While most major Layer-1 blockchains have bounced back strongly after the first-half market crash, Sui (SUI) is still lagging behind. Its price remains about 40% below its Q1 peak, while Ethereum (ETH) has not only recovered all its losses but also gained over 60% in Q3.

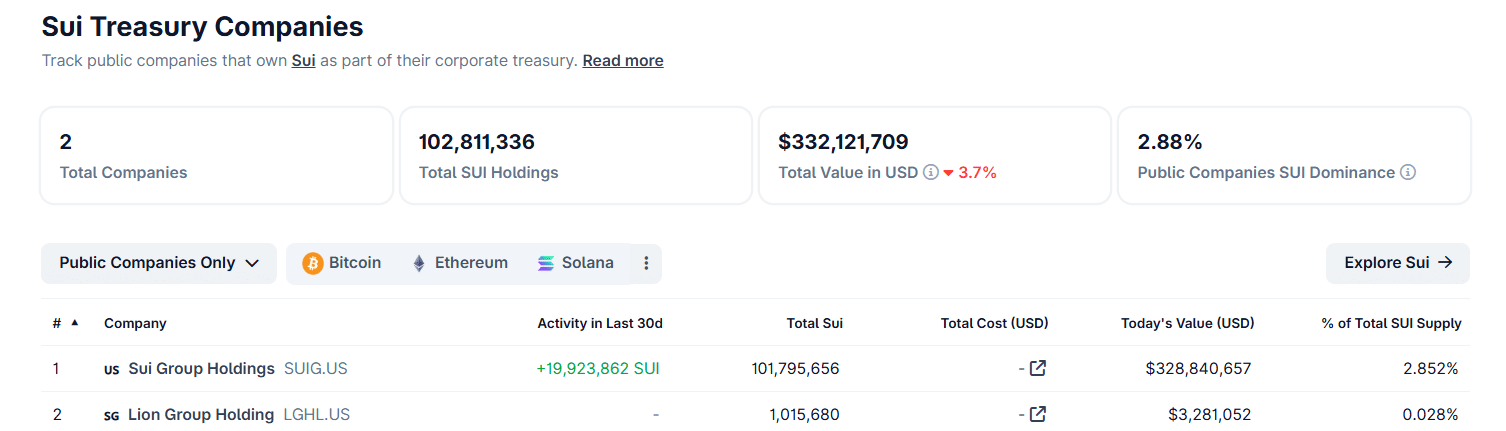

ETH’s rebound was fueled partly by institutional inflows, with BitMine (NASDAQ: BMNR) holding 2.4 million ETH. On the SUI side, SUI Group Holdings (NASDAQ: SUIG) has amassed a hefty 101 million SUI, accounting for 2.8% of total circulating supply. In just the past 30 days, SUIG scooped up an additional 19 million SUI – nearly 27 times the pace of BMNR’s ETH accumulation (702,000 ETH).

This aggressive accumulation highlights SUIG’s growing appetite for SUI, even as the market remains cautious. Notably, SUIG recently launched a $50 million stock buyback program, already repurchasing 276,000 shares. Many analysts view this as a strong signal of SUIG’s long-term confidence in SUI, which still appears undervalued compared to other L1 peers.

However, SUIG’s stock price has struggled. Shares have dropped 32% from their $5.37 opening, reflecting weak demand. In this context, the buyback serves not only to support the stock price but also to inject liquidity and safeguard the firm’s massive 101 million SUI treasury.

Meanwhile, Sui’s on-chain data paints a very different picture. Daily active addresses (DAA) just hit a monthly high of 927,000 — far surpassing Ethereum’s 530,000, which has remained flat. On transaction volume, Sui processes an average of 4.5 million daily transactions — nearly 3× Ethereum — showing that users are actually engaging with the network beyond simple token holding.

With strong institutional backing combined with rising real-world usage, the case for SUI being undervalued is gaining traction. If this trend continues, Sui could position itself as a key pillar in the upcoming Web3 transformation.