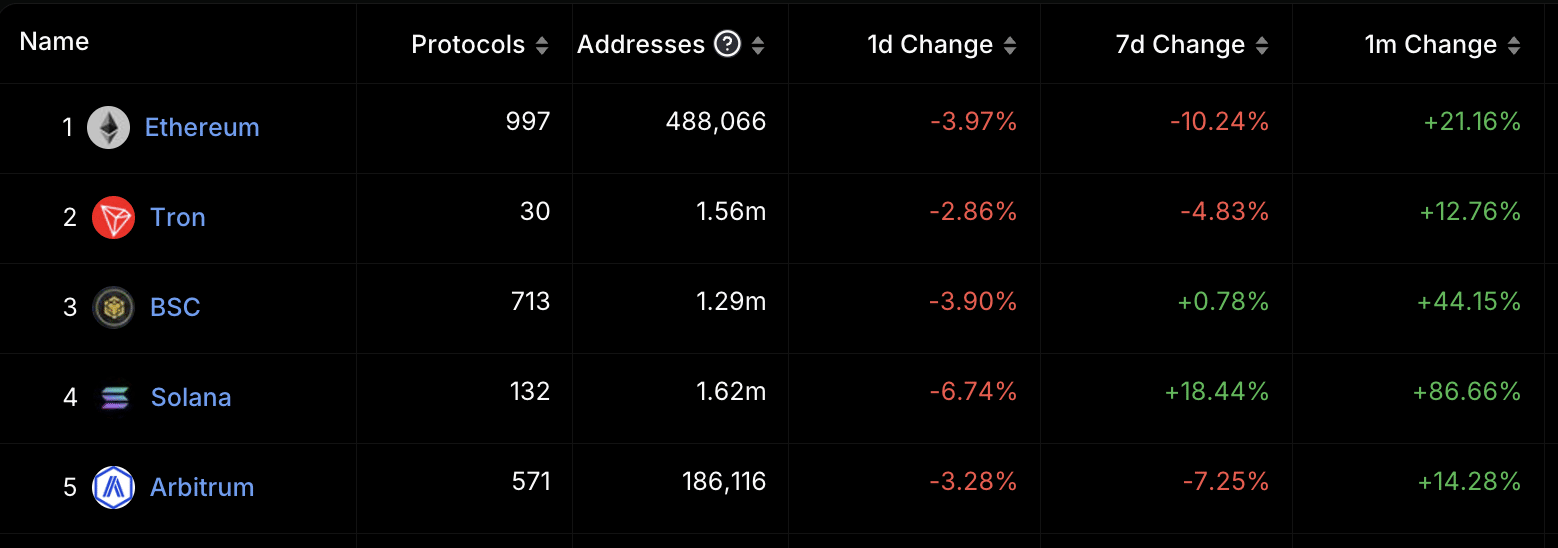

The DefiLlama data reveals a remarkable surge of over 80% in the Total Value Locked (TVL) of Solana’s decentralized finance (DeFi) ecosystem over the past month. This impressive growth has propelled Solana’s DeFi TVL to its highest point in two years, currently standing at $3.8 billion. Among the top 5 DeFi networks by TVL, Solana ranks as the blockchain with the highest growth rate in the past month.

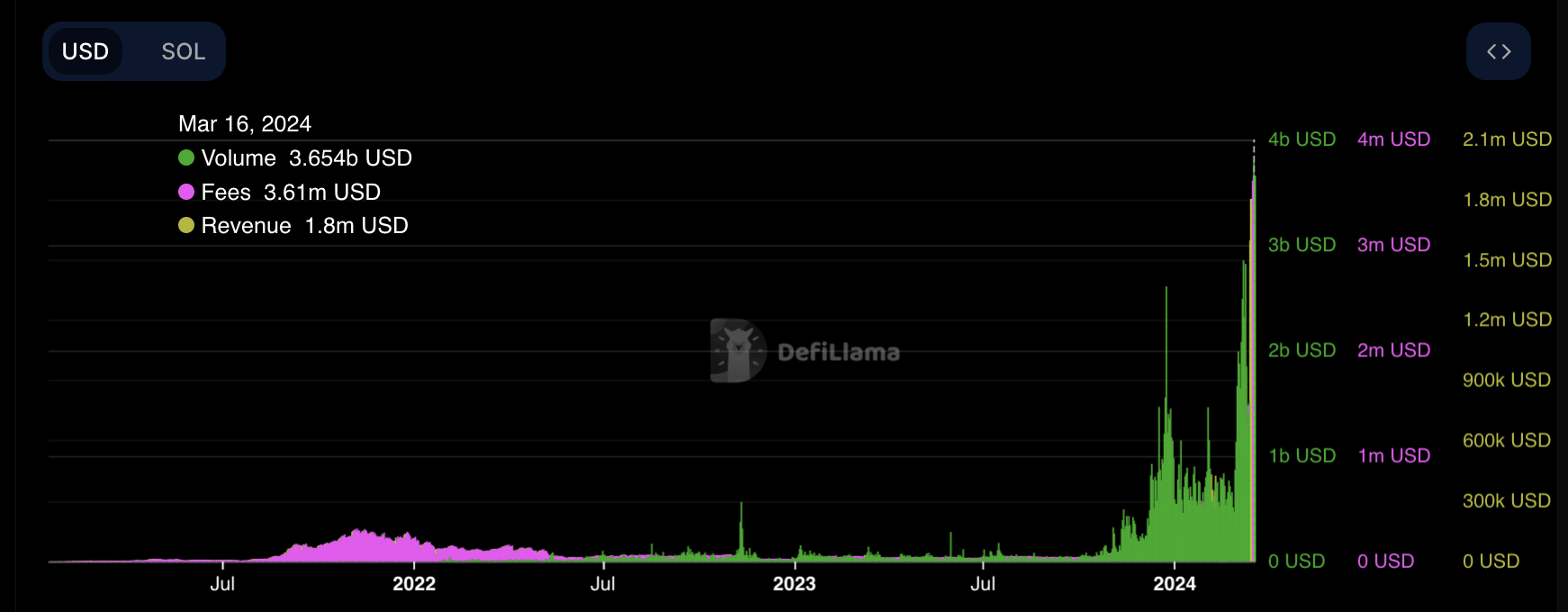

The surge in Solana’s TVL over the past month can be attributed to a significant increase in trading volume on Layer 1 (L1) DeFi protocols within the network. Since the beginning of the month, the total daily trading volume recorded on these protocols has surged by 125%. In fact, on March 15th, trading volume on Solana’s DeFi reached its highest level in years at $3.7 billion.

The network’s total fees reached $3.61 million on March 16th, marking the highest daily fee collection since its inception. Revenue generated from these fees amounted to $1.6 million, representing the network’s highest daily revenue.

Source: DefiLlama

Related: Ethereum and Solana Follow Bitcoin’s Trend

SOL Challenges Market Trajectory

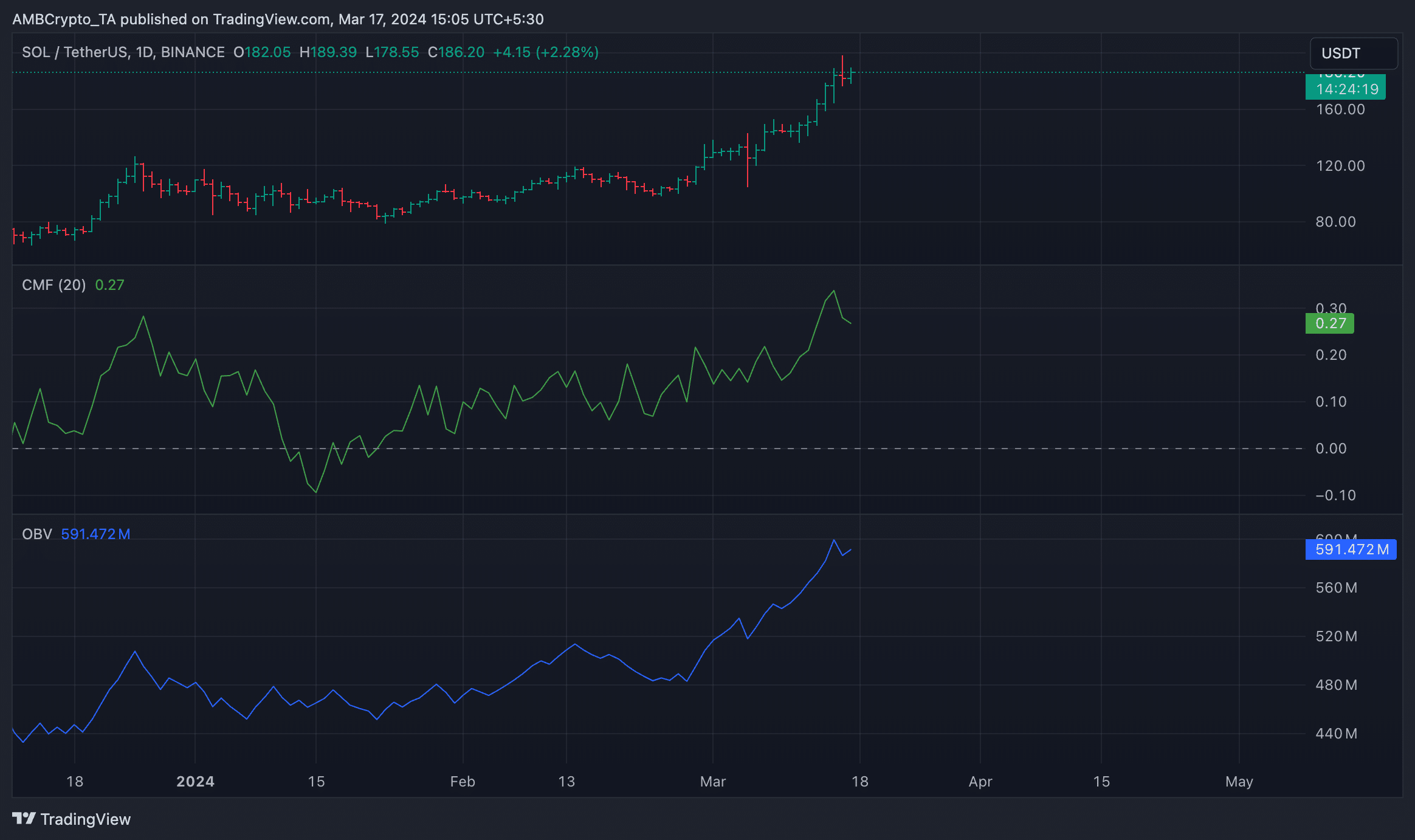

At the time of writing, SOL has traded hands at $187. According to CoinMarketCap data, the altcoin’s value has surged by 72% over the past month. While the rest of the market grapples with price reversals, SOL bucks the trend as optimism grows. Analysis of its daily chart movement indicates a stable increase in demand for SOL.

Source: DefiLlama

For instance, the On-Balance Volume (OBV), which tracks buying and selling pressure of the coin, is showing an upward trend at press time. At 591.42 million at the time of reporting, SOL’s OBV has surged by 16% since the beginning of March. When a coin’s OBV witnesses such growth, it indicates increasing buying momentum.

Source: TradingView

The rising trend in SOL’s Chaikin Money Flow (CMF) further confirms this growth. This indicator measures the flow of money into and out of an asset. Currently standing at 0.27, up from 0, SOL’s CMF indicates a growing influx of liquidity into the market.

Thanks for your support ofduty

Hii

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Send your question to email contact@azc.news