Surge in ‘Buy Bitcoin’ Searches in the UK

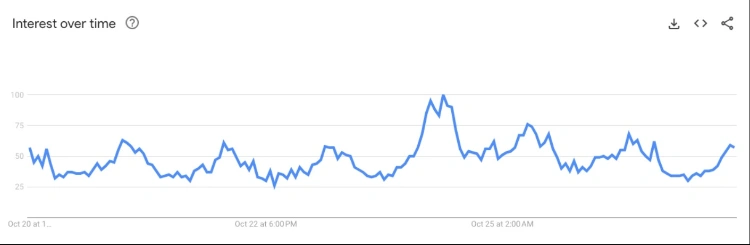

Google searches for “buy Bitcoin” have experienced an explosive 826% surge in the United Kingdom over the past week, mirroring a global trend sparked by a substantial rise in Bitcoin’s value.

This remarkable increase in search interest, as reported by Cryptogambling.tv, demonstrates the growing fascination with digital assets and the potential influence of conventional financial institutions in this domain.

While the United Kingdom led this surge in searches, a notable uptick in Bitcoin-related queries was observed across the world. For instance, in the United States, inquiries like “should I buy Bitcoin now?” rose by more than 250%, and more specialized queries, such as “can I buy Bitcoin on Fidelity?” skyrocketed by over 3,100% within the past week.

Furthermore, the worldwide search term “Is it a good time to buy Bitcoin?” saw a 110% increase, indicating a widespread interest in Bitcoin investment. Additionally, searches related to the “BlackRock Bitcoin ETF” surged by 250%, highlighting the broader enthusiasm for information about BlackRock’s spot Bitcoin exchange-traded fund (ETF), currently awaiting approval.

This surge in interest aligns with Bitcoin’s substantial price increase over the past two weeks, where it briefly exceeded $35,000 on October 24, marking its highest value since May 2022. This excitement can be attributed to the impending approval of a spot Bitcoin ETF, which many experts believe will trigger increased institutional investment.

Prominent ETF analysts Eric Balchunas and James Seyffart estimate a 90% probability of approval by January 10 next year. As of the latest available data, Bitcoin has surged by more than 27% in the past two weeks, according to TradingView price data.

I’ve gotten a lot of questions regarding my current view on Spot #Bitcoin ETFs over the last couple weeks. This is the first section of the note I put out yesterday with @EricBalchunas.

TLDR: Our view hasn’t changed much https://t.co/dRAm5IsdQf pic.twitter.com/Htsi3n2XxV

— James Seyffart (@JSeyff) October 13, 2023

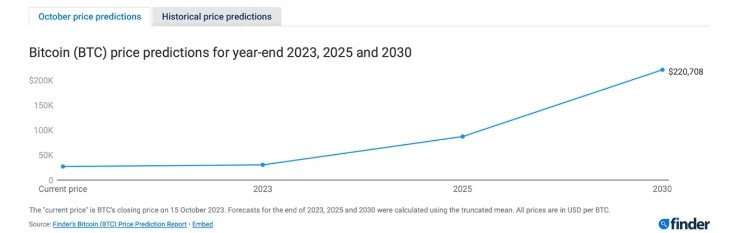

Bitcoin to Hit $87,000 by 2025

A recent report from finder.com, titled “Bitcoin to Hit $87,000 by 2025,” gathers insights from 31 experts in the fintech and crypto industry to predict the future of Bitcoin (BTC). These experts weigh in on various factors that could influence Bitcoin’s price, including the potential approval of a spot Bitcoin exchange-traded fund (ETF).

The consensus among these experts suggests that Bitcoin will end 2023 at around $30,000 per unit, surpassing its previous all-time high of $69,000, and reaching a value of $87,000 by 2025.

Mitesh Shah, the founder of Omnia Markets, is among those who anticipate an ETF approval this year, and he believes that such approval would open the doors for institutional investment, causing an immediate price spike. He predicts that Bitcoin could end the year at $35,000 and reach $105,000 by 2025, with BlackRock’s ETF application being a likely candidate for approval.

The report also highlights the significance of the impending 2024 Bitcoin halving event, with 57% of the experts foreseeing a modest price increase leading up to the event.

>>> Bitcoin Dominance Reaches 2.5-Year High as Halving Approaches

Historically, Bitcoin’s price has risen after halving events due to a reduced rate of new Bitcoin entering circulation. Damian Chmiel, a senior analyst and editor at Finance Magnates, predicts that Bitcoin could settle at $30,000 in 2023 and rise to $50,000 by 2025, while remaining optimistic about its long-term prospects.

However, not all experts share such bullish sentiments. Desmond Marshall, the managing director at Rouge International and Rouge Ventures, holds a more bearish view due to recent regulatory actions and economic concerns. He anticipates that Bitcoin’s value will reach $35,000 by 2025, echoing its current price trajectory.

In contrast to some more optimistic projections made in the past, this report takes a more cautious stance. It concludes that 66% of the surveyed fintech and crypto specialists consider the present moment as a good opportunity to acquire Bitcoin, while 24% advise holding onto existing holdings, and 10% recommend selling Bitcoin at this juncture.