As the curtains closed on 2023, investors seeking to capitalize on the upward momentum of Tellor’s (TRB) price were in for a rude awakening. On December 31st, TRB experienced a surge, reaching $600 and enticing traders to join the rally.

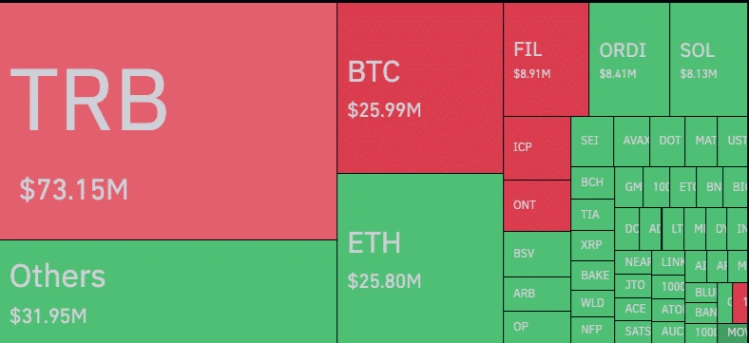

However, the euphoria was short-lived, as TRB’s value plummeted shortly after, triggering a massive $73 million liquidation. Coinglass data highlighted that this wipeout marked the most significant liquidation in any cryptocurrency contract within the past 24 hours.

Holding the Tellor Team Accountable for Market Turmoil

Blame for this market turmoil was quickly attributed to the Tellor team. At the time of reporting, TRB’s price had stabilized at $198.35, hinting at a potential recovery. Despite its relatively lower standing at the 124th position on the market cap rankings, the Tellor project, built on the Ethereum (ETH) blockchain, serves as a crucial infrastructure for integrating off-chain data into smart contracts.

Yet, a deeper examination by AZC News revealed a more nuanced narrative. Beyond the project’s utilitarian purpose, recent findings from Lookonchain suggested that the sudden surge and subsequent dump of TRB might be indicative of manipulation orchestrated by the Tellor team. This revelation added a layer of intrigue to an otherwise perplexing market event.

In the past 24 hours, $TRB soared to $600 and then plummeted to $137, causing $68M of assets to be liquidated, making it the most liquidated token.

We noticed that the #Tellor team deposited 4,211 $TRB($2.4M) after the price of $TRB skyrocketed.

Address:https://t.co/efHPXCiMiG pic.twitter.com/IBty2Wf2gI

— Lookonchain (@lookonchain) January 1, 2024

Amidst the unfolding drama, the smart money handle disclosed a noteworthy detail – the team had injected $2.4 million worth of TRB into the market shortly after the coin’s price surge commenced. This revelation raises suspicions that the team may have played a role in both inflating the token’s value and orchestrating its subsequent downfall, causing anguish among retail traders.

Shorts Strategize for Gains Amidst Market Uncertainty

While shorts anticipate capitalizing on the situation, a broader analysis of Tellor’s market dynamics reveals a surge in Open Interest (OI) to $423.24 million. OI represents the total value of outstanding derivative contracts in futures trading, serving as an indicator of market activity.

A spike in OI often suggests an influx of new capital into the market, signaling bullish sentiment. Conversely, a decline indicates traders closing positions and extracting liquidity. In the case of TRB, the surge in 8-hour Open Interest implies the presence of traders holding open contracts.

However, understanding the nature of these positions requires delving into the OI-Weighted Funding Rate. This metric provides insights into trader sentiment, with a positive rate reflecting a bullish stance characterized by numerous long positions.

Related: Vitalik Buterin Updates Ethereum’s Roadmap for 2024

Contrary to expectations, TRB’s Funding Rate, at the time of reporting, had dipped to -1.937%. This negative reading signifies a prevalence of short positions in the market. Despite the ongoing price recovery, caution is advised against hastily adopting short positions on TRB in the interim, given the evolving market dynamics.