A New Wave of ETFs Set to Hit the Market

-

As of October 21, data shows that more than 200 new exchange-traded funds could launch within the next year, signaling surging investor demand for crypto exposure.

-

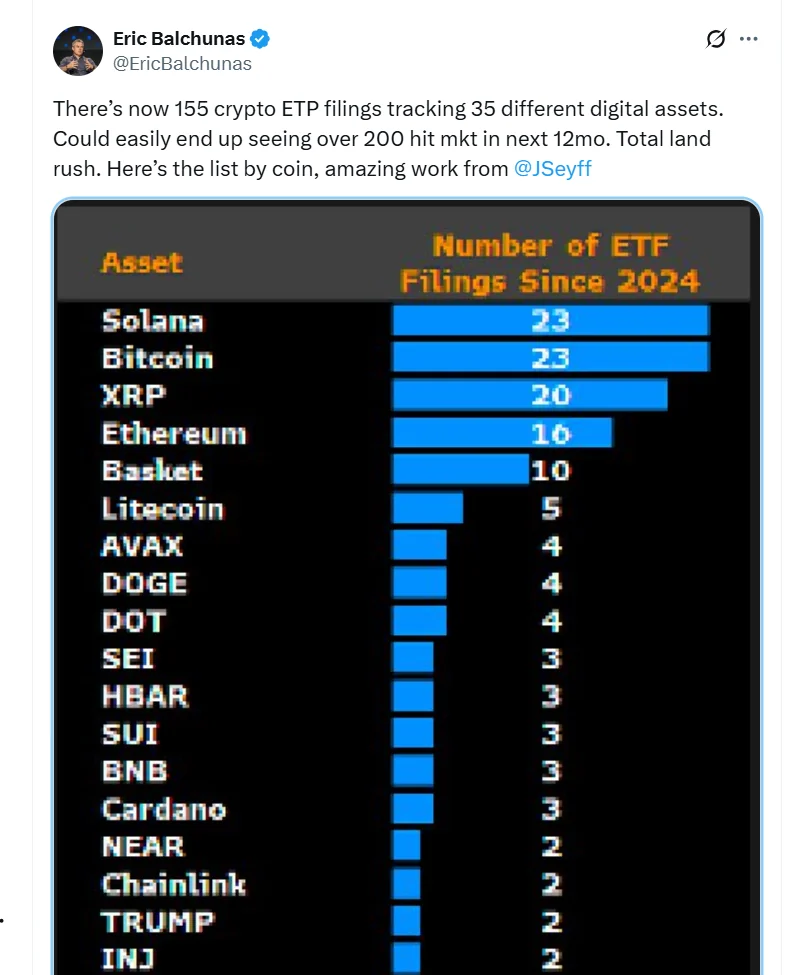

Solana (SOL) and Bitcoin (BTC) lead the pack with 23 filings each, followed by XRP (20 filings) and Ethereum (ETH) (16 filings).

-

Other proposed products include those tracking Litecoin (LTC) (5 filings), Dogecoin (DOGE), Avalanche (AVAX), and Polkadot (DOT) (3 each). Even the TRUMP meme coin has two ETF filings in the queue.

Bloomberg ETF analyst Eric Balchunas described the surge of filings as a “total land rush” among financial institutions.

How Will Traditional Investors Respond?

-

Nate Geraci, co-founder of the ETF Institute, warned that the sheer number of single-token ETFs could overwhelm traditional investors.

-

He predicts most mainstream investors will prefer index-based or actively managed ETFs, which diversify risk across multiple assets — similar to traditional stock index funds.

-

Geraci emphasized: “Highly bullish on index-based and actively managed crypto ETFs.”

Strong Inflows Reflect Growing Demand

-

According to SoSoValue, on October 21, spot Bitcoin ETFs attracted $477 million in new inflows, while Ethereum ETFs brought in $142 million.

-

Two altcoin ETFs launched in September — REX-Osprey XRP ETF and DOGE ETF — surprised analysts with first-day trading volumes of $24 million and $6 million, respectively.

-

Meanwhile, Bitcoin whales are reportedly moving assets into ETFs through tax-efficient swaps, with BlackRock alone handling over $3 billion worth of these conversions.

Outlook and Challenges

Despite the strong momentum and investor enthusiasm, many ETF proposals remain pending regulatory approval, with delays tied to the ongoing U.S. government shutdown.

➡️ Bottom line: The crypto ETF market is entering an unprecedented boom — as major financial institutions and individual investors alike rush to secure their stake in the multi-billion-dollar race for digital asset ETFs.