The US Securities and Exchange Commission (SEC) has officially approved two hybrid cryptocurrency ETFs from Franklin Templeton and Hashdex. This is a major step forward in bringing Bitcoin and Ethereum into the traditional financial markets through tightly regulated investment products.

Combined Bitcoin and Ethereum ETFs will be listed on Nasdaq and Cboe BZX

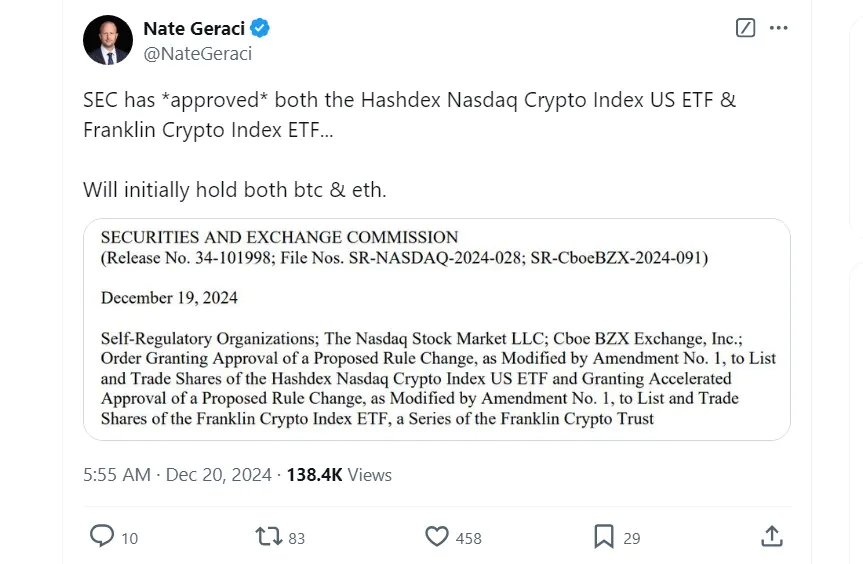

The Hashdex Nasdaq Crypto Index US ETF and Franklin Templeton Crypto Index ETF have been approved by the SEC to trade on the public market. These funds will be listed on Nasdaq and Cboe BZX, allowing investors to directly trade Bitcoin and Ethereum in spot form. Both funds will hold Bitcoin, Ethereum, cash, and cash equivalents in their structures.

The SEC’s approval of these ETFs ensures that investments in cryptocurrencies comply with important regulations, including the Securities Act of 1934 and the Investment Company Act of 1940.

The approval process also includes market surveillance measures to prevent fraud and manipulation. The decision is expected to increase the status and acceptance of digital assets in the financial system.

Read more: Bitcoin Continues to Plunge Following Fed’s Statement

Market volatility surrounding the SEC’s decision

The US SEC’s decision comes amid a sharp volatility in the cryptocurrency market. Bitcoin has fallen significantly, trading at over $96,000, down from above $108,000 at the beginning of the week. Ethereum has also dropped 15%, to $3,440.

According to data from CoinGlass, more than $1 billion worth of cryptocurrencies have been liquidated in the past 24 hours. However, experts believe that the launch of these ETFs will help stabilize the cryptocurrency market and attract more institutional investors. “This move has created a clear and legal way for investors to participate in the digital asset sector,” said a market analyst.