The U.S. Securities and Exchange Commission (SEC) is working on a conditional “innovation exemption” framework aimed at fostering the development of blockchain-based products and services.

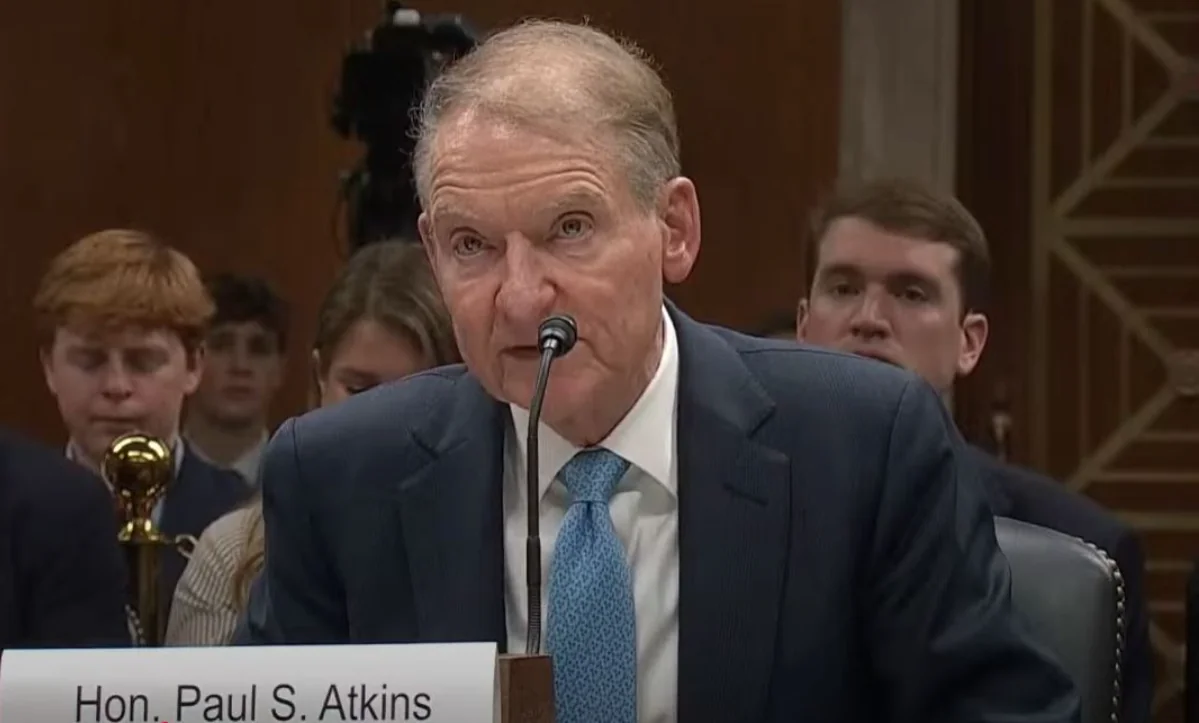

Speaking at the “DeFi and the American Spirit” roundtable on June 3, hosted by the SEC’s Crypto Task Force, SEC Chair Paul Atkins — a former crypto lobbyist — said he has directed staff to explore a framework that would temporarily exempt companies from certain regulatory requirements, provided they meet specific criteria. The goal is to accelerate the rollout of blockchain innovations while the SEC reviews and potentially amends its current rules.

“Atkins believes this exemption could help realize President Trump’s vision of making the U.S. the global crypto capital by encouraging developers and businesses to innovate within a legal framework,” he stated.

He also noted that existing securities regulations are largely built around traditional financial intermediaries such as brokers, exchanges, and clearinghouses — a structure that may no longer fit the rise of decentralized technologies and self-executing smart contracts. As such, regulatory adjustments are needed to better accommodate these new models.

The SEC’s Crypto Task Force was established on January 21 under Acting Chair Mark Uyeda, with the mandate to create a practical regulatory framework for digital assets. Atkins also revealed that the agency would shift toward a “notice and comment” rulemaking process, moving away from policy enforcement via litigation — a key point of criticism under his predecessor.

During the roundtable, Atkins criticized former SEC Chair Gary Gensler’s approach, which relied heavily on lawsuits and settlements to shape crypto policy. Since Gensler stepped down in January, the SEC has softened its stance, dropping several long-standing enforcement actions against crypto firms and issuing clearer guidance — including confirmation that common staking activities do not violate securities laws.