Solana (SOL) has experienced a remarkable ascent, with its value surging over 520% in the past year, currently trading above $50, a stark contrast to its dip below $8 following the collapse of FTX, a now-defunct crypto exchange, and Alameda Research, a trading arm associated with FTX and a major player in the crypto market.

While Solana enjoys a “blistering” rally and achieves new 2023 highs, concerns arise regarding the imbalance in liquidity, particularly when viewed in native unit terms. The term “native unit” in this context refers to the base unit of account for the currency, which is SOL in this case. Analyzing market depth using native units provides insights into the coin’s relative liquidity without the need for conversion into other denominations, such as USD or BTC.

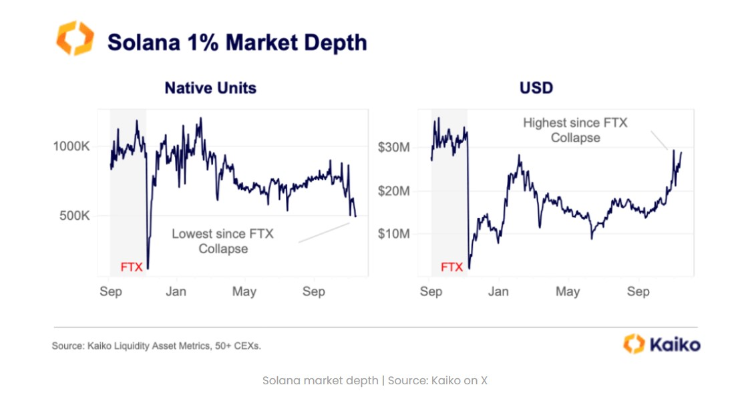

As of November 14, at a 1% market depth, Solana’s liquidity in USD terms is reported to be at its highest level since the FTX collapse. However, when assessed using native units as a liquidity gauge, the coin faces challenges, reaching its lowest point since the FTX incident.

The aftermath of the FTX collapse had profound implications not only for SOL and its native tokens but also for the broader crypto markets. The fear of contagion following the bankruptcy of the Sam Bankman Fried exchange in November 2022 led to a significant drop in SOL prices, accompanied by a decline in Bitcoin (BTC) prices, which failed to act as a perceived safe haven.

By November 2022, Bitcoin had experienced a flash crash below $16,000, and Solana plummeted from highs of $220 to as low as $8. This downturn also impacted Solana’s liquidity adversely.

Examining SOL’s liquidity in native units reveals that it has yet to fully recover and may require more time, despite the overall optimism within the Solana communities. According to Kaiko, market makers seem inclined to maintain stable liquidity for SOL, even amid surging prices in USD terms.

Related: Ripple Price Analysis: Bulls Remains Active Near $0.64

Presently, SOL prices remain steady above $50 but show signs of a potential cooldown in the upside momentum, with a series of lower lows in lower time frames. This suggests that SOL traders might be exiting their long positions. Nevertheless, the $38 level, marking the highs of November 2022, remains a crucial point for technical analysts.