Solana’s price surged beyond the $90 threshold, marking a notable breakout from its two-week consolidation range. The $90 level, which had posed as a formidable resistance over the past ten days, succumbed to the upward momentum triggered by Bitcoin’s ascent above the $42k resistance.

In a parallel development, Solana set a new record for stablecoin transfer volume, underscoring its heightened adoption and usage. Simultaneously, its Total Value Locked (TVL) exhibited a consistent uptrend, adding further weight to the platform’s growing prominence.

Solana’s Potential Surge Beyond $100 in December

Anticipation mounts for Solana as it eyes the $100 milestone in December. Having surpassed the local high of $79.5 on December 20th, the coin rebounded from a brief dip to $67 on December 18th, with subsequent price increases. Despite a momentary dip during this period, the Relative Strength Index (RSI) remained above the neutral 50 mark, indicating resilience.

The 12-hour chart portrayed a bullish technical structure, complemented by the On-Balance Volume (OBV) trending upwards, signifying sustained buying pressure on SOL. Looking ahead, the Fibonacci extension levels of 61.8% and 100% at $89.32 and $96.45 emerge as the next price targets.

In the upper echelons, the $103-$106.5 resistance zone looms large, retaining bearish control from a higher timeframe perspective. With historical significance as resistance in April 2022, this zone holds the potential to pose a formidable challenge once again.

Intense Bullish Sentiment in Short-Term Outlook

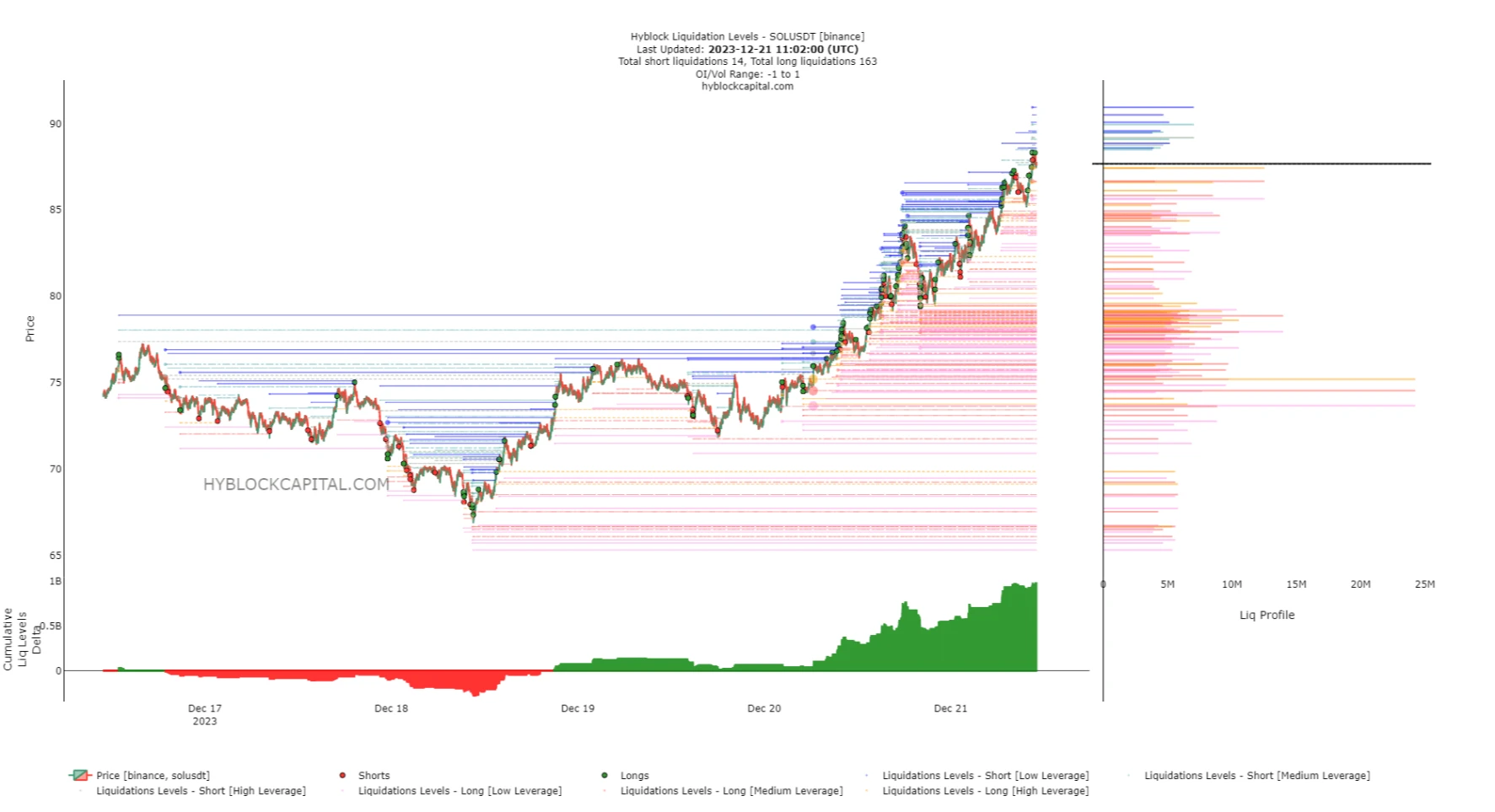

The near-term outlook reflected a strong bullish sentiment, as evidenced by the substantial bullish expectations. Hyblock’s liquidation levels underscored the prevailing dominance of bulls, with the Cumulative Liq Levels Delta witnessing a notable surge over the past two days, having hovered near the zero mark on December 19th.

While this surge indicated the bulls’ confidence in potential short-term gains, it also signaled vulnerability to potential losses in the event of a minor market downturn.

Related: Solana’s Saga Phone Suddenly Became a “Hot Item” Because of a Memecoin

Considering the market dynamics, a downward movement could exert significant pressure on overleveraged long positions, potentially resulting in a liquidity squeeze. Notably, the 83.7-$85.35 range housed several liquidation levels, with estimates suggesting multiple liquidations exceeding 10 million.

Similarly, the $77-$79.6 zone featured numerous liquidations exceeding 15 million, implying that a descent to these levels might precede any potential reversal for SOL.