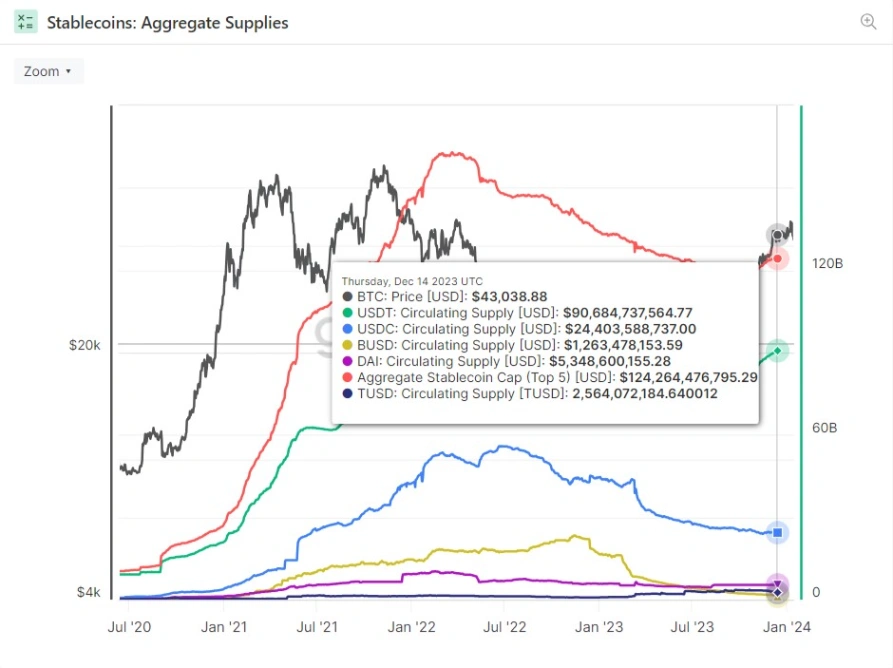

In a noteworthy shift, Tether, the driving force behind the USDT stablecoin, has seen its market dominance skyrocket from 50% to an impressive 71% over the course of 2023, according to Glassnode’s latest findings.

However, this surge in prominence has not been without its challenges. A United Nations report released on Monday highlights that Tether’s exponential growth has drawn the attention of undesirable elements, including criminals, money launderers, and scammers, particularly in Southeast Asia.

Tether (USDT) Surpasses $95 Billion Market Cap

The most recent milestone in Tether’s ascent occurred on the evening of January 12, as the company successfully generated an additional $1 billion. This surge catapulted the market capitalization of USDT to an unprecedented $95 billion, showcasing the stablecoin’s formidable position in the market.

In stark contrast, Tether’s closest contender, Circle, the entity behind the USDC stablecoin, has taken a different strategic path. Circle recently filed for an initial public offering (IPO) with the U.S. Securities and Exchange Commission (SEC). However, despite this move, Circle has only 27 billion tokens in circulation, starting the year 2023 with a total of 48 billion USDC—significantly trailing Tether’s dominant market position.

Beyond its stablecoin success, Tether’s financial prowess extends to its Bitcoin investment portfolio, valued at approximately $3 billion as of January 4, 2024. This strategic diversification has proven to be a substantial source of profit for the company, further solidifying its influential role in the evolving cryptocurrency landscape.

Paolo Ardoino, the seasoned Chief Technology Officer (CTO), transitioned into the role of Chief Executive Officer (CEO) at the close of the preceding year, succeeding Jean-Louis van der Velde. Since assuming this leadership position, Ardoino has actively fostered collaborations with U.S. law enforcement agencies, a strategic move that yielded notable results.

I remember when I spoke for the first time in front of a public audience about @Tether_to .

It was March 2020, in London, at the CryptoCompare conference.

The title of my speech was “Tether: a story of innovation”.

I never did public speaking before.

I was excited and quite shy…— Paolo Ardoino 🍐 (@paoloardoino) December 26, 2023

Illustrating this commitment, joint efforts have led to the freezing of wallets associated with the U.S. Office of Foreign Assets Control’s (OFAC) sanctions list. This collaborative initiative resulted in the successful seizure of over $435 million in illicit funds, showcasing Ardoino’s proactive approach in ensuring regulatory compliance.

Tether (USDT) Use Surges Among Bad Actors

Amidst these developments, there are reports suggesting an increase in Tether’s (USDT) usage among entities engaging in cyber fraud, money laundering, and underground banking activities, particularly in Asia. Noteworthy schemes include “sextortion,” a form of blackmail involving threats to disclose sensitive content or personal information, and “pig butchering,” a socially engineered romance aimed at building trust before extracting funds.

Related: Tether (USDT) is Currently “Dominating” the Stablecoin Supply.

While Tether’s widespread use has raised concerns, the company has demonstrated a willingness to cooperate with U.S. law enforcement and regulatory authorities. According to data from Dune Analytics, Tether has taken assertive measures by banning over 1,260 addresses associated with illicit activities, collectively holding more than $875 million in USDT. This proactive stance aligns with Tether’s commitment to addressing the misuse of its platform and maintaining a robust framework for responsible usage.