Sam Bankman-Fried’s (SBF) team has sparked controversy by declaring that “FTX was never bankrupt,” even though the exchange was placed under bankruptcy protection in 2022. They revealed that FTX’s petition-date holdings were worth around $136 billion, and that most creditors have already been repaid more than 120%.

Key Highlights

-

“FTX was never insolvent” claim:

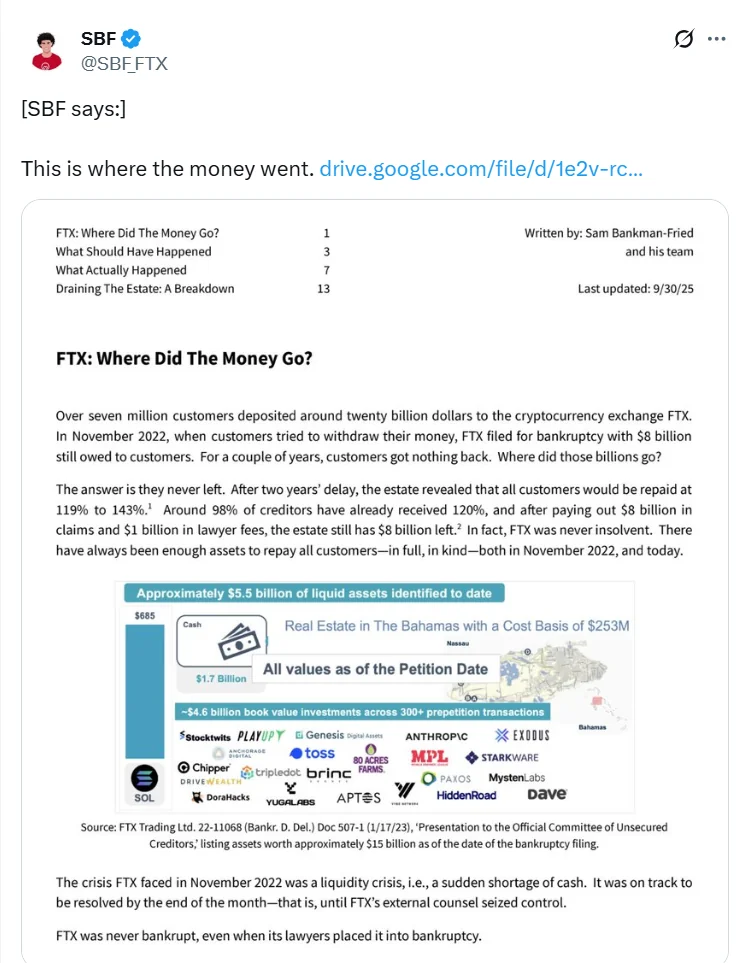

The SBF team released documents claiming that $8 billion in customer assets “never left the exchange” when lawyers filed for bankruptcy. They argue the collapse was caused by a temporary liquidity crunch, not insolvency.

-

Massive repayment rates:

Around 98% of creditors have received 120% repayments, and the team promises that all customers will get between 119% and 143%. Even after paying $8 billion in claims and $1 billion in legal fees, the estate reportedly still holds $8 billion in net assets. -

A vast investment portfolio:

Sbf Shares On X

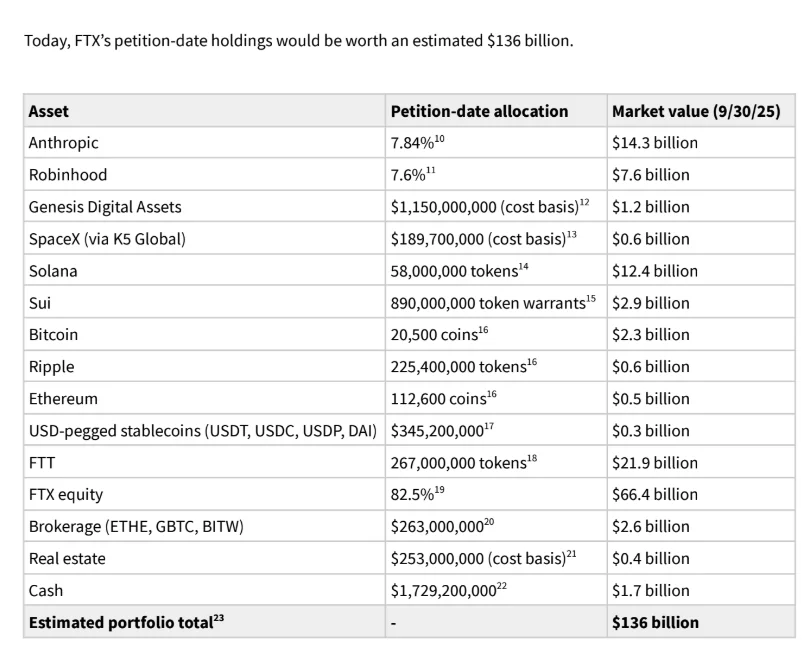

FTX’s current assets include:-

$14.3B in Anthropic equity,

-

$7.6B in Robinhood (HOOD) stock,

-

$12.4B in SOL, $2.9B in SUI, $2.3B in BTC, $600M in XRP, $500M in ETH,

-

Along with $1.7B in cash and $345M in stablecoins.

-

-

Crypto community backlash:

On-chain investigator ZachXBT accused SBF of spreading “misinformation,” pointing out that users were repaid based on 2022 crypto prices, not current higher valuations.

Many in the community insist that SBF must remain in prison and should not be pardoned. -

Political undercurrents and token reaction:

Speculation about Donald Trump potentially pardoning SBF has intensified, following his recent pardon of Binance’s CZ. Meanwhile, FTX Token (FTT) surged over 3%, reaching $0.83, with trading volume up 33% in 24 hours.

The shocking claim that “FTX was never bankrupt” has reignited one of crypto’s biggest controversies — is this the truth buried for three years, or just Sam Bankman-Fried’s desperate attempt to reclaim his shattered reputation?