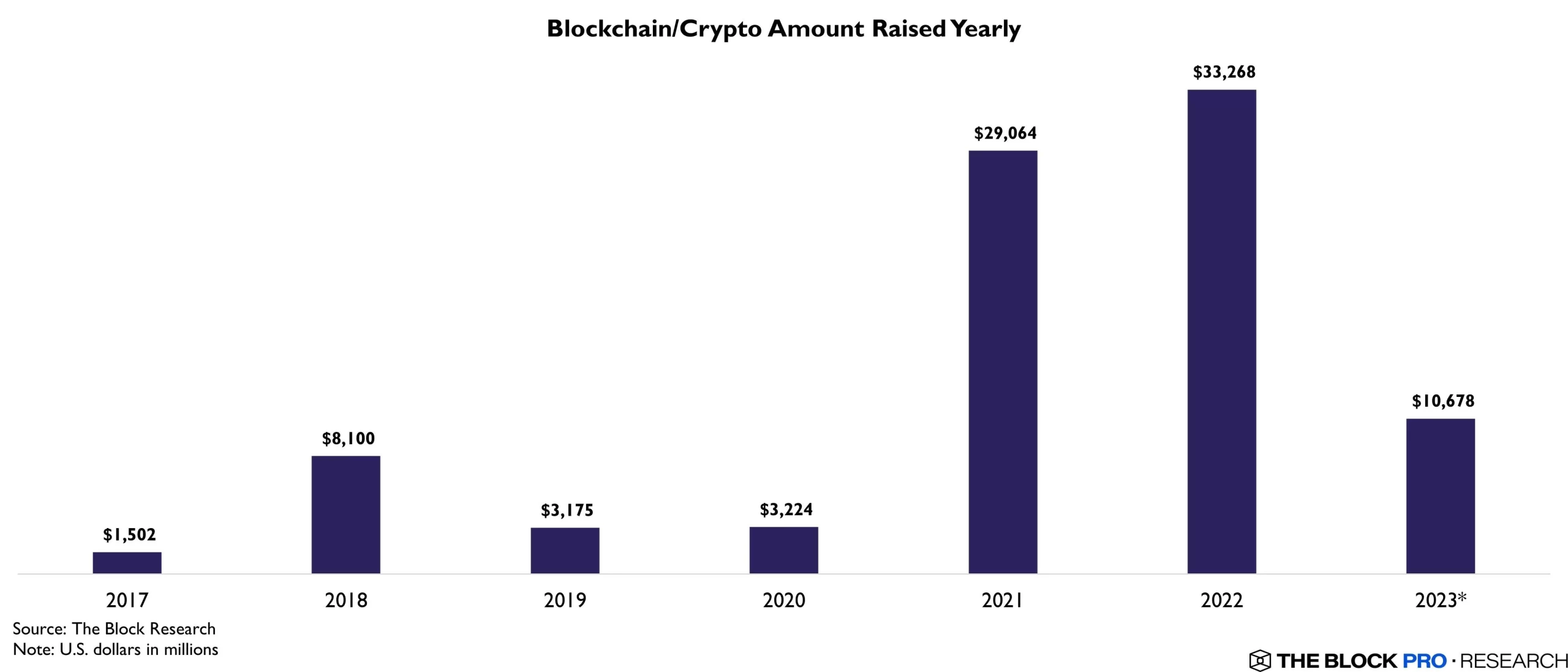

The amount of capital invested in crypto will decrease by two-thirds in 2023

According to The Block’s statistics, throughout 2023, crypto Investment Funds (VCs) spent a total of 10.7 billion USD on investment and capital raising activities, down 68% from 33.3 billion USD of 2022.

However, this figure is still enough to make 2023 the year with the third highest amount of money mobilized for investment activities in history.

Statistics on the amount of money mobilized by crypto projects each year. Source: The Block (December 26, 2023)

Abhishek Saxena, manager at Polygon Ventures, shared with The Block:

“The sharp decrease in investment cash flow in 2023 is predictable due to the unfavorable macro situation, legal issues, plus the shock from the previous year’s collapses. However, many investors and projects are still surprised by the level of market decline. The recent crypto winter was a necessary adjustment, helping the crypto industry focus more on important aspects and reshape itself.”

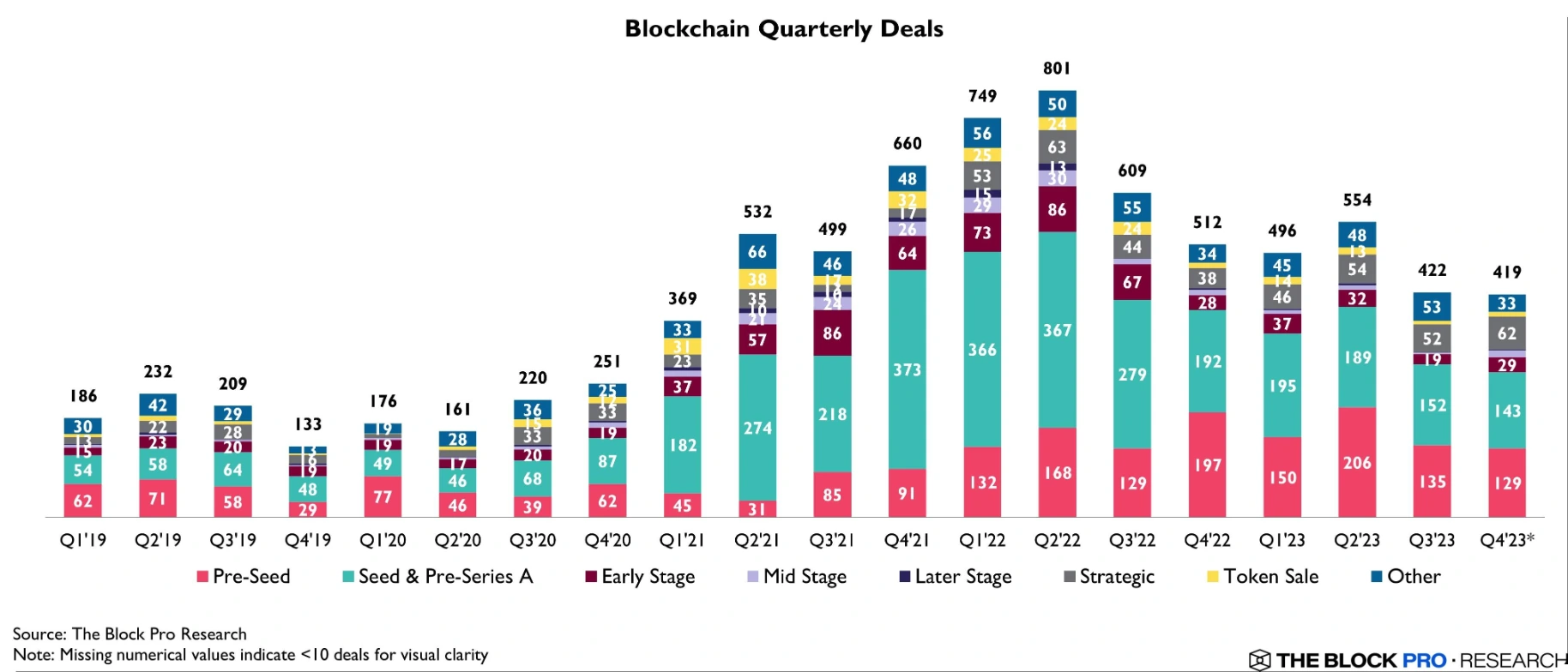

This year, there were a total of 1,819 capital raising deals organized by VCs, down 32% from 2,671 the previous year. Most of the investment took place in the first half of 2023 before starting to decline sharply for the rest of the year. However, from November onwards, there were signs of strong recovery in the crypto market.

Statistics on the number of capital calls based on nature. Source: The Block (December 26, 2023)

Most investment deals are carried out in the form of pre-seed, seed and Series A rounds, showing the interest of investment funds in projects that are in the concept and construction stages product.

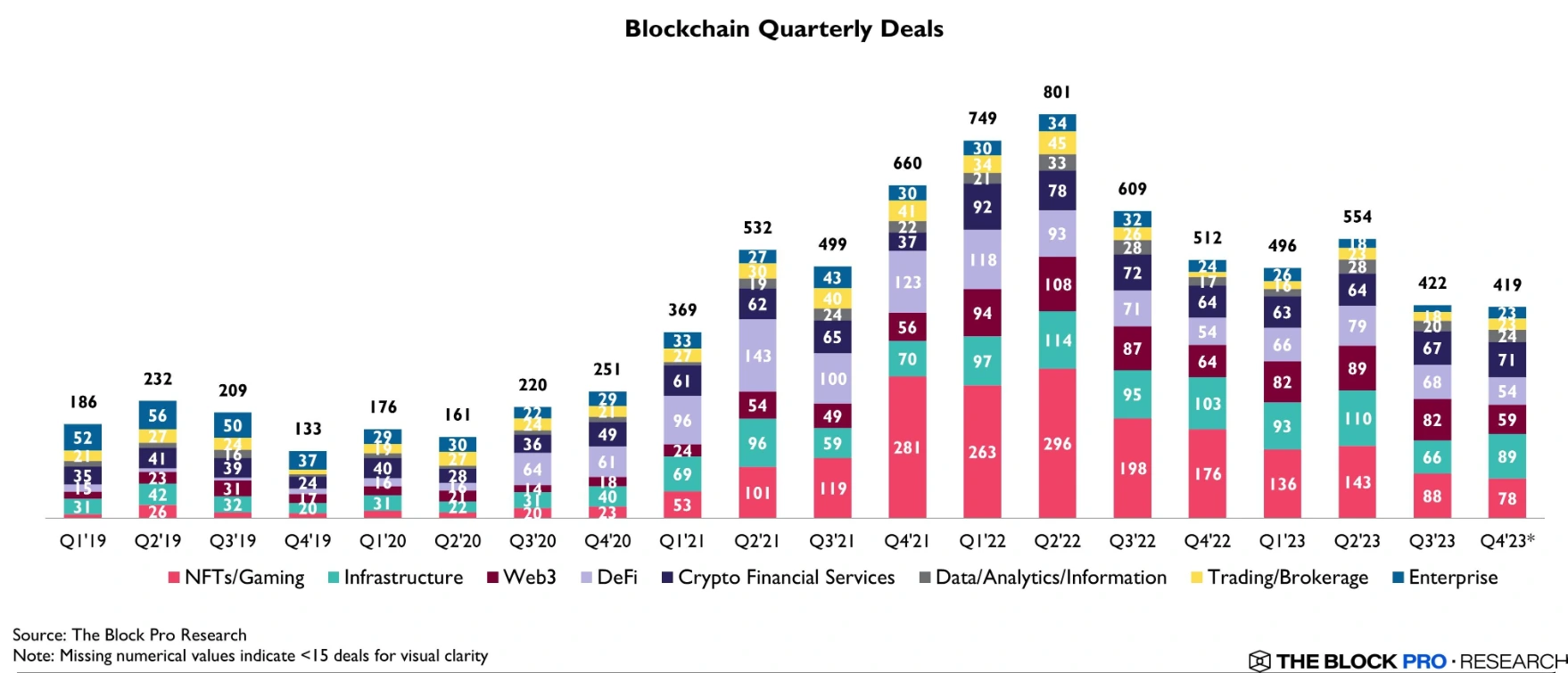

In terms of sectors receiving the most capital from funds, projects related to NFT/gaming, blockchain infrastructure and Web3 still hold a prominent position, although the allocation ratio has become more diversified compared to 2022.

Statistics on the number of funding rounds based on field. Source: The Block (December 26, 2023)

Related: Ethereum OG Creates cyber.Fund Investment Fund Targeting Cryptocurrency, AI and Robotics

Both large funds and investors are waiting for a year 2024 that is expected to bring many new opportunities, when the crypto market has begun to show signs of turning around and exiting the downtrend phase.