This price rise occurs just before today’s US Federal Open Market Committee (FOMC) meeting. Federal Reserve officials are anticipated to maintain a dovish stance, keeping interest rates steady at 5.25%—5.50%. Traders should brace for potential volatility post-FOMC meeting, given the fluctuating price movements observed since Monday.

TON and Trust Wallet Announce Integration

On July 30, Trust Wallet revealed its strategic partnership with Toncoin, enabling its users to engage effortlessly with the Telegram ecosystem. The TON Blockchain underpins this ecosystem, driving decentralization through web3 initiatives and rapidly emerging as one of the industry’s fastest-growing networks, connecting project founders, developers, and users.

Trust Wallet & @ton_blockchain are joining forces🔥

We’re working with the #TON team to make the TON & #Telegram ecosystem even more accessible to all #TrustWallet users! Stay tuned for further updates.

Explore $TON in Trust Wallet now👇https://t.co/2J9OHmd6qS pic.twitter.com/lq6CQaByRP

— Trust Wallet (@TrustWallet) July 30, 2024

Trust Wallet, a premier mobile crypto wallet, offers secure storage, buying, swapping, and management of various cryptocurrencies and NFTs. It facilitates user interaction with decentralized applications (DApps) and supports multiple blockchains, making it an essential tool for crypto enthusiasts.

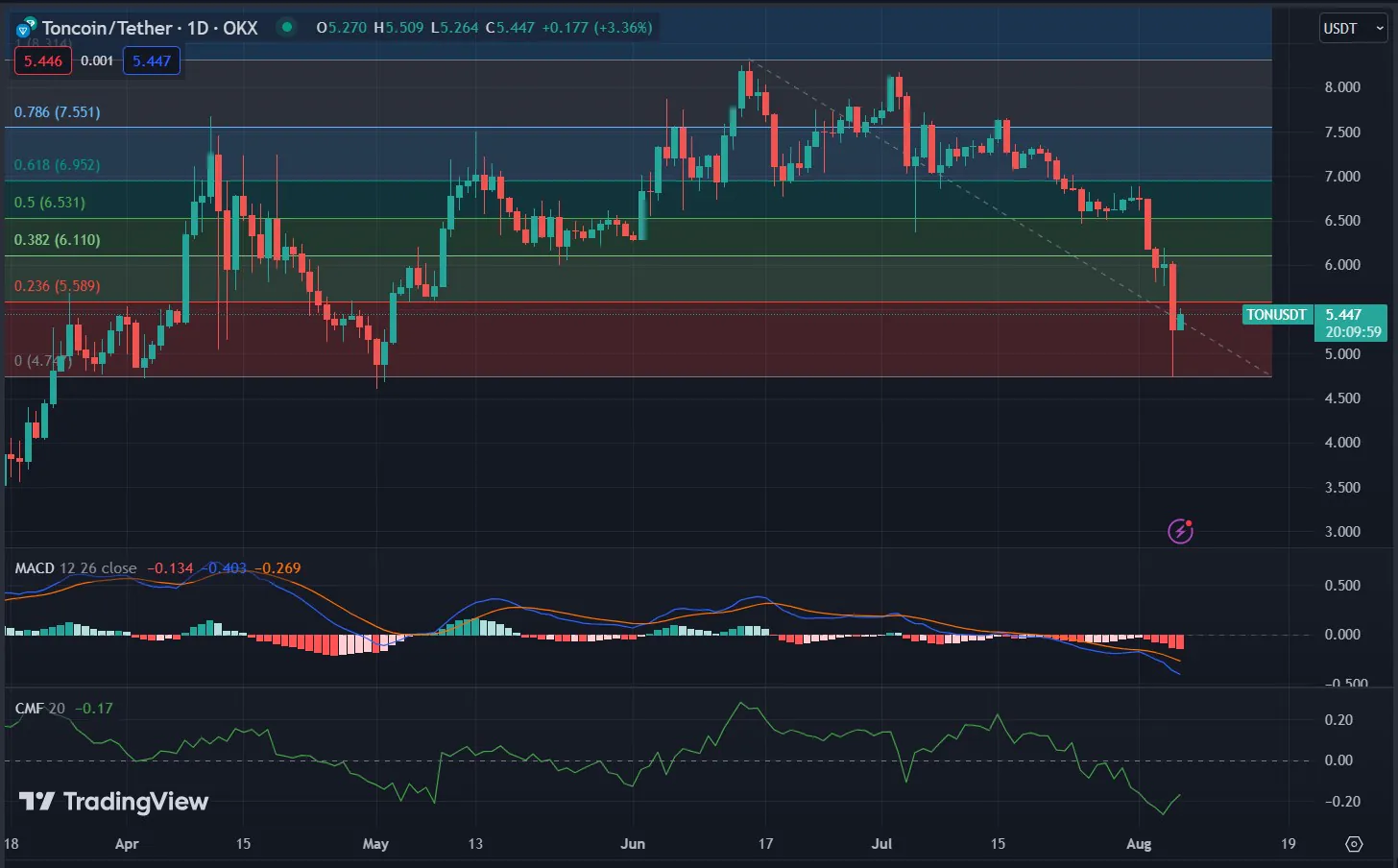

Toncoin Price Gains After Key Support

Toncoin’s price discovered robust support at $6.5, bolstered by an ascending trendline, which enabled bulls to initiate a trend reversal. Traders have been contending with a pronounced downtrend since TON peaked at its all-time high of $8.28.

Bearish indicators from the Moving Average Convergence Divergence (MACD) and the Relative Strength Index (RSI) have prompted traders to short Toncoin. Since the beginning of July, the RSI has shown a consistent downward trend within the neutral zone.

Should the price remain above the trend line by week’s end, bullish momentum might gain strength, potentially breaking through the $7.5 resistance level and advancing towards $10. The MACD could confirm a buy signal on the daily chart, further propelling the uptrend. Traders looking to leverage this indicator should wait for the blue MACD line to cross above the red signal line within an overall upward trend towards the neutral zone before placing buy orders.

The initial profit target is $7.5. However, if the price surpasses this level, Toncoin could rally to $8 and possibly enter a discovery phase, aiming for new all-time highs.

Conversely, a death cross pattern heightens the risk of a continued decline below the trend line and support at $6. This pattern emerged when the 20-day EMA fell below the 50-day EMA. Depending on the intensity of the market headwinds, a more significant sell-off to $5 cannot be ruled out.

1982

Shamaaj@gmail.com