The administration of newly elected South Korean President Lee Jae-myung is accelerating efforts to legalize the issuance of domestic stablecoins in a bid to grow the digital asset market. Lee’s ruling Democratic Party has introduced the Digital Asset Basic Act, aiming to enhance transparency and foster competition in the crypto industry.

Under the proposed bill, South Korean companies would be allowed to issue stablecoins if they hold a minimum equity capital of 500 million won (around $368,000). They must also ensure refundability through reserves and receive approval from the Financial Services Commission (FSC).

According to data from the Bank of Korea, stablecoin transactions — mostly involving U.S. dollar-pegged tokens — reached 57 trillion won ($42 billion) in the first quarter of the year on the country’s five major exchanges. The new legislation is expected to further boost trading activity and expand South Korea’s crypto market, where over 18 million people — more than a third of the population — reportedly participate.

President Lee, who took office following a snap election victory on June 3, is moving quickly to fulfill his campaign promises. In addition to supporting the issuance of a won-pegged stablecoin, he has proposed allowing the National Pension Fund to invest in Bitcoin and other digital assets, and advocated for the launch of Bitcoin exchange-traded funds (ETFs) in South Korea.

“We need to establish a won-backed stablecoin market to prevent national wealth from flowing overseas,” Lee said during a policy forum in May.

However, the initiative faces resistance from the Bank of Korea. Governor Rhee Chang-yong warned that non-bank-issued stablecoins could undermine the effectiveness of monetary policy. The central bank also argued it should play the leading role in regulating any local currency-backed stablecoin.

Investor confidence remains cautious in the wake of the high-profile collapse of the Terra blockchain and its algorithmic stablecoin UST — co-founded by Korean developer Do Kwon — which wiped out billions of dollars in May 2022.

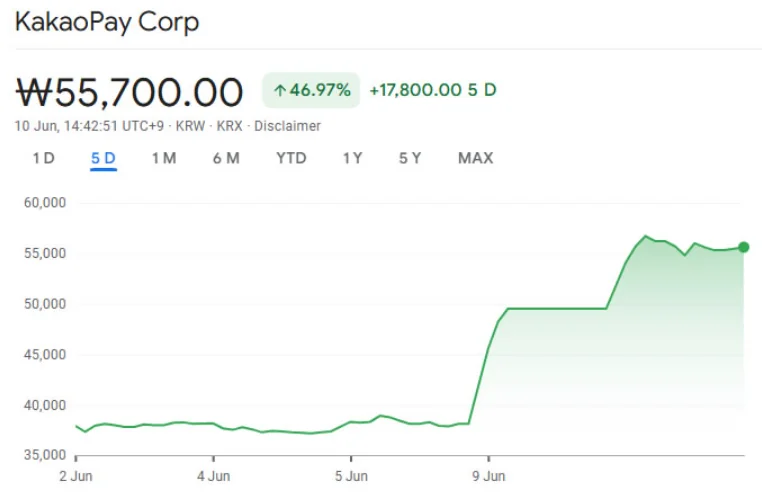

Despite regulatory uncertainties, crypto-related stocks in South Korea have surged. KakaoPay, a mobile payment and digital wallet service, saw its share price jump as much as 45% over the past five days. However, JPMorgan analysts Stanley Yang and Jihyun Cho cautioned that the rally may be speculative, as the tangible benefits of Lee’s stablecoin policy are still uncertain.