The initiative aims to revolutionize the way billions of dollars in cross-border payments are made every day, by leveraging advances in secure messaging and data transmission.

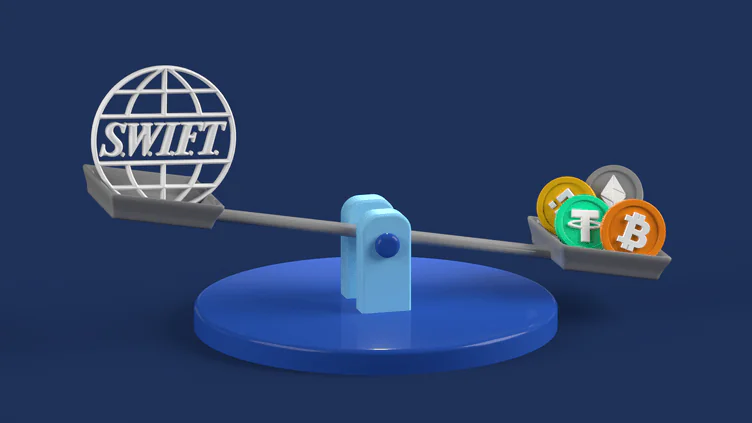

SWIFT to Advance Digital Asset Transactions

After several trials, SWIFT is moving closer to launching an advanced decentralized infrastructure that will facilitate transactions between public and private blockchains, central bank digital currencies (CBDCs), and other digital assets.

SWIFT plans to deploy this advanced decentralized infrastructure in early 2025, enabling real-time digital asset transactions. If successful, this could open up the possibility of faster and cheaper cross-border payments, a major development for both consumers and businesses.

Tom Zschach, Chief Innovation Officer at SWIFT, said that for digital assets to succeed globally, it is essential that they can coexist seamlessly with traditional forms of currency. The initiative promises to present an exciting opportunity for the thousands of financial institutions that use the SWIFT network.

Thanks to its extensive global network, financial institutions could soon be able to seamlessly switch between established and emerging digital assets without disrupting their existing systems. While similar solutions have long existed in the crypto world, SWIFT’s involvement could bring much-needed legitimacy to the sector.

Missed Opportunity for Crypto Companies?

SWIFT’s decision to integrate blockchain technology into its traditional banking network may be groundbreaking, but it’s not a pioneering effort.

Ripple, a blockchain company, has been working on a similar solution for years. Ripple’s cross-border payments network, Ripple Payment Direct (RPD), allows users to transfer value globally using XRP as a liquidity token.

RPD enables partner banks and financial institutions to exchange fiat currencies flexibly. For example, a user in Europe can send Euros to Asia, and the recipient can receive the equivalent value in the local currency of their choice.

Ripple’s ongoing legal battle with the U.S. Securities and Exchange Commission (SEC) has slowed its progress. Despite bringing hundreds of banks and financial institutions onto its platform, many believe that regulatory hurdles have held back its potential.

Meanwhile, Visa, a giant payment processing corporation, has also entered the game recently, introducing a tokenized platform, underscoring the growing interest in combining traditional and decentralized finance.