Over the past 24 hours, the cryptocurrency market has witnessed a strong sell-off. Both Bitcoin [BTC] and Ethereum [ETH] recorded declines of around 7% – 8%, with further declines likely. For ETH, the $3.5K level is being considered as a key short-term support level.

A bearish flag pattern is forming

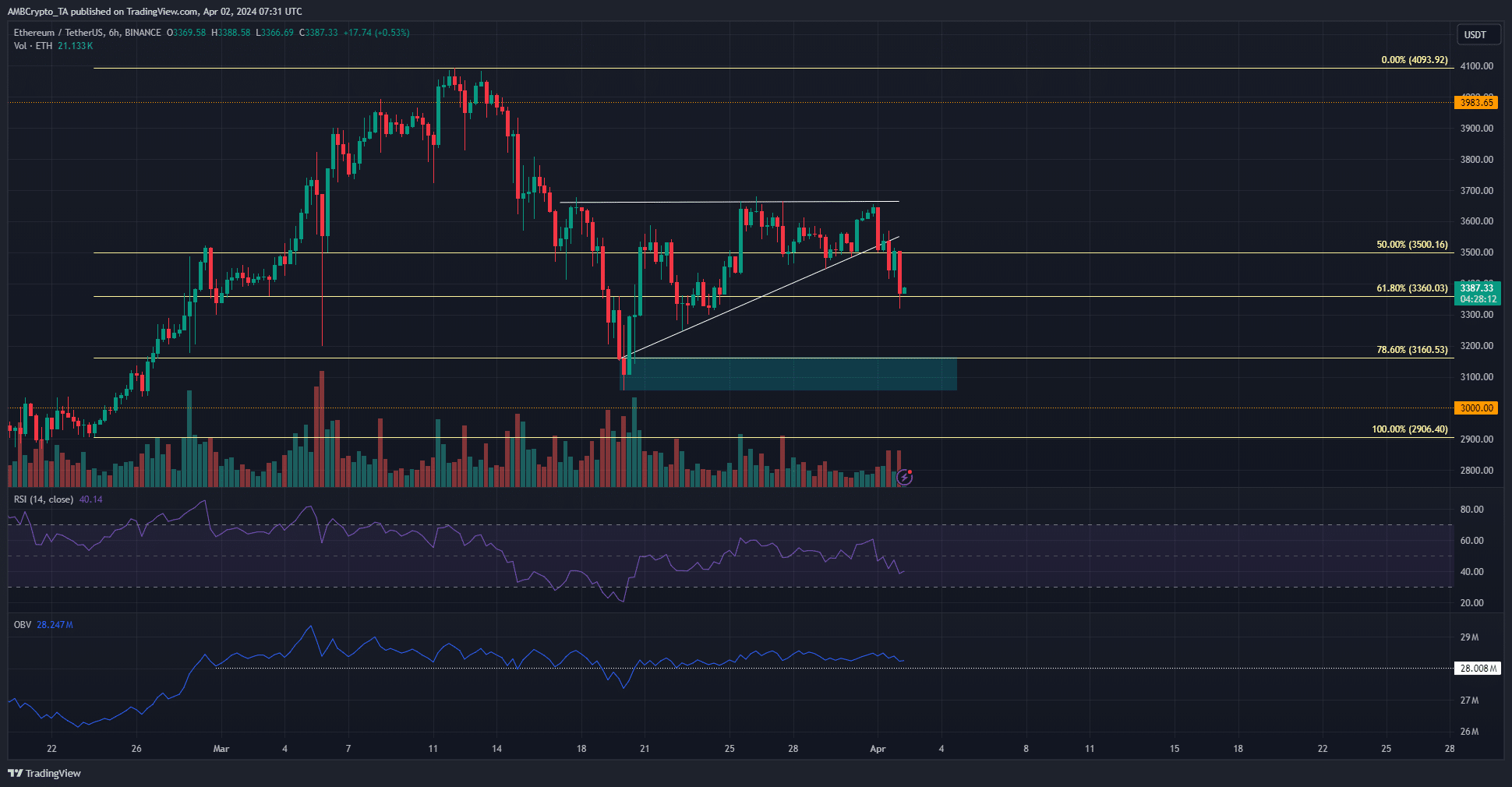

Cryptocurrency analyst Ali Martinez has highlighted that there are signs of a bear flag formation forming. If this prediction comes true, the price could drop to $2.8k. The question is whether the bears can execute this scenario?

In the battle between the bear flag and the bridge zone, who will win? Based on the length of the flagpole, it can be predicted that the price could drop as low as $2.6k. The $2.8K to $2.9K area is where ETH was concentrated in February before surpassing the $3K mark.

Source: ETH/USDT on TradingView

Therefore, this area could act as a support on the way down and give bears pause. The $3.1k level is also a key area with lower trading volume, and has seen a significant reaction compared to the price earlier this month.

Over the past two weeks, trading volume has decreased as Ethereum formed a bearish pattern. The break below the uptrend line confirmed the presence of this pattern. If the price drops below $3,056, the market could continue to decline on the 12-hour chart.

Related: Depleted Ethereum Supply Signals Imminent Price Surge

Ethereum is currently undervalued

Source: Santiment

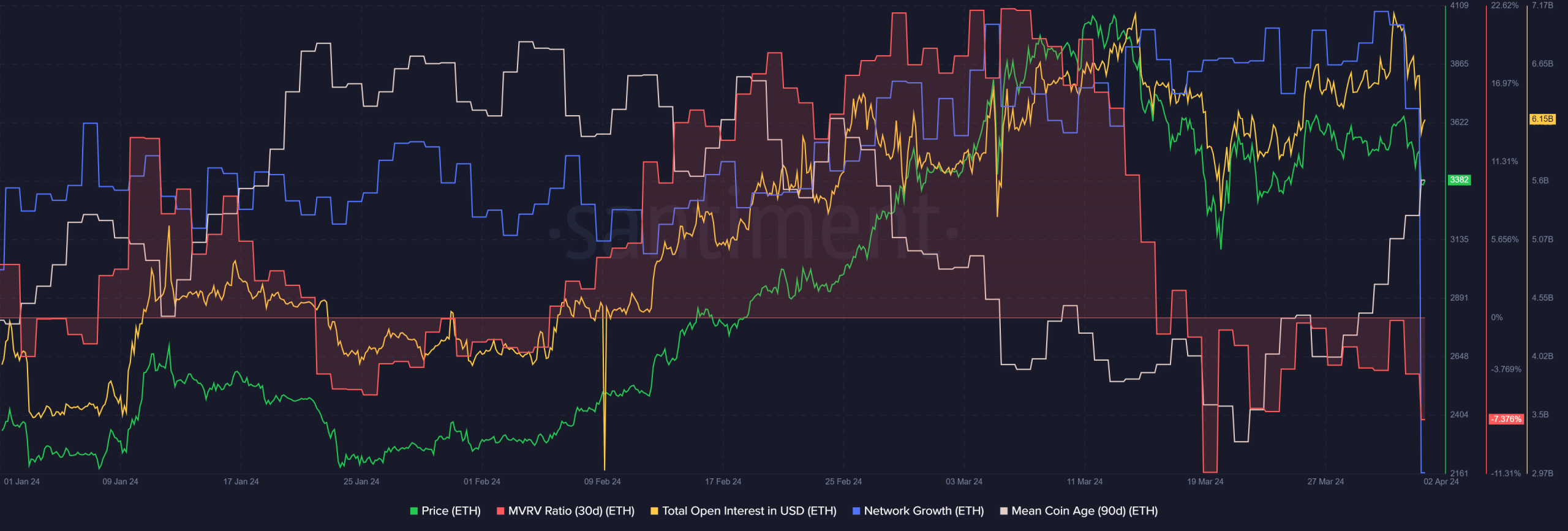

Analysis of Ethereum’s on-chain metrics has recorded positive findings for investors. The 30-day MVRV ratio has fallen below zero since March 18, suggesting that the asset is undervalued.

However, the average age of the coins, although trending downward since February 9, is starting to show signs of increasing slightly.

Both of these indicators together create a strong buy signal. However, this is not a short-term signal and risk management needs to be built on technical analysis. At the same time, at the time of this writing, the bears hold the upper hand.

Comparing the network growth in March with January, we see an increasing number of new addresses created on the network.

Total open interest decreased along with the price indicating short-term bearish sentiment. However, there are signs that a drop to $3.1k or $2.6k would still present a buying opportunity for long-term holders.

Good