The cryptocurrency market in the fourth quarter of 2023 is holding its breath, awaiting the SEC’s approval of the Bitcoin spot ETF. Despite continuous delays and deadline extensions, investor sentiment is eagerly fixed on the possibility of the SEC giving the green light.

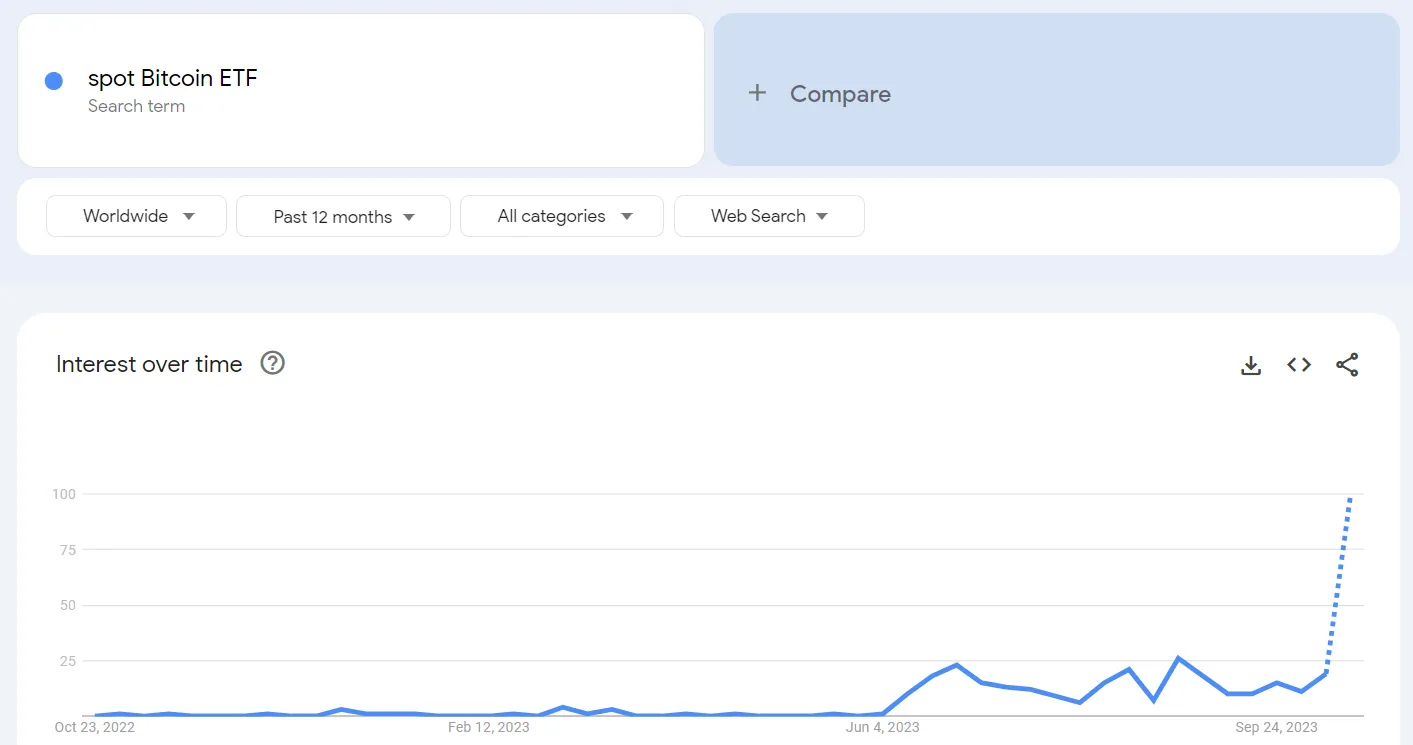

This optimism is well-reflected in the global search volume for the keyword “spot Bitcoin ETF” on Google, which is currently at its peak, registering a perfect score of 100.

Source: Google Trends

The Journey of “Bitcoin ETF” on Google Trends

According to data from Google Trends, the keyword “Bitcoin ETF” hit a score of 100 two years ago when the first Proshares Bitcoin ETF was listed on the New York Stock Exchange on October 19, 2021. Subsequently, this keyword experienced a lengthy period of relative calm before surging in recent months.

Both “spot Bitcoin ETF” and “Bitcoin ETF” keywords are indicative of public interest, particularly among individual and small-scale investors in Bitcoin and the cryptocurrency market at large. This indicates that ETFs are no longer confined to large institutions and have penetrated the world of individual investors.

Despite facing resistance from the SEC, most people believe that the SEC will approve a Bitcoin ETF in the coming year. Even experts at Bloomberg are predicting an approval rate as high as 95%.

SEC’s Scrutiny of Crypto ETF Proposals

This trend is not surprising at all. When numerous industry giants and experts take to the media to talk about Bitcoin and ETFs, and even leading investment funds like BlackRock apply for Bitcoin ETF registration, it naturally piques the interest of the public. They turn to Google to search for these keywords, leading to a surge in search volume.

The most compelling evidence of investor FOMO (Fear of Missing Out) is the recent mishap involving Cointelegraph on the evening of October 16. A single social media post falsely claimed that “SEC had approved BlackRock’s proposal for a Bitcoin spot ETF,” causing the price of BTC to skyrocket to $30,000 within a short hour.

Related: BlackRock CEO Addresses Bitcoin Price Surge Caused by False ETF News

Despite being debunked as fake news, this incident underscores the pent-up interest in this space, waiting for that final trigger to ignite the market. As Larry Fink, CEO of BlackRock, shared with The Block, “Investor interest has driven BTC’s growth far beyond the impact of fake news. Even after the dust settled, Bitcoin was trading around $29,000, highlighting investors’ positive confidence.”

According to predictions from Matrixport, BTC’s price could potentially surge to $42,000 – $56,000 if BlackRock’s ETF is approved. While this forecast might seem overly optimistic, it does reflect the market’s sentiment regarding the potential emergence of a Bitcoin ETF in the coming year.

In conclusion, the cryptocurrency market is undergoing positive transformations, with the search volume for “spot Bitcoin ETF” on Google reaching its zenith. The heightened interest from both individual and institutional investors suggests that the crypto ETF landscape is evolving rapidly. With the SEC’s scrutiny of crypto ETF proposals, it’s only a matter of time before we witness significant developments in this space.

FAQs

1. What is a Bitcoin spot ETF? A Bitcoin spot ETF is an exchange-traded fund that allows investors to directly own and trade physical Bitcoin, as opposed to futures contracts.

2. Why is the SEC’s approval of a Bitcoin ETF important? The SEC’s approval of a Bitcoin ETF would provide mainstream investors with a regulated and secure way to invest in Bitcoin, potentially boosting its adoption and price.

3. What impact does Google Trends have on the cryptocurrency market? Google Trends can indicate the level of public interest and curiosity in cryptocurrency-related topics, offering insights into market sentiment.

4. How can investors prepare for potential developments in the crypto ETF space? Investors can stay informed about crypto ETF news, diversify their portfolios, and consult with financial advisors to make informed decisions.

5. What are the risks associated with investing in cryptocurrency ETFs? Cryptocurrency ETFs come with market risks, regulatory risks, and the inherent volatility of cryptocurrencies, so it’s essential to do thorough research before investing.