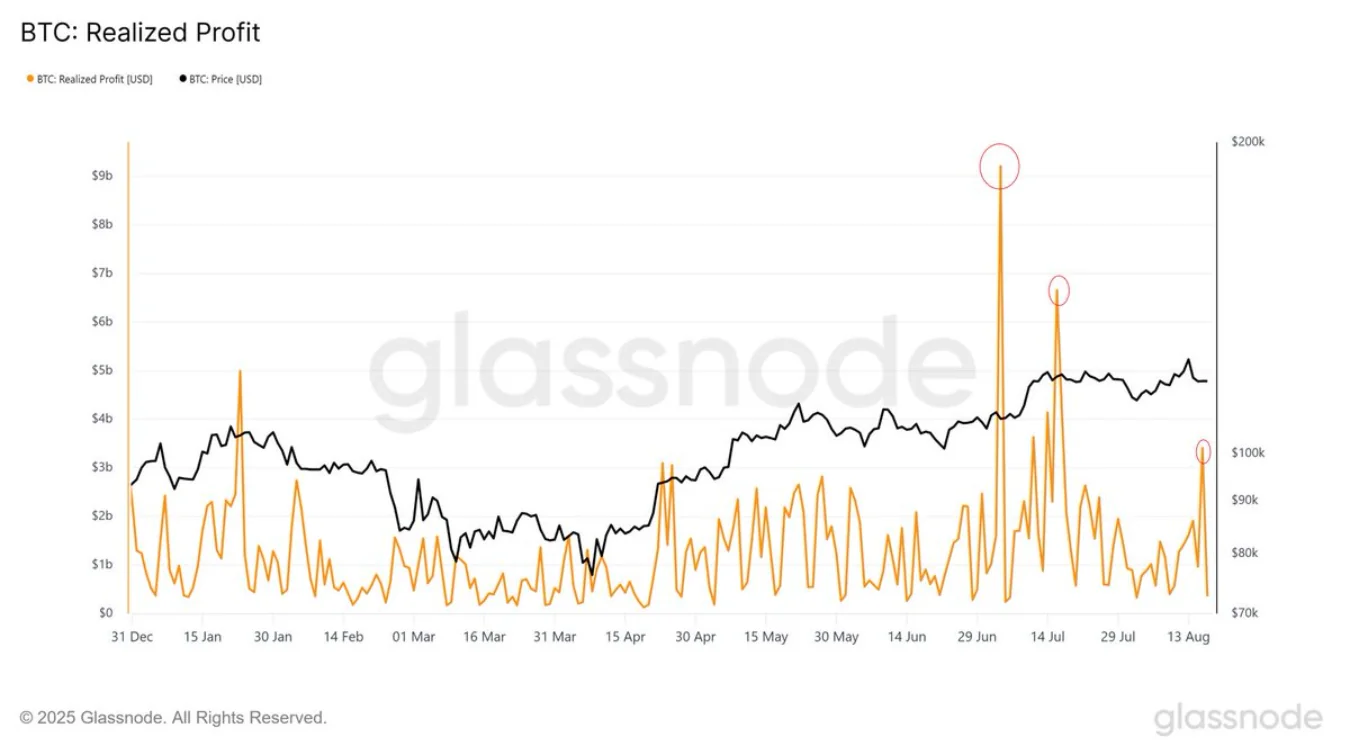

The sharp drop from the all-time high of $124,474 initially seemed like a natural outcome—some investors tend to take profits at record highs, while others rush to open short positions at the same time.

Commenting on the recent price action, Andre Dragosch, Head of Research for Europe at Bitwise, noted:

“Yes, we have seen increased profit-taking from short-term holders, but the size of these sell-offs has been shrinking over time.”

Still, the 6.72% correction below $115,000 was deeper than many anticipated, prompting some analysts to warn of a potential slide toward $110,000 or lower.

Shubh Varma, co-founder and CEO of Hyblock, explained: “Over the past week, liquidity has been the main driver of Bitcoin’s weekend price action. Heading into the weekend, liquidity built up on the downside, creating pools of potential liquidation targets. By the end of the weekend, those zones were swept away—once again showing that thin weekend markets are highly vulnerable to liquidity grabs.”

Varma also pointed out that as these “liquidity grabs” unfolded, new supply began appearing both in the order book and on-chain:

“Large ETH unstaking events added fresh supply. Yet during the weekdays, demand from Digital Asset Treasuries (DATs) remained strong. In fact, several institutions announced major BTC and ETH purchases last week, with demand not only absorbing this supply but far exceeding it, fueling upward momentum.”

The challenge, however, lies in Wall Street closing on weekends, which temporarily dries up institutional demand and exposes imbalances in order flow. According to Varma: “We saw this in both the order book and slippage metrics. Liquidity sat below, slippage spiked, and both the 1% and 2% bid-ask depth flipped bearish. That combination triggered a cascade that wiped out key liquidation zones.”

When asked about Monday’s surprise dip below $115,000 and the likelihood of further downside, Varma pointed to a surge in open interest in the same region where liquidity was swept:

“This area should act as strong support since both longs and shorts entered positions there—while shorts, in particular, are now trapped.”