Ethereum (ETH) surged past the $3,300 mark, riding a strong bullish wave that continued to propel the world’s second-largest cryptocurrency upward. As of the latest update, ETH recorded a 2.61% increase in the 24-hour period and a remarkable 12% surge over the week, as reported by CoinMarketCap.

Profitability highest since November

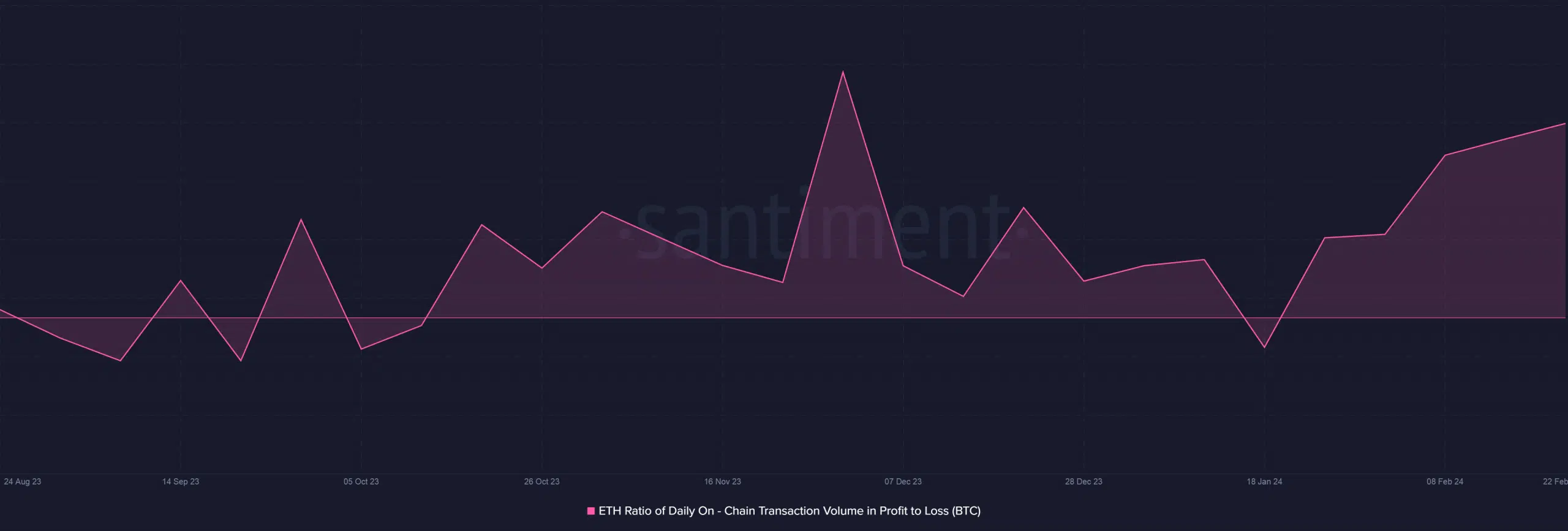

The recent price surge translated into substantial profits for most traders. Santiment, a blockchain analytics firm, revealed that Ethereum’s on-chain profit/loss ratio reached a three-month high in the past week. Notably, for every loss-making transaction on the network, approximately 2.3 transactions were identified as profitable. The current percentage of total supply in profit surpassed 93%, reminiscent of the levels observed in August 2021, three months prior to ETH’s previous all-time highs.

Source: Santiment

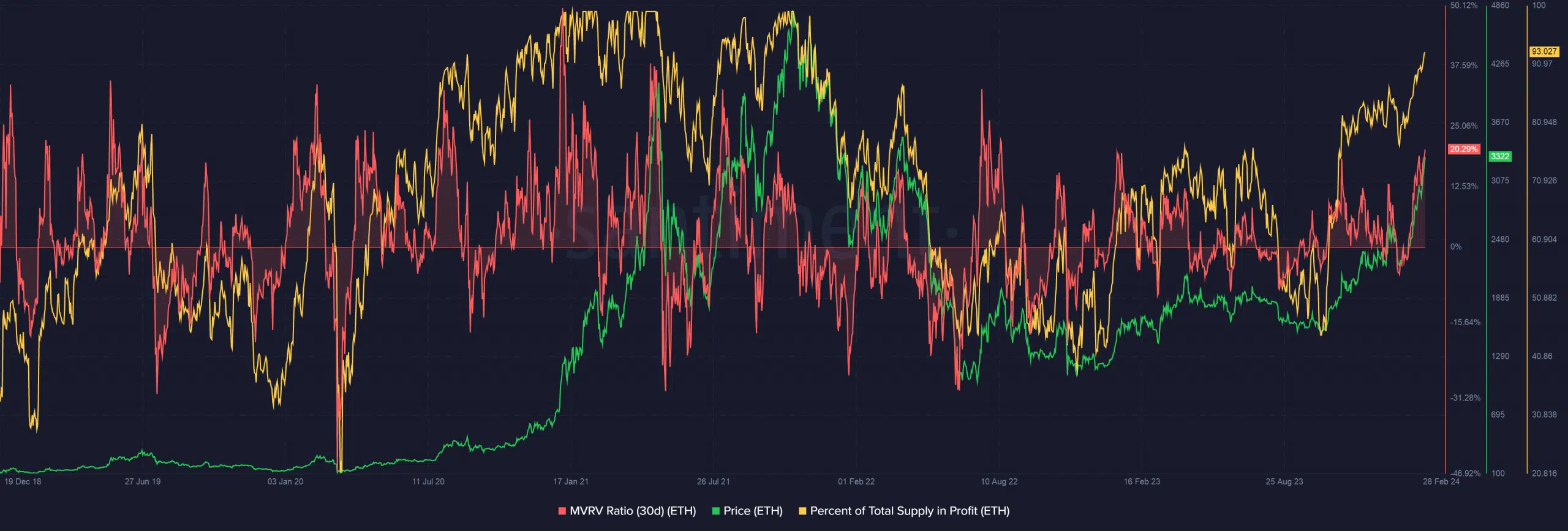

Further analyzing the data, the 30-day MVRV Ratio indicated that, on average, all ETH holders were enjoying gains exceeding 20% on their investments. While an increasing MVRV Ratio historically signaled traders’ willingness to sell, the MVRV Long/Short Difference indicator suggested that long-term holders were realizing higher profits compared to their short-term counterparts.

Source: Santiment

Be mindful of pullbacks

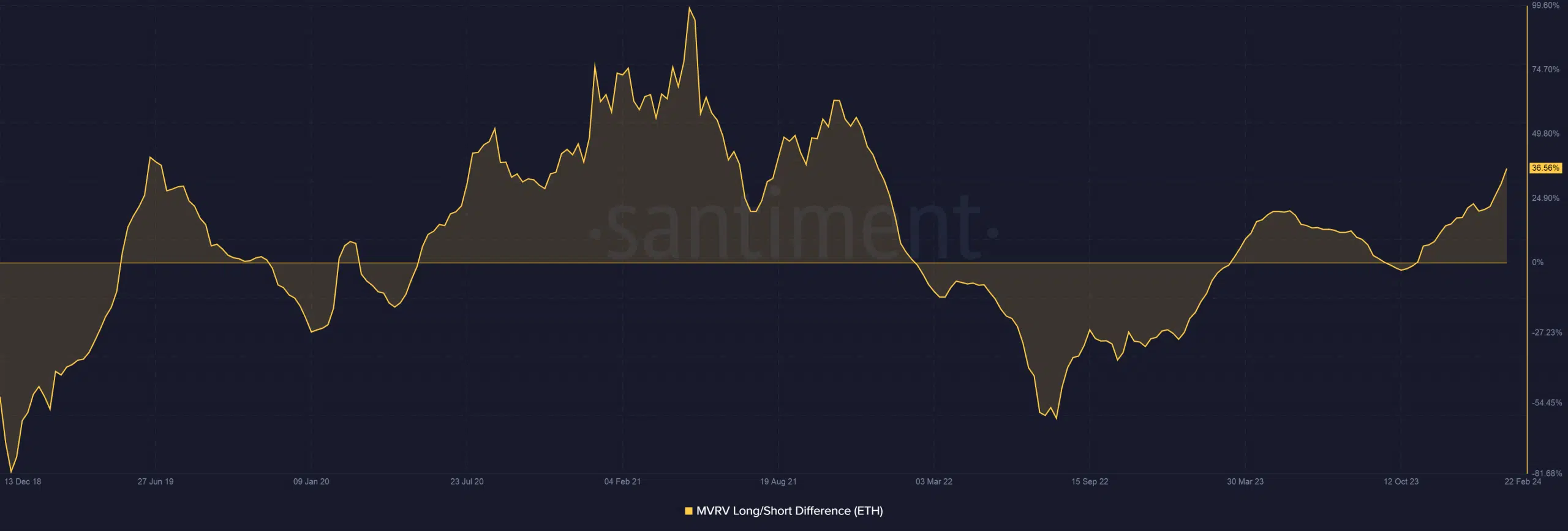

This scenario painted a compelling picture, suggesting that steadfast long-term holders, often referred to as “diamond hands,” might opt to wait for prices to reach and surpass previous all-time highs before considering distribution.

Source: Santiment

Related: Ethereum’s Dencun Upgrade Set to Launch March 13

Stay vigilant for potential pullbacks amid Ethereum’s bullish momentum. Despite the upward surge, it’s crucial to be aware of possible corrections.

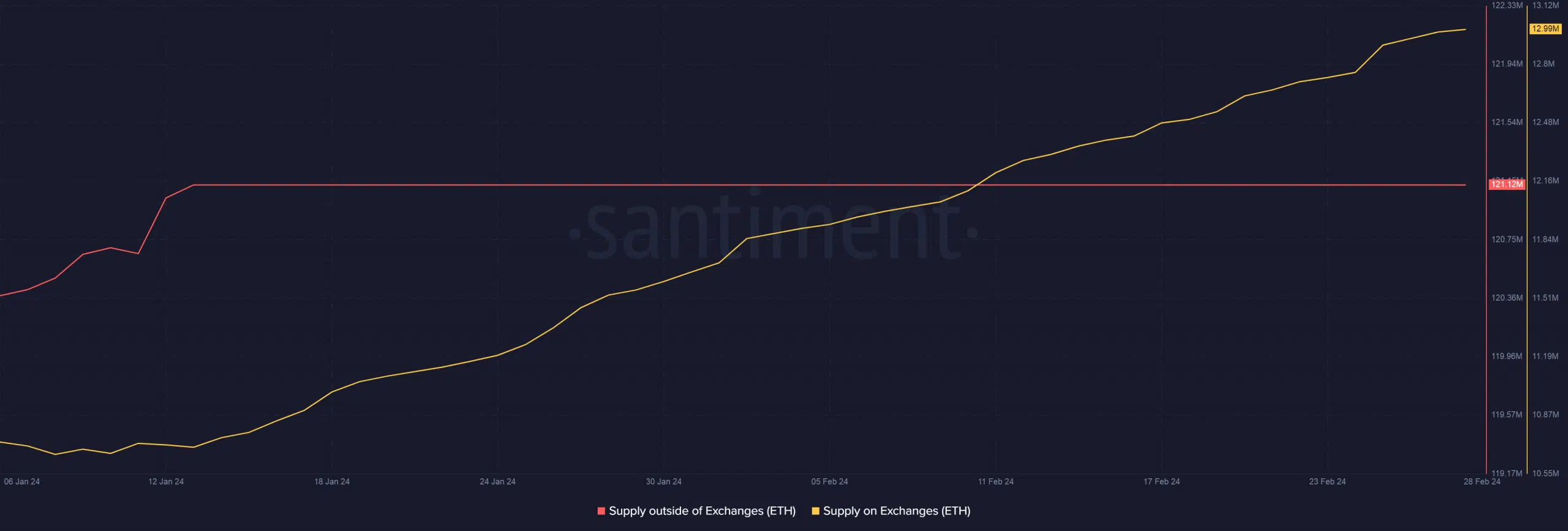

The total amount of ETH held on exchanges has consistently risen since the beginning of 2024, while the supply outside exchanges has stabilized. Typically, this dynamic indicates an increase in short-term sell pressure. During such corrections, consider seizing the opportunity to buy the dip.

Source: Santiment

Looking ahead, the Ethereum community is gearing up for the anticipated Dencun Upgrade, designed to decrease transaction fees on layer-2 (L2) chains. As outlined in a recent blog post by the Ethereum Foundation, the upgrade has successfully been implemented on all testnets and is scheduled for a mainnet launch on March 13th. Despite potential fluctuations, supporters remain confident in an extended bullish market, with the Dencun Upgrade serving as a significant catalyst.