Sudden Decline in Stablecoin Activity in the United States

Chainalysis, a blockchain intelligence firm, has recently highlighted a significant drop in stablecoin activity within the United States. The firm’s report indicates that while U.S. entities initially played a key role in legitimizing and fostering the stablecoin market, an increasing number of cryptocurrency users are now engaging in stablecoin-related activities through platforms and issuers located overseas.

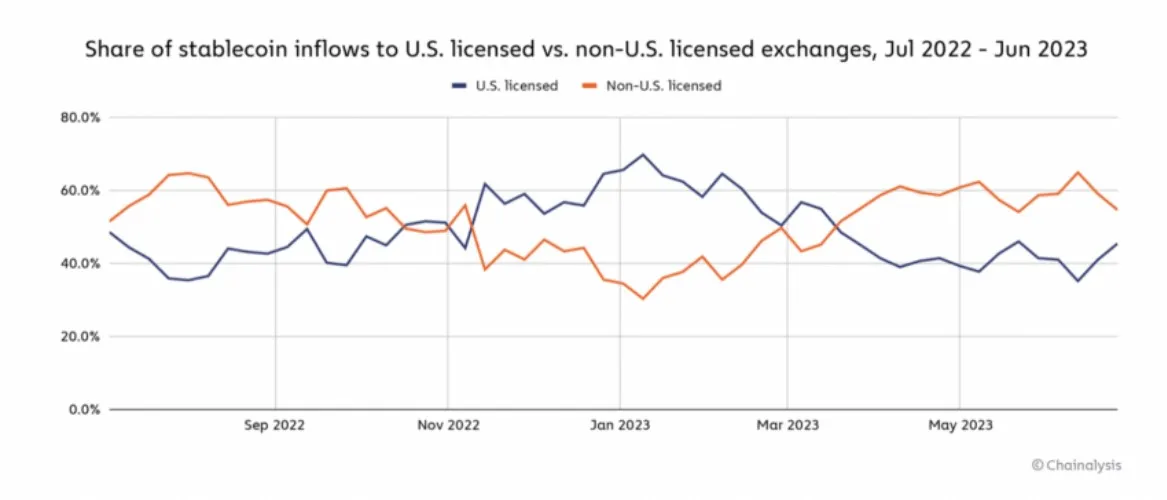

Stablecoins have been a major driver, accounting for over 50% of all on-chain transaction volumes on centralized exchanges in recent times. However, during the same period, the majority of stablecoin inflows to the 50 largest cryptocurrency services have shifted away from U.S.-based services to those located abroad. In fact, as of June, a substantial 54.6% share of stablecoin inflows to the top 50 services were directed to non-U.S. licensed exchanges.

The report underlines that a vast majority of stablecoins are tied to the U.S. dollar, and it emphasizes the crucial role of vigilant regulation by the U.S. government. With over 90% of stablecoin activity revolving around U.S. dollar-pegged assets, U.S. regulators are keen to exert regulatory authority over stablecoins, particularly considering the central role of USD-denominated reserves in these assets.

Jason Somensatto, Head of North American Public Policy at Chainalysis, acknowledges that regulating stablecoins presents certain challenges but anticipates that these issues will be resolved in the near future. He believes that these debates are solvable and should be resolved in the interest of global competition and necessary regulation.

These developments follow the release of a stablecoin bill draft by the U.S. House Financial Services Committee on April 15. The bill proposes various changes, including a temporary halt on algorithmic stablecoins and giving the Federal Reserve more control over stablecoins offered by nonbank entities.

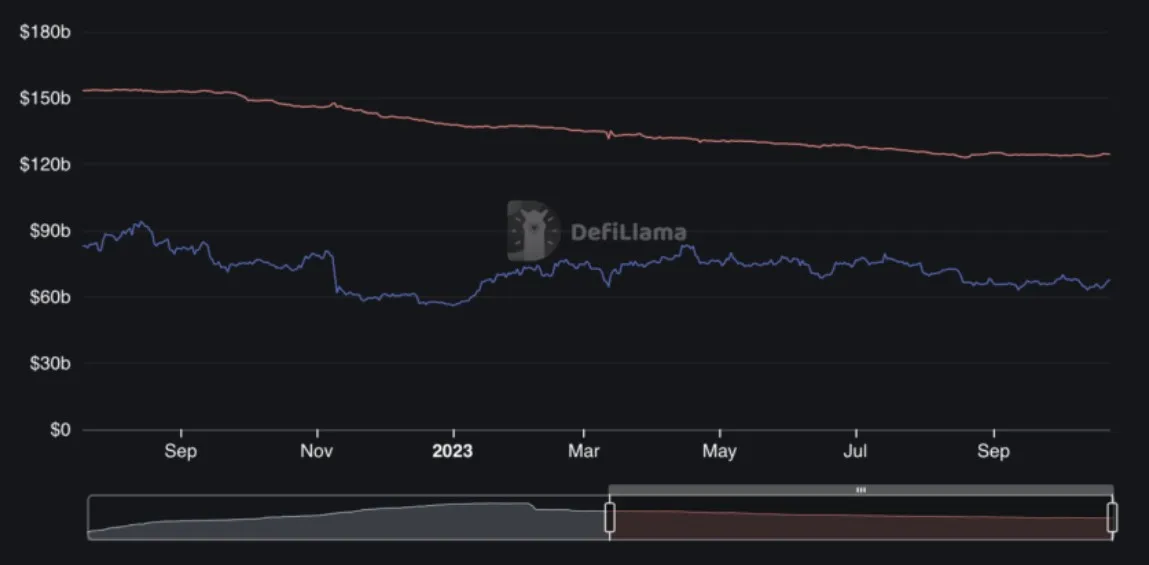

As of now, the total market capitalization of stablecoins stands at $124.56 billion, with USDT accounting for a dominant share of 67.6%. Notably, recent data published on September 22 by BeInCrypto revealed that the market capitalization of stablecoins had dropped to $124 billion in September, marking its lowest point since August 2021.

Within this context, it’s worth mentioning that among the 118 stablecoins in circulation, BUSD and FRAX, two prominent stablecoins in the top 10 by market capitalization, saw the most significant declines. BUSD’s market capitalization decreased by 19.2% to $2.5 billion, while FRAX experienced a decline of 16.7%, bringing its market capitalization down to $670 million.

The Bitcoin price may be on the verge of entering its most bullish phase, potentially signaling a significant breakout. Currently trading above $34,000, after more than a year in the $20,000 range, Bitcoin is approaching its 2023 high, which is less than $1,000 away. Breaking this level could trigger an “impulse phase,” a highly bullish period just before a significant acceleration in price.

>>> Bitcoin Surges to $35K USD, Reaching Highest Level in Months

The impulse phase typically occurs when certain psychological price thresholds are surpassed. During this phase, the Relative Strength Index (RSI) often enters overbought territory. Although this might seem concerning for a rallying asset, Bitcoin and other cryptocurrencies can stay overbought for extended periods during strong trends.

The daily RSI has already entered overbought territory, and the 3-day RSI is not far behind. Once the weekly RSI also reaches overbought levels, it could signal an unstoppable bull run. In the past, when this happened, Bitcoin surged for nearly 90 days without a major correction.

Another indicator suggesting that Bitcoin is entering the impulse phase is the Elliott Wave Principle, with BTCUSD potentially moving into its third wave, which is always impulse in nature. Impulses prompt market participants to take action, either buying or selling the asset. Given Bitcoin’s current bullish trend, the impulse phase would likely coincide with an upward movement.

Confirmation of a potential third wave would come with a clear break above the 2023 high. Falling below the June 2023 low would invalidate the current bullish pattern. If indeed entering an impulse phase, Bitcoin may experience fewer pullbacks, similar to its behavior in late 2020 when it surged from $13,000 to $42,000 with minimal interruptions.