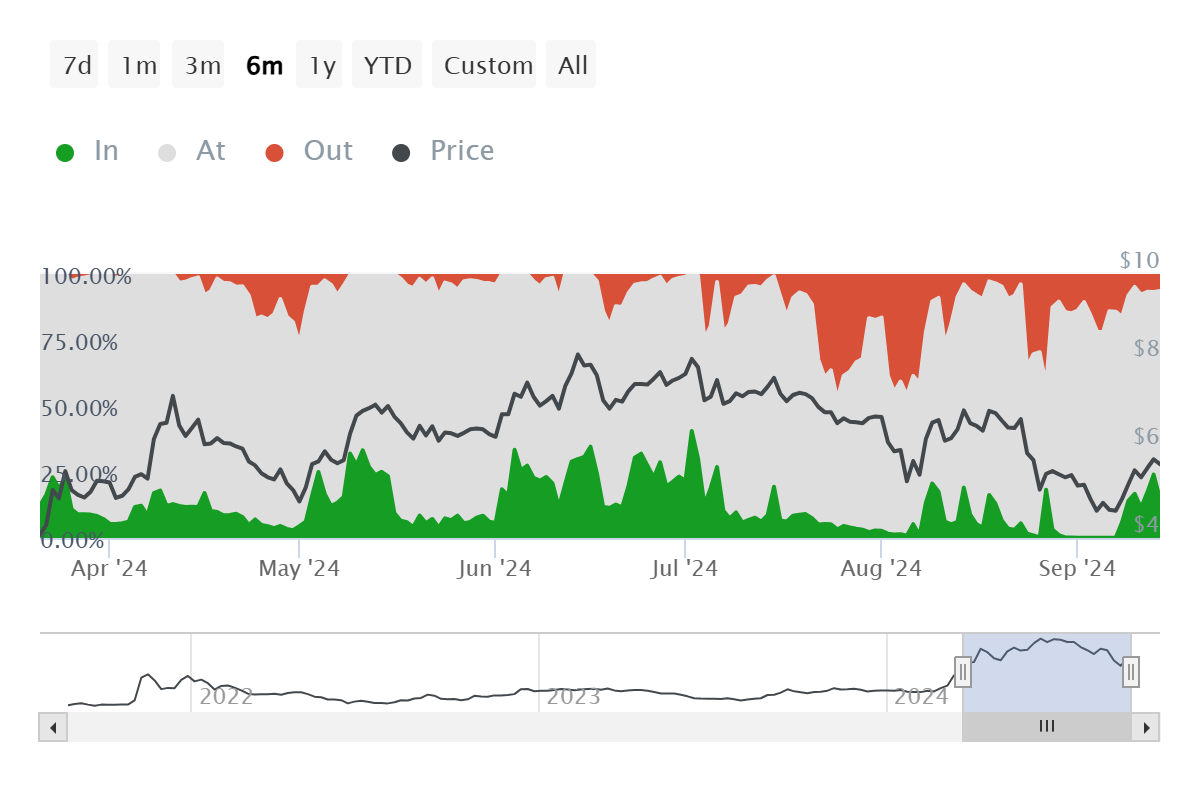

Both market indicators and the fact that TON holders are refraining from taking profits support this optimistic outlook.

Toncoin shows signs of revival

From a technical standpoint, Toncoin’s macro momentum suggests bullish potential. The Moving Average Convergence Divergence (MACD) indicator is forming a double-bottom bullish divergence, often signaling an impending price increase.

The indicator is also nearing a bullish crossover, as the bars on the chart reflect a weakening downtrend. This shift in market sentiment could significantly benefit Toncoin’s price.

Currently, market sentiment surrounding Toncoin appears relatively stable. According to the latest data, active profitable addresses show that selling pressure is low. Investors in profit account for less than 16% of all active addresses, typically a bullish indicator.

When this figure exceeds 25%, it often signals downward momentum, as increased selling can drive prices down. Fortunately, this scenario is not unfolding, allowing Toncoin room to rebound. The market’s cautious optimism suggests that prices could rise further, assuming other conditions remain favorable.

TON Price Prediction: Short-term Upswing Expected

Toncoin is currently trading at $5.62, hovering near the invalidation point of a head-and-shoulders bearish pattern, which initially indicated a potential 41% decline to $2.79. However, this bearish outlook will be officially nullified if Toncoin can flip the $6.04 level into support. Achieving this would confirm a shift in market sentiment, potentially setting the stage for sustained upward momentum.

Should Toncoin successfully break past the $6.04 resistance, it could aim for $7.09, a key resistance level. Reaching this price would yield significant returns for investors, bolstering confidence in the cryptocurrency’s long-term potential. Such a surge could also attract more buyers, further fueling Toncoin’s price trajectory in the coming weeks.

On the other hand, failing to reclaim the $6.04 level could trigger a pullback to $4.80, the breakout point. If Toncoin falls below this support, it may decline to $4.29, which would invalidate the current bullish thesis and increase downward pressure on the market.