The Shifting Risk Landscape: Central Banks Advised to Rethink Strategies in the Face of CBDC Challenges

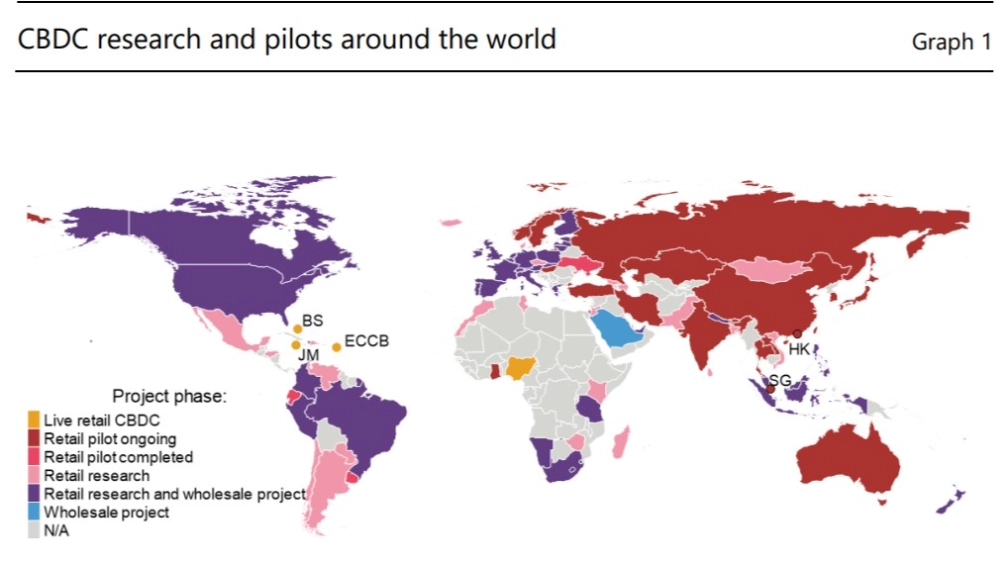

In a recent report, the Bank of International Settlements (BIS) outlines the evolving risk profiles associated with the introduction of central bank digital currencies (CBDCs). Emphasizing that these risks are dynamic and require ongoing assessment, the report encourages a continuous reevaluation of strategies.

The BIS underscores the need for central banks to go beyond viewing CBDCs merely as a technologically advanced form of currency. Instead, it urges them to recognize the transformative nature of CBDCs, signaling a fundamental shift in daily transactional practices. The report stresses that issuing a CBDC is not just a technological initiative but a profound operational overhaul for central banks.

Acknowledging the substantial implications of CBDC adoption, the report advocates for the development and implementation of a robust risk management framework tailored to the unique challenges posed by the CBDC model. In essence, central banks are urged to adapt their approaches and embrace a comprehensive strategy that aligns with the transformative potential of CBDCs.

Building a Robust Foundation: Integrated Risk Management and Global Collaboration for CBDCs

The complexity of risks associated with central bank digital currencies (CBDCs) prompts a call for a comprehensive risk management framework, according to the latest report. Highlighting the multi-faceted nature of these risks, the report stresses the need for an integrated approach to inform the design of the CBDC model and manage risks throughout its lifecycle.

Related: Cardano Finds Support in Critical Zone, Potential Rally to $0.46

Simultaneously, the report advocates for continuous surveillance of CBDCs, emphasizing the importance of adaptive planning. To ensure the reliability and continuity of services in the face of various scenarios and threats across the entire digital currency cycle, robust business continuity plans are deemed essential.

In a related development, Augustin Carstens, the Chief of the Bank for International Settlements (BIS), advocates for a unified global set of rules governing CBDCs. Recognizing the significance of international collaboration, Carstens emphasizes the need for consistent rules to guide the implementation of CBDCs successfully.

He underscores the intricate relationship between technological advancements and a sophisticated legal framework, stating that trust in money is fundamentally tied to a well-established legal foundation. Carstens asserts that without a solid legal framework, the proper functioning and trust in money are compromised.