In a petition sent to the bankruptcy court, the attorney representing the crypto exchange denied the request from the US Internal Revenue Service (IRS). This lawyer asked them to recalculate and clarify the tax proposal that the IRS is imposing on FTX.

FTX still maintains that the exchange does not owe taxes. While the IRS requires FTX to pay up to 24 billion USD.

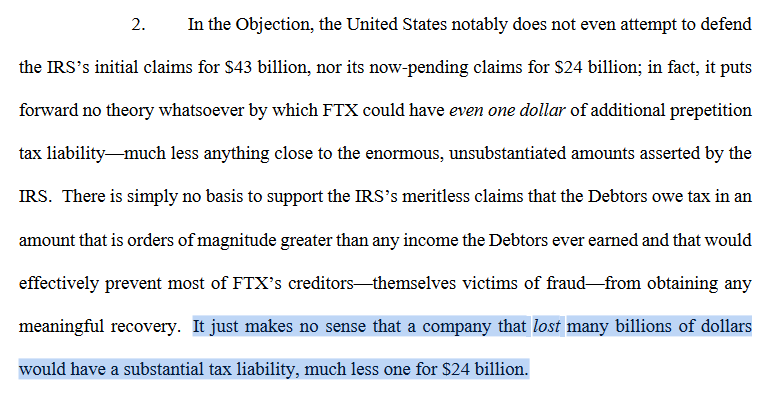

FTX’s lawyer said that during 3 years of operation, FTX did not make any dividends or income to investors and did not record revenue large enough to pay taxes up to 24 billion USD.

The lawyer asserted that the only way FTX can pay taxes is to reduce the amount of compensation paid to customers. This affects the amount of money that each user stuck on the exchange can receive back and delays the process of returning assets. The time for users to receive their money back is expected to start from Q2/2024.

Therefore, the exchange’s representative declared the IRS’s tax request to be “ridiculous and baseless”. The lawyer also revealed that FTX has responded to 2,300 requests for information from the tax department. FTX has also provided all requested documents, except for some documents that will be transferred in January 2024.

Previously in April 2022, the US Internal Revenue Service required FTX, Alameda and Sam Bankman-Fried’s subsidiaries to pay taxes up to 44 billion USD. By November, this number had dropped to $24 billion.

Related: FTX Deposits 22 Million Crypto Assets onto Exchanges

The IRS said the $24 billion figure is related to corporate income taxes, social security taxes for employees, and penalties that FTX incurred between 2018 and 2022. However, the tax department stated that this is not yet the final number because the audit results are pending.