According to a report from Artemis and Dune, the number of active stablecoin wallets has seen a significant rise, increasing from 19.6 million in February 2024 to over 30 million in February 2025, marking a 53% growth within just one year.

The report, titled “Stablecoin Outlook 2025: Supply, Adoption, and Market Trends,” highlights the rapid expansion of stablecoins, reflecting the growing engagement of users. On-chain analysts emphasize that this trend underscores the increasingly vital role stablecoins play in the digital finance ecosystem.

Stablecoins – A Bridge Between Traditional Finance and Cryptocurrencies

In 2024, stablecoins emerged as a crucial bridge between traditional finance and the cryptocurrency space. The sharp increase in the number of active wallets can be attributed to several factors, including:

- The growing adoption of stablecoins by financial institutions.

- The increasing use of stablecoins in payments and decentralized finance (DeFi).

- The expanding global accessibility of stablecoins.

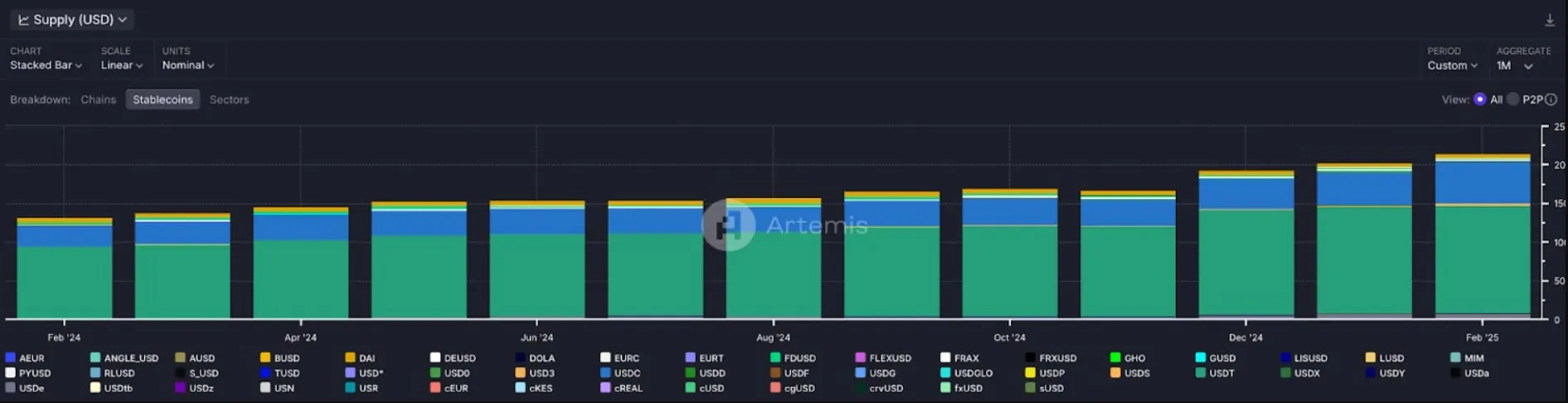

Stablecoin Supply Rises by 63%

In addition to the rise in active wallets, the total supply of stablecoins also saw a significant increase. Specifically, from $138 billion in February 2024, the total supply of stablecoins reached $225 billion by February 2025, reflecting a 63% year-on-year growth.

Unlike other cryptocurrencies, stablecoins are generally pegged to a value of $1, meaning their market capitalization mirrors their total supply.

Stablecoin Transaction Volume Reaches $35 Trillion Over the Year

Stablecoin transaction volume also surged during the same period. In February 2024, the monthly transaction volume stood at $1.9 trillion, rising to $4.1 trillion by February 2025, marking a 115% increase.

December 2024 recorded the highest transaction volume for stablecoins, reaching $5.1 trillion, before seeing a slight decrease in 2025. In total, stablecoins facilitated $35 trillion in transactions over the past year.

Whale and Institutional Activity in Stablecoin Transactions

While many metrics indicate explosive growth, the average transaction size for stablecoins saw only a slight increase, from $676,000 in 2024 to $683,000 in 2025. However, there were two notable spikes in May and July, when the average transaction size hit $2.6 million and $2.2 million, respectively.

According to analysts from Artemis and Dune, these fluctuations reflect the significant involvement of institutions and whales in the stablecoin market, indicating its widespread use in both retail and institutional transactions.