An anonymous trader on the decentralized derivatives exchange Hyperliquid — who shocked the market by earning $192 million in profits just minutes before Donald Trump announced new tariffs on China — has once again opened a massive short position, betting on another downturn in the crypto market.

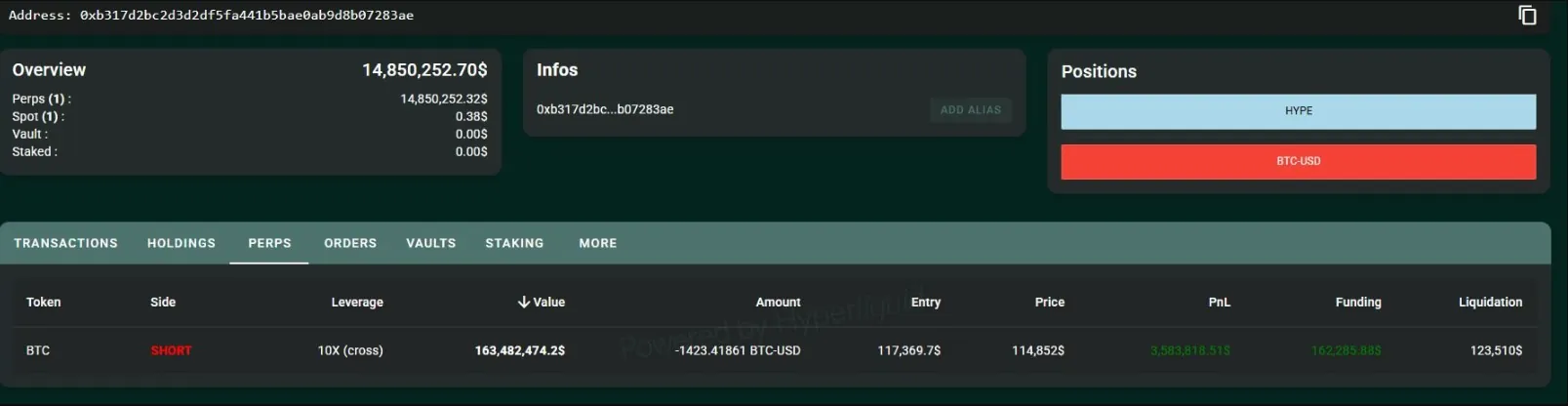

According to on-chain data, the wallet 0xb317, dubbed the “insider whale,” recently opened a $163 million perpetual short contract on Bitcoin with 10x leverage on Sunday. The position is currently showing a $3.5 million profit, but will be liquidated if BTC climbs above $125,500.

The crypto community was already buzzing last week after this trader placed a short just 30 minutes before Trump’s 100% tariff announcement, which sent the entire market into a tailspin — yet earned the trader a staggering $192 million windfall.

Suspicions Rise Over “Insider Whale” Manipulation

The uncanny timing of these trades has fueled speculation that the trader may have access to insider information or even market-manipulating power. Some analysts believe that the whale’s enormous short positions may have triggered a leverage wipeout across the crypto market over the weekend.

“This guy shorted another nine figures worth of BTC and ETH just minutes before the crash began,” noted analyst MLM. “And that’s only what’s visible on Hyperliquid — imagine what he might have done on centralized exchanges.”

According to data from HyperTracker, more than 250 wallets lost millionaire status on Hyperliquid following Friday’s crash. Meanwhile, another trader has taken the opposite bet, opening a $11 million long position on Bitcoin with 40x leverage, signaling growing speculation on both sides of the market.

Binance Draws Scrutiny Amid Market Chaos

At the same time, many in the community have suggested that Binance, the world’s largest crypto exchange, may have contributed to the market chaos. Reports claim its order books and market makers malfunctioned, stop-losses failed to trigger, and several tokens depegged or crashed to zero.

However, Binance denied any involvement, asserting that “no crash actually occurred” and blaming the confusion on a “display issue.” In a Sunday update, the exchange emphasized that its core spot, futures, and API trading systems remained fully operational during the event.

While maintaining its innocence, Binance still paid out around $283 million in compensation to traders holding USDE, BNSOL, and WBETH as collateral, who were liquidated due to the depegging issue.

Notably, Binance’s native token BNB has rebounded strongly, surging over 14% in the past 24 hours to reclaim the $1,300 level, offering a glimmer of optimism after one of the market’s most volatile weekends.