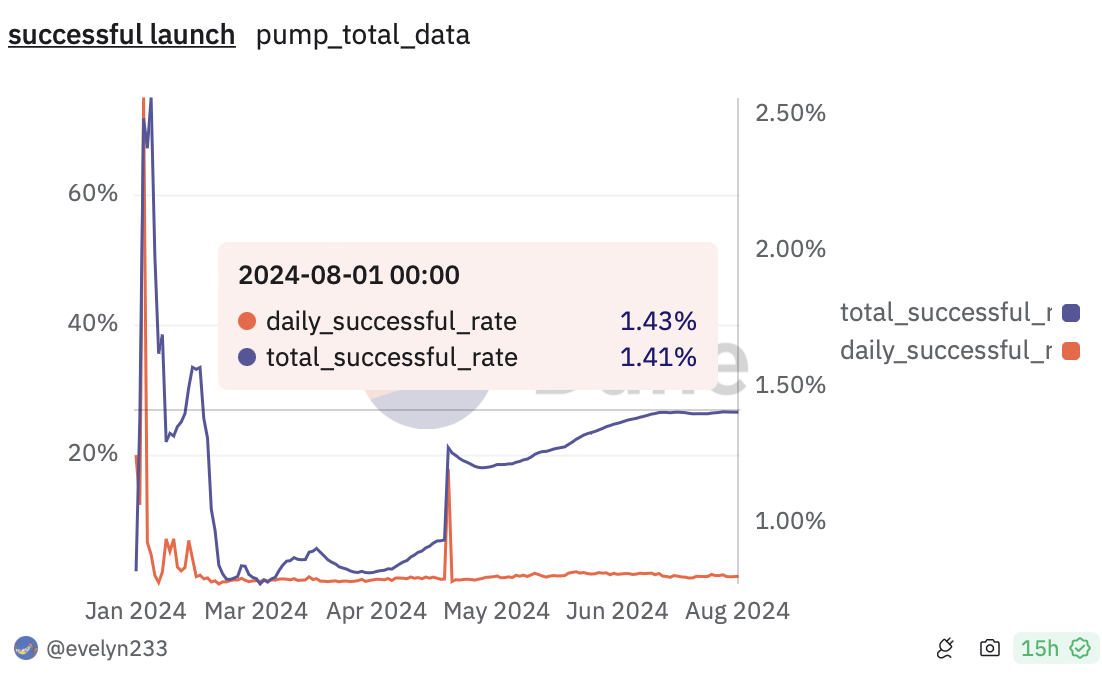

The memecoin creation platform within the Solana ecosystem, Pump Fun, has seen most of its cryptocurrencies fail. According to Dune Analytics data, the success rate of Pump Fun’s crypto tokens on the Solana-based DeFi platform Raydium is a mere 1.41%, fluctuating between 1.21% and this percentage since May, with an all-time high of 2.56% on February 16.

What’s happening in the memecoin space?

Adam Cochran, a partner at Cinneamhain Ventures, revealed in an August 1 post on X that about 1.4% of projects listed on DEX from Pump Fun achieved a value of $69,000. Cochran also highlighted that no new token has surpassed a Fully Diluted Valuation (FDV) of $20 million, which measures the total value of a cryptocurrency if all tokens were in circulation. According to Cochran, this indicates that the memecoin cycle has finally stabilized.

Web3 developer and cryptocurrency commentator Bread noted that out of the 1.58 million tokens created, only 22,300 were listed on Raydium. However, other commentators argue that the success rate does not reflect the overall memecoin market but rather illustrates how easily Pump Fun can generate memecoin projects.

Although only a few tokens have been successfully launched into the market, those that did have contributed significantly in terms of fee revenue. A token created on Pump Fun incurs a 1% transaction fee until it reaches a market value threshold. During the same period, there have been instances where Pump Fun’s revenue surpassed that of Ethereum. On July 29, Pump Fun generated approximately $864,000 in a 24-hour period, about 57% more than Ethereum’s $550,000 in the same timeframe.

Details on the Subject

The platform has become trendy among celebrities, with Caitlyn Jenner, Iggy Azalea, Jason Derulo, and others launching and promoting crypto assets using their images since May.

CoinMarketCap data shows that the total market value of the memecoin market has decreased by 2.67% in the past 24 hours, reaching $44.94 billion. However, trading volume has increased by 27.29% in the same period, reaching $4.48 billion. Among the top 100 memecoins by market value, Book of Memes (BOME) is the only token that has risen by 14.79% in the past seven days, trading at $0.009 as of July 26.