The cryptocurrency market, especially Ethereum (ETH), is showing signs of positivity after initial challenges, driven by strong sentiment towards decentralized finance (DeFi) and positive technical signals.

ETH experienced a decline, testing support around $3,200. However, recent signals indicate a more positive shift, with Ethereum’s price hovering around $3,379 and showing upward momentum, aiming to surpass the $3,500 mark.

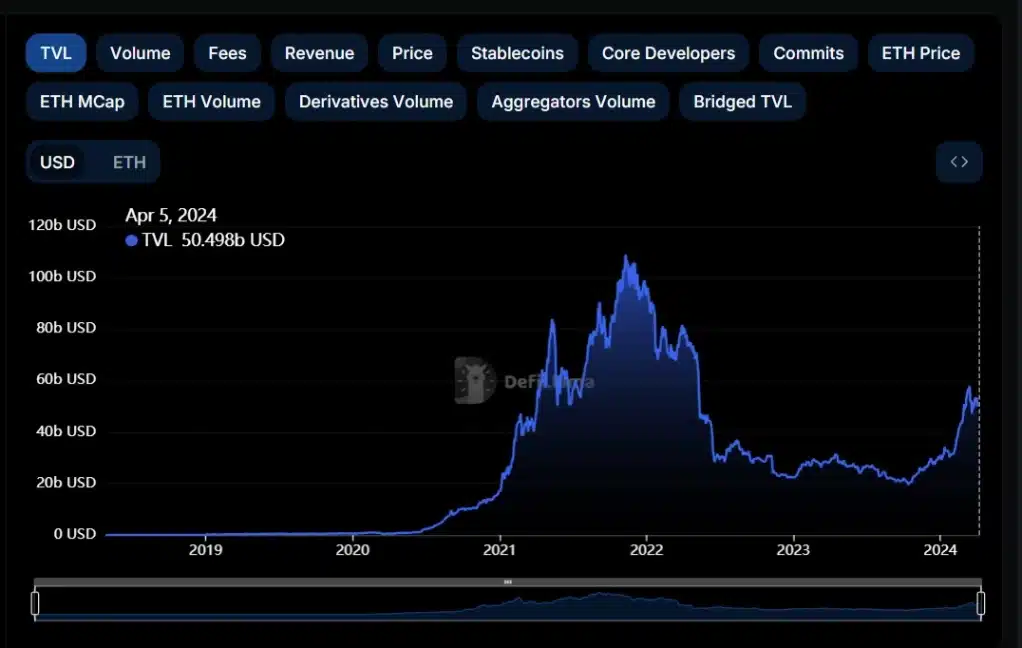

In addition to this positive sentiment, the DeFi sector within the Ethereum ecosystem has demonstrated resilience amidst recent market volatility. Despite a slight decrease from a peak of around $58 billion to $47 billion, the total value locked (TVL) in DeFi has rebounded to over $50 billion, indicating increasing interest and confidence in the market’s future prospects.

Investors seem inclined to participate in securing the Ethereum network and earning profits rather than immediately selling. If the trend of increasing value locked in these smart contracts continues, expecting further price appreciation in the coming weeks and months seems reasonable.

Related:

Technical indicators are supportive of Ethereum’s price increase. The token is gradually approaching the $3,500 level, with the 20-day EMA serving as a key support level at $3,364. The MACD indicator has signaled buying pressure, indicating increasing buying momentum and affirming the prospects of price appreciation.

The upcoming Bitcoin halving event could also drive increased interest in major altcoins like Ethereum, potentially pushing prices to new highs. However, the expected resistance level is around $3,435, as a significant number of addresses are holding ETH at this level.

Well , he will bet on the growth of ETH😎

Nice

Great

Hi there, just became alert to your blog through Google, and found that it’s really informative.

I’m gonna watch out for brussels. I will be grateful if you continue this

in future. A lot of people will be benefited from your writing.

Cheers!