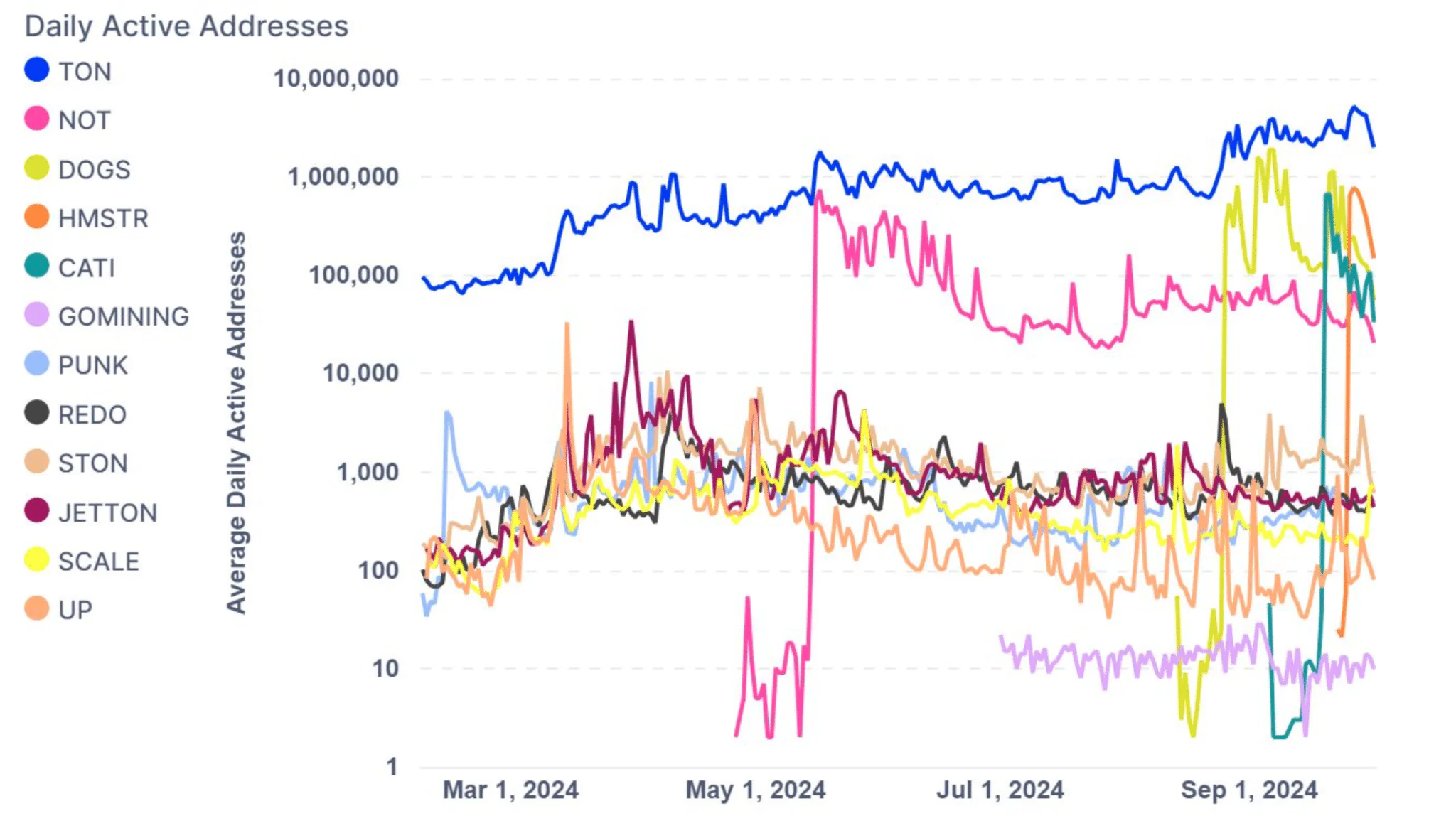

Deep Dive Into the Toncoin Ecosystem IT Tech, a popular cryptocurrency analyst, shared on Twitter some notable developments related to the Toncoin ecosystem. First, the tweet mentioned that Toncoin’s daily active addresses have increased sharply, reaching 3.8 million by the end of September, up from 2.2 million in August.

This clearly shows a significant increase in Toncoin’s global adoption and usage. Another notable development involves the “whales”. According to the tweet:

“The concentration of ‘whales’ is very high in the TON ecosystem, with GOMINING and JETTON accounting for 97% of the total volume. The dominance of large investors can impact market dynamics, affecting retail investors and the overall liquidity of the market.”

In addition, the price movement of the token has remained quite stable. Despite the market fluctuations, Toncoin’s market capitalization remained at $13.4 billion as of the end of September. This reflects investor confidence and Toncoin’s solidity in the ecosystem, providing a sense of security amid the fluctuations.

Will these factors help TON turn bullish?

While the above happened, the price of TON fell by more than 9% in the past week. However, in the past 24 hours, the situation has turned in favor of investors as Toncoin recorded a price increase of more than 1.8%. At the time of writing, the token is trading at $5.35.

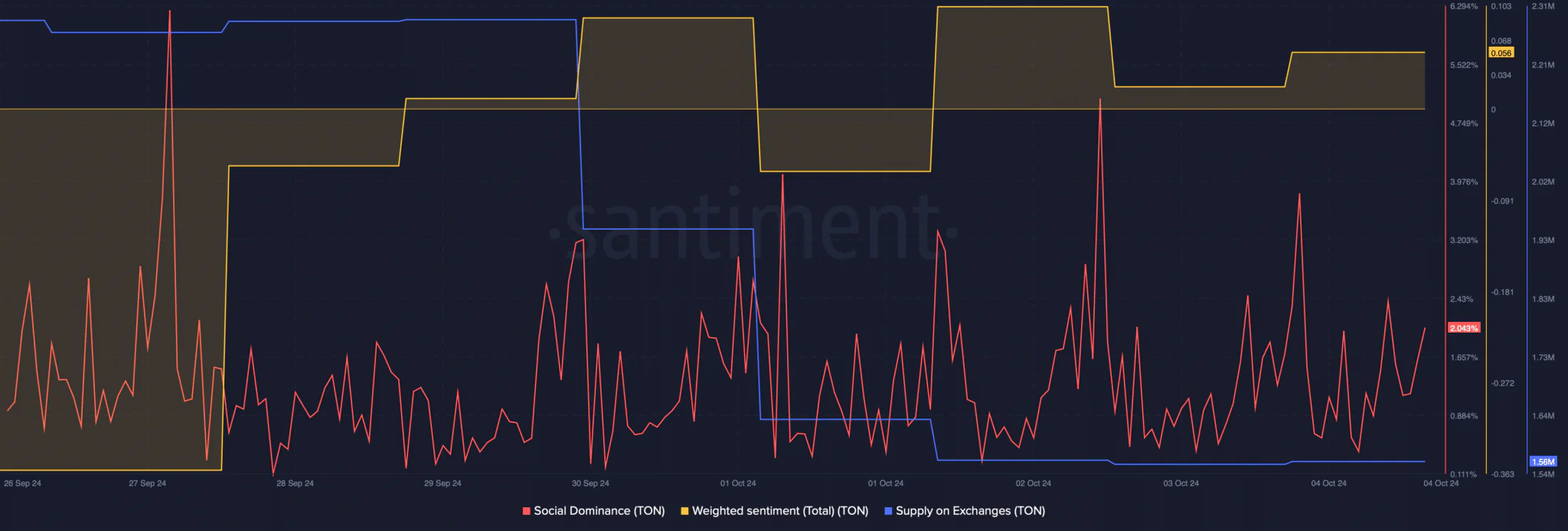

To see if the increased adoption and the aforementioned factors are enough to sustain this uptrend, we looked at on-chain data. According to Santiment’s analysis, Toncoin’s market sentiment has remained positive for most of the past week. This shows that optimism about the token is high. At the same time, the level of discussion about TON on social media is also quite high, reflecting its popularity in the crypto community.

In addition, the supply of TON on exchanges has decreased sharply, indicating that investors are buying in the hope that the price will continue to increase in the coming days.

We also checked the TON daily chart to see what market indicators suggest about the possibility of maintaining the uptrend. According to our analysis, the price of TON has touched the lower limit of the Bollinger Bands. Whenever this happens, the probability of a strong price increase is usually very high. If this scenario actually plays out, TON’s first target could be $6.8. However, if the bears gain the upper hand, the token’s price could drop to $4.4 on the chart.