After experiencing a market correction that saw Stacks (STX) drop to $1.89, the altcoin bounced strongly over the past day, reaching a high of $2.62 with a gain of 19.63%. However, STX has since recorded a slight correction. At the time of writing, STX is trading at $2.53, representing a gain of 11.63% over the past 24 hours.

During the same period, STX’s trading volume has surged by 202.25% to $534.69 million, according to data from Coinglass. Prior to this impressive rally on the daily chart, STX saw a decline of 1.79% over the past week. However, on the monthly chart, the altcoin has surged by 29.42%.

Despite the recent gains, STX is still trading around 34.3% below its all-time high (ATH) of $3.84. With demand for Stacks surging, the question is whether the altcoin is entering a more sustainable uptrend.

STX Chart Analysis

Stacks is showing strong momentum, driven by a significant increase in buying pressure. This momentum is reinforced as STX approaches a bullish crossover on both indicators. Specifically, the altcoin’s relative strength index (RSI) has increased from 47 to 56, while the moving average (MA) has decreased from 64 to 61. This momentum suggests that buying pressure is increasing while selling pressure is waning.

This is further reinforced as the +DI on the Directional Movement Index (DMI) continues to rise, while the -DI declines. Specifically, STX’s +DI rose to 24.86 while -DI fell to 25.

This development shows that STX is approaching a bullish crossover. If this crossover occurs, it will confirm the strength of the current uptrend.

In addition, this positive trend is also clearly reflected in investors holding long positions. According to data from Coinglass, long orders are dominating the market.

Specifically, the Long/Short ratio shows that long orders dominate with 54.69% of the total orders in the 4-hour time frame. This implies that the majority of investors are expecting the price to continue to rise.

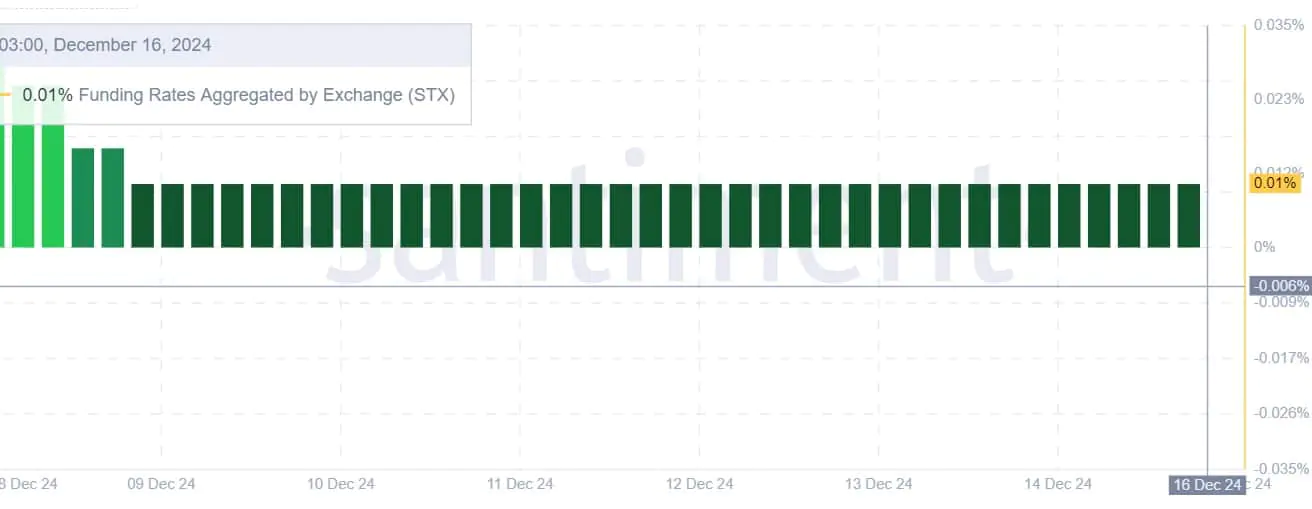

In addition, the demand for long positions is also reinforced by the positive Funding Rate aggregated from exchanges. This shows that when STX falls in price, investors are still willing to pay more to maintain their long positions.