The legendary fortune of Satoshi Nakamoto – the founder of Bitcoin – has dropped by approximately $42.8 billion, after BTC’s price fell sharply by more than 30% from its all-time high.

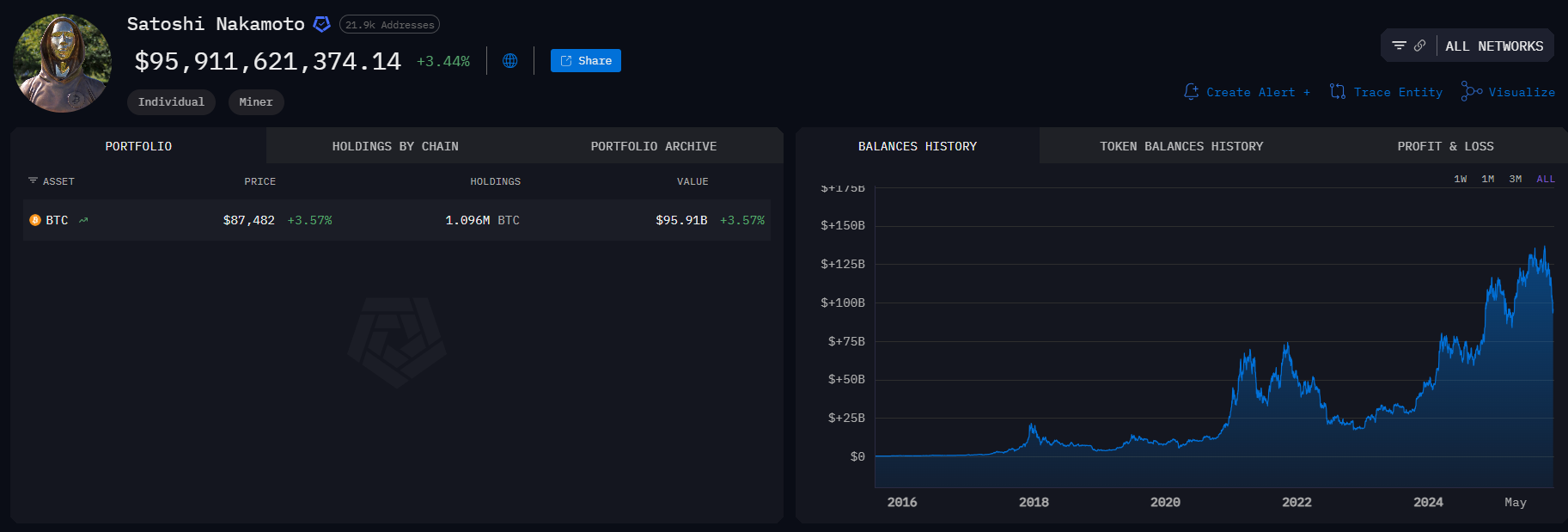

According to analyses from Arkham Intelligence and the Patoshi mining pattern, Satoshi’s 1.1 million Bitcoins fell from $138 billion in October 2025 to about $96 billion. This sharp decline moved the “Bitcoin pioneer” from 11th to roughly 20th place among the world’s wealthiest, just below Bill Gates.

Key points:

-

Satoshi’s Bitcoin holdings: 1.1 million BTC, identified through Sergio Lerner’s Patoshi pattern, concentrated in over 22,000 early mining addresses, untouched for more than a decade.

-

Massive asset drop: BTC hit $126,296 on October 6, 2025, valuing Satoshi’s holdings at $138.92 billion; currently BTC trades at $87,390, reducing his fortune to $96.13 billion.

-

Impact on wealth ranking: If Forbes ranked him, Satoshi would be just below Bill Gates and above Françoise Bettencourt Meyers & family, at position 20.

-

Unverified asset ownership: Forbes excludes Satoshi from official billionaire lists due to unverified identity and uncertainty whether he is an individual or a group.

-

Transparency yet mystery: Although the Bitcoins have never moved, their existence is highly visible on the blockchain. However, the assets could be considered lost, inaccessible, or abandoned.

-

Quantum computing risks: Quantum computers could potentially break early Bitcoin cryptography, prompting ideas to “freeze” Satoshi’s coins or fork the network before a possible “Q-Day.”

-

Satoshi in popular culture: The film “Killing Satoshi” will premiere in 2026, exploring the mystery and geopolitical implications of the dormant Bitcoin fortune.

-

Potential to become the richest person: If Bitcoin rises to $320,000–$370,000, Satoshi could claim the title of the world’s richest person. Currently, the fortune has remained untouched for over 15 years.

Satoshi Nakamoto remains an enigmatic symbol of Bitcoin, with a colossal fortune that is both highly visible and untouchable, sparking endless speculation among investors and the public.