A crypto executive believes that if Sharplink Gaming announces its plan to acquire a large amount of Ethereum tomorrow, the move could “spark a rally” in the company’s stock.Shares of the sports betting platform Sharplink Gaming plummeted by 73% in after-hours trading on Thursday after the company filed to register a large volume of shares for potential resale, while it prepares for a major Ethereum purchase.However, Sharplink Gaming Chairman Joseph Lubin — who is also the CEO of blockchain software firm Consensys — insisted that the market had misinterpreted the filing.

In a post on Wednesday, Lubin said that some were misreading Sharplink’s Form S-3 filing with the Securities and Exchange Commission (SEC), which registers the potential resale of nearly 58.7 million common shares.

He emphasized that this was merely a registration for the possibility of future sales, not actual sales. “This is standard post-PIPE procedure in traditional finance (tradfi), not an indication of any immediate selling,” Lubin explained.

The filing comes as the company prepares to implement a new Ethereum-based treasury strategy involving the large-scale acquisition of Ether (ETH).

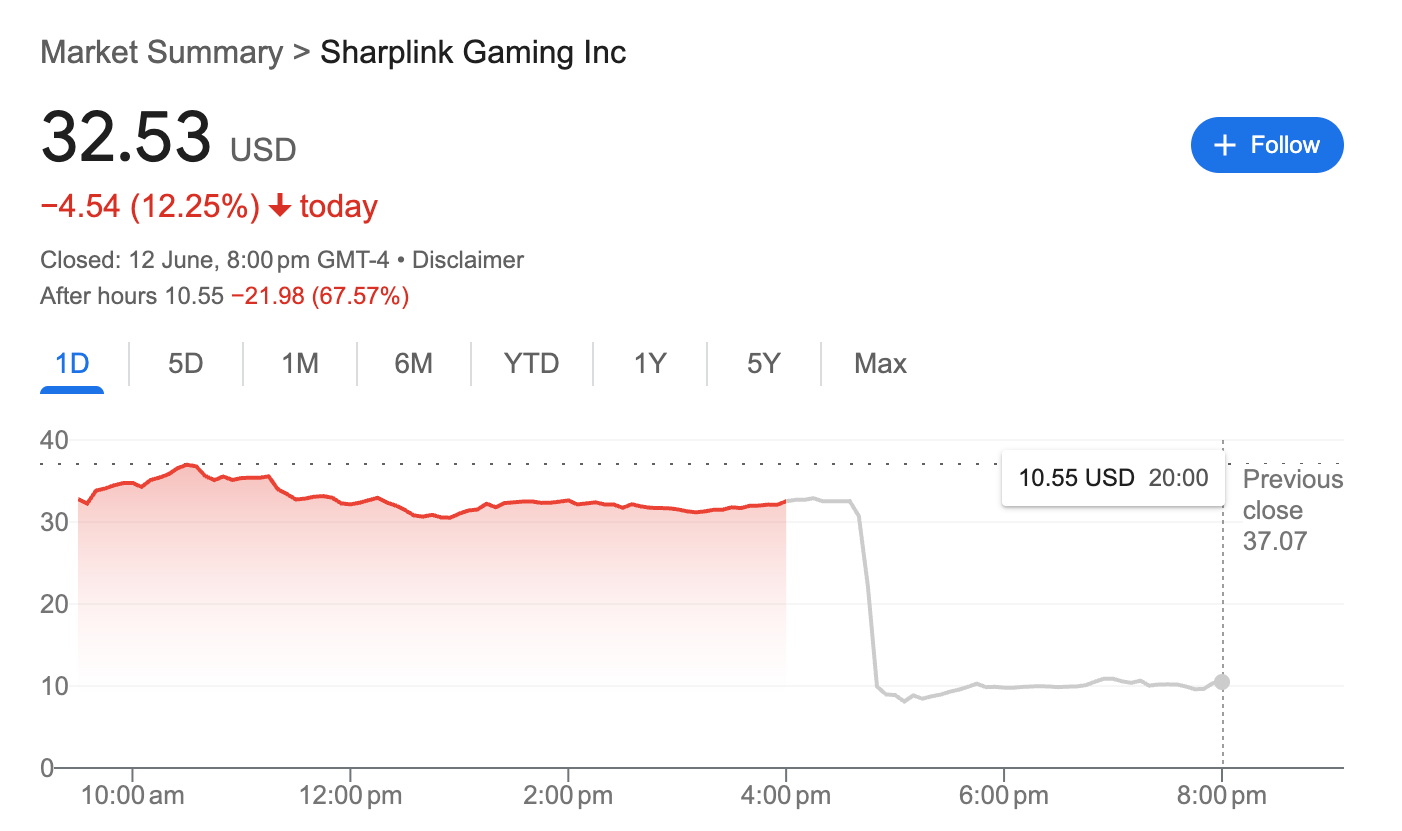

According to Google Finance, Sharplink Gaming’s stock (SBET) closed Thursday down 12.25% at $32.53, before plunging another 73% in after-hours trading to below $8. At the time of publication, the stock had slightly rebounded, trading at around $10.55, representing a 67.6% drop.

Consensys’ General Counsel Matt Corva clarified that the filing does not reflect any actual stock sales that have occurred or necessarily will occur. “This is just a basic filing, nothing more,” Corva said.

He added that the information had already been disclosed two weeks earlier, and that this filing simply serves as an official confirmation that SBET had sold shares to investors, which are now counted as part of its outstanding shares.

Previously, on May 30, Sharplink Gaming announced plans to issue up to $1 billion in common stock, with most of the proceeds intended for Ethereum purchases, just days after revealing its new Ethereum-focused treasury strategy.

Lubin reiterated that neither he nor Consensys had sold any shares. Notably, Consensys led Sharplink Gaming’s recent $425 million funding round to support its Ethereum acquisition plan.