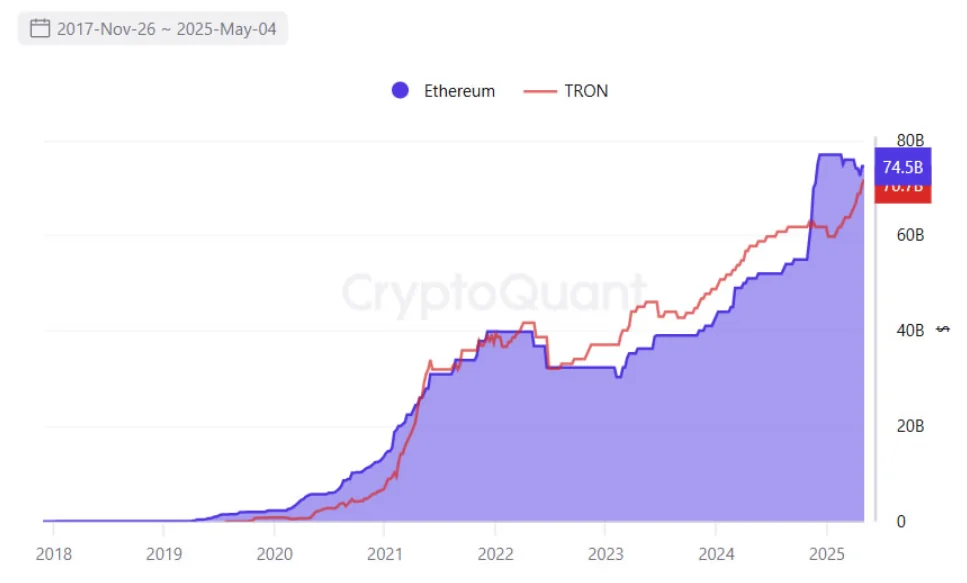

From 2022 to 2024, Tron led Ethereum in USDT circulation—and now, it’s on track to reclaim that position.

On May 5, leading stablecoin issuer Tether minted another $1 billion worth of USDT on the Tron network, according to data from Arkham Intelligence. This latest issuance brings the total USDT circulating on Tron to $71.4 billion, based on Tether’s transparency report.

Meanwhile, Ethereum currently hosts $72.8 billion in circulating USDT—just $1.4 billion more than Tron. If this trend continues, Tron is poised to overtake Ethereum once again as the top network for the world’s largest stablecoin, a title it held from July 2022 to November 2024. Previously, an $18 billion mint on Ethereum allowed it to regain the lead, according to CryptoQuant.

Solana ranks third, with $1.9 billion USDT in circulation. Smaller amounts of USDT also exist on Ton, Avalanche, Aptos, Near, Celo, and Cosmos.

As of now, the total USDT supply has hit a record high of $149.4 billion, marking an 8.6% increase since the beginning of the year. This gives Tether a commanding 61% share of the stablecoin market, according to CoinGecko. Its closest competitor, Circle, holds a 25% share with nearly $62 billion USDC in circulation.

Stablecoin issuance has surged over the past six months and now represents around 8% of the total cryptocurrency market capitalization.

In a report released in late April, the U.S. Department of the Treasury projected that the stablecoin market could reach $2 trillion by 2028—if regulatory clarity is established.

U.S. Stablecoin Legislation Nears Approval

Two key legislative proposals are seen as essential to shaping the future of stablecoins in the U.S.

The “Guiding and Establishing National Innovation for US Stablecoins” (GENIUS) Act outlines clear definitions for “payment stablecoins” and establishes reserve requirements for issuers. Reports indicate that the U.S. Senate is expected to vote on the GENIUS Act before May 26.

Meanwhile, the “Stablecoin Transparency and Accountability for a Better Ledger Economy” (STABLE) Act, which focuses on the approval and oversight of federally qualified nonbank stablecoin issuers, is also making its way through Congress.

Tether has also announced plans to launch a U.S.-based stablecoin later this year, pending the passage of relevant legislation.