The data from DappRadar illustrates a noteworthy increase in October, with transactions totaling 99 million USD more than the preceding month. Specifically, September recorded a volume of 306 million USD, whereas October soared to 405 million USD, reflecting a substantial 32% increase.

The persistent downtrend has finally been broken, sparking renewed optimism within the market. Reports underscore Solana’s prominence as a noteworthy NFT network currently. The NFT transaction volume on the SOL network escalated by 15%, rising from 24 million USD to 27.6 million USD.

Related: What is an NFT and how does it work?

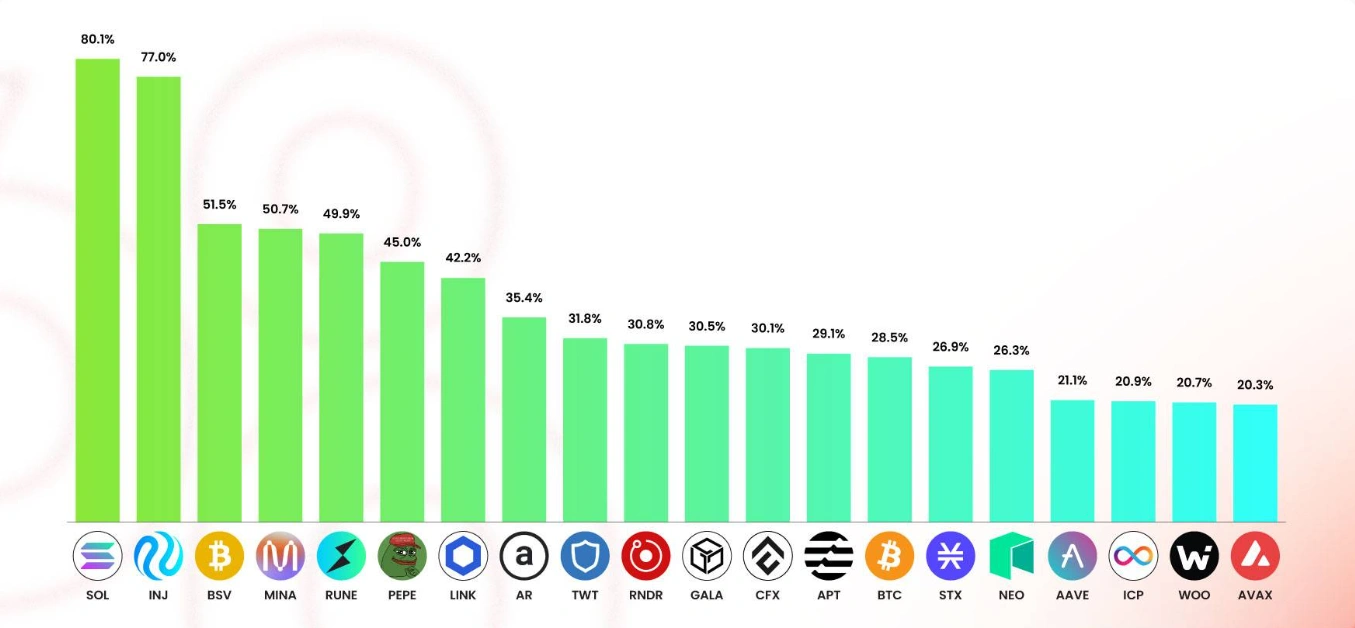

Part of this surge can be attributed to the substantial growth in token prices. According to azc.news, SOL led the charts in October with an impressive 80% surge, outperforming its competitors by a significant margin.

The return to competitive dynamics within the Layer-1 race signals a rekindling of momentum for Solana. Even VanEck predicts a price target of 3,211 USD for SOL by the year 2030.

Despite Solana’s remarkable performance, Ethereum remains the cornerstone of the NFT domain. NFT transactions on the Ethereum network witnessed a substantial 50% surge, reaffirming its leading position.

We’ve had 4 consecutive weeks of rising NFT volume. pic.twitter.com/GnuqmxA5xN

— NFTstats.eth (@punk9059) November 3, 2023

However, despite the positive momentum in October, it’s premature to assume that the downturn in the NFT market has concluded. Several web3 companies continue to downsize their workforce, with OpenSea bidding farewell to 50% of its employees, Yuga Labs laying off staff, and stories emerging about investors selling NFTs at a loss, indicating the persistent ebb within the digital art domain.

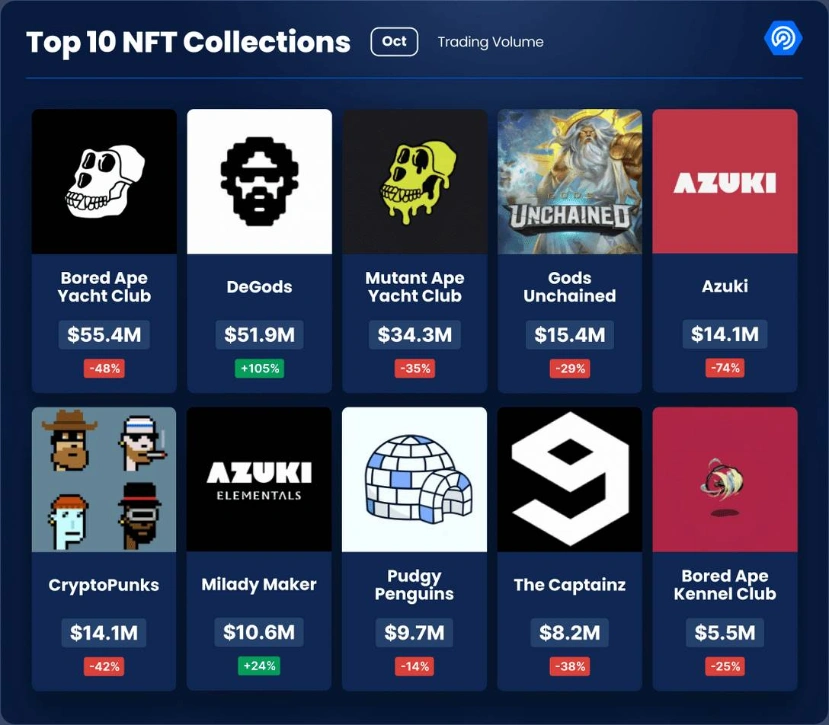

The fortunes of leading NFT collections are still oscillating. While some collections like DeGods and Milady Maker witnessed growth in transaction volume in October, most collections are grappling with significantly reduced floor prices, making a return to their former glory seem increasingly challenging.

The upward trend in October’s NFT market transactions indicates a potential shift, but the inherent challenges and complexities within the space persist. It’s a nuanced landscape with positive indicators but underlying concerns that necessitate a cautious approach for both investors and collectors.