Christopher Harborne and AML Global Ltd. filed a lawsuit against Dow Jones & Company – the parent company of The Wall Street Journal (WSJ) – alleging defamation and publishing misinformation regarding Tether and Bitfinex.

Documents submitted to the Delaware court on February 28th revealed that WSJ published an article in March 2023 targeting efforts to maintain banking relationships with Tether and Bitfinex.

In the article, WSJ criticized Tether and Bitfinex for using forged documents and setting up shell companies to open bank accounts. However, they later removed portions related to Harborne and AML to avoid implying their involvement in Tether and Bitfinex’s fraudulent activities or money laundering.

WSJ exposed:

They opened new accounts using figurehead executives and tweaked company names. And some of those accounts facilitated illicit behavior.

Immediately after the article’s publication, Tether CEO and Bitfinex CTO Paolo Ardoino denied the claims, stating that WSJ was setting a narrative and providing misinformation.

On February 21, 2024, a week before the lawsuit was filed, a magazine editor added a note:

The previous version of this article included a section related to Christopher Harborne and AML Global, who registered accounts at Signature Bank. We removed any reference to them to avoid any implication that AML’s account-opening efforts were part of Tether, Bitfinex, or related companies’ efforts to deceive banks, or misrepresent information during the registration process.

As of now, the owner of a Thailand-based aviation fuel brokerage firm alleges counter to WSJ’s defamation, stating that it accused him of aiding Tether and Bitfinex’s illegal activities.

Related: Bitfinex Stops Providing Crypto Services to Customers in the UK

Bitfinex Shareholders Sue WSJ

While Harborne is merely a shareholder of Bitfinex and holds no managerial role in the company, the lawsuit clarifies. Harborne is simply a shareholder with a stake of about 12%, which is also the result of compensation plans for customers after the exchange hack in 2016.

The news agency contends that the lawsuit Christopher Harborne filed is filled with inaccurate and distorted information. Commenting on the lawsuit, a spokesperson for The Wall Street Journal stated that, after over 9 months of publishing the article, lawyers for Harborne and AML Global contacted them to dispute 5 paragraphs related to them. After consideration, the news agency decided to remove this portion from the article and add a clarification above.

FUD but No Impact on Tether

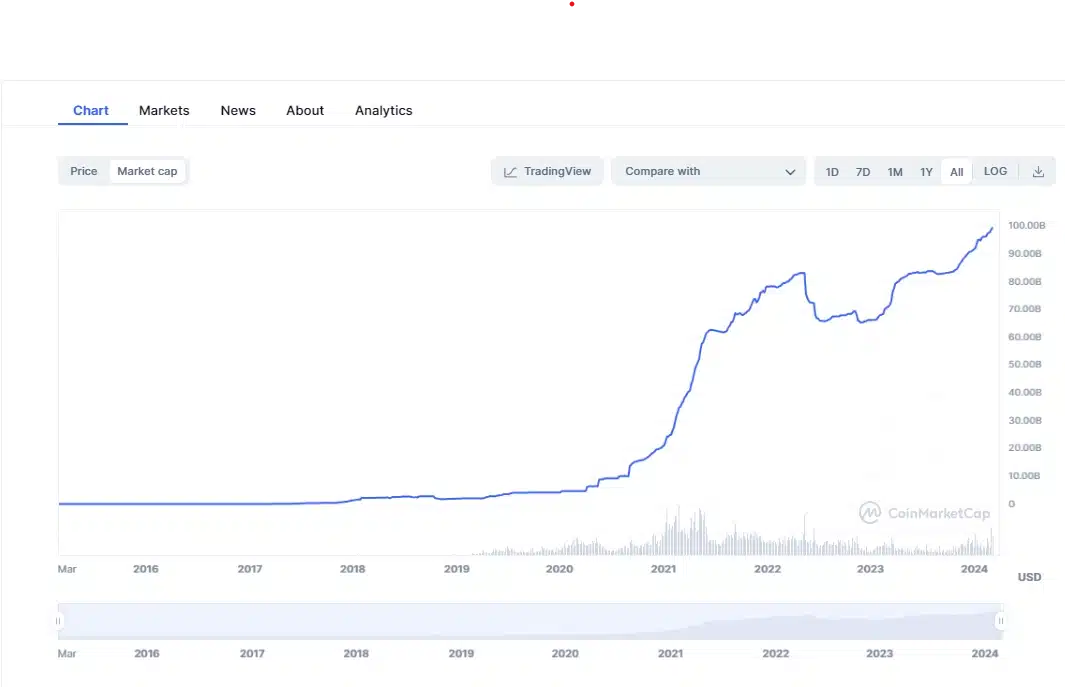

Despite the FUD (fear, uncertainty, and doubt), the stablecoin USDT from Tether, the giant, has shown impressive growth in 2023, reaching over $20 billion in market value while competitors struggle with concerns about the spillover effects from the US financial system.

The company garnered over $2.85 billion in net profit in Q4/2023, the highest figure to date. Of this, $1 billion came from holding US Treasury bonds and the remaining $1.85 billion from profits from Bitcoin and gold investments.

OMN

OMN  BTC

BTC  ETH

ETH  USDT

USDT  XRP

XRP  BNB

BNB  SOL

SOL  USDC

USDC  TRX

TRX  DOGE

DOGE