Based on historical data and current market signals, Bitcoin is poised for a potential 10–15% rally, targeting the $132,000–$138,000 range in the short term. This momentum follows the breakout of its previous all-time high at $111,800, marking the beginning of a new price discovery phase.

Over the past week, Bitcoin recorded its strongest performance since May, rising 8.74% and closing at a record high of $119,310. Notably, in the early hours of Monday, BTC touched a new peak of $123,100 on Binance before slightly retracing to around $120,000.

On-chain Data and Market Sentiment Support the Bullish Outlook

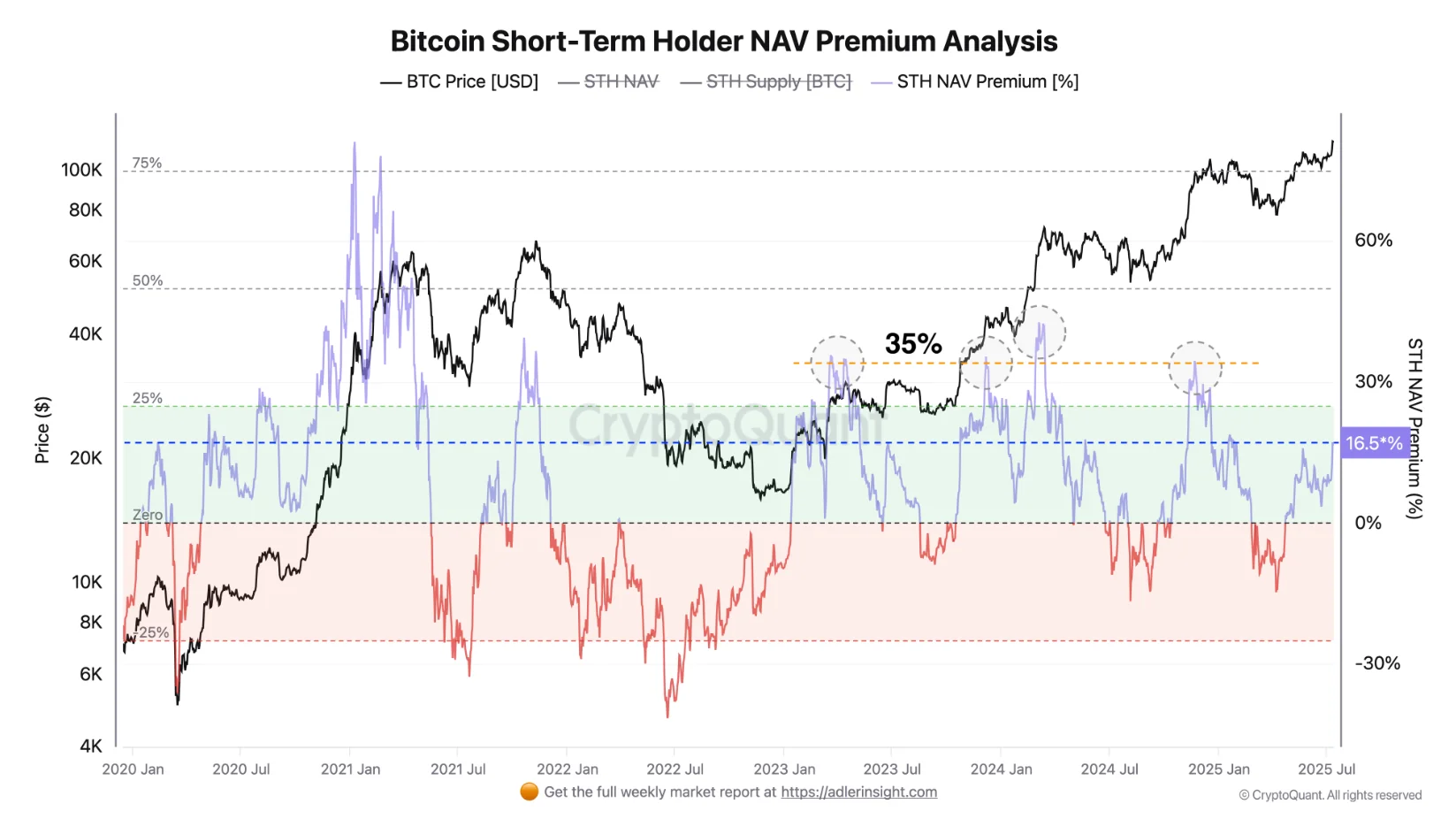

On-chain metrics suggest further upside potential. One key indicator is the Net Asset Value (NAV) deviation — which measures the gap between the market price and average acquisition cost for short-term holders — currently sitting at 16%. This reflects mild optimism and remains well below the 30–35% range often associated with excessive FOMO and local tops.

Spot trading volume surged 50% last week, according to Glassnode, yet it still lags 23% behind the year-to-date average. This indicates that the market is far from overheated and still has room to grow.

ETF Inflows Emerging as a Key Catalyst

Spot Bitcoin ETFs continue to shine. On Thursday alone, they attracted $1.18 billion in inflows — the second-highest daily total on record. According to Ecoinometrics, these inflows now act as a strong “buy” signal, a notable shift from their previously neutral stance.

Additionally, the Coinbase Premium — which tracks the price gap between Coinbase and Binance — has maintained a positive 14-day simple moving average (SMA-14) for the longest stretch since the start of the current bull cycle. This suggests consistent buying pressure from U.S. retail and institutional investors.

Short-Term Price Target: $132K–$138K

Having broken past its previous high, Bitcoin is now in uncharted territory, a phase often accompanied by significant rallies. In past cycles, BTC surged 167% after breaking $20,000 in late 2020 and gained 49% after breaching $69,000 in late 2024. However, historical patterns show that the magnitude of gains has been gradually decreasing.

Following this trend, analysts now expect a more moderate 10–15% increase before a short-term correction occurs. This sets a reasonable short-term price target between $132,000 and $138,000 in the coming one to two weeks.