A Bitcoin wallet dating back to the earliest days of the cryptocurrency has suddenly “come alive” after more than 14 years of silence. The address, believed to have mined around 4,000 BTC between April and June 2009, recently transferred 150 BTC — marking its first activity since June 2011.

A Rare Movement from the Satoshi Era

-

The coins, once worth only $67,000, are now valued at roughly $16 million.

-

According to Glassnode data, only a handful of pre-2011 wallets move funds each year, making each such event a notable occurrence.

-

These early-era wallets often attract attention because they date back to a time when Bitcoin’s mysterious creator, Satoshi Nakamoto, was still active in online discussions.

More Psychological Than Practical Impact

-

Historically, awakenings of old wallets have triggered short-term anxiety as traders fear that early holders might be preparing to sell.

-

However, in most cases, the funds were simply moved for security, inheritance, or reorganization, not liquidation.

-

The 150 BTC transfer represents a negligible fraction of Bitcoin’s daily trading volume, which exceeds $20 billion — meaning its actual market impact is minimal.

A Sensitive Moment for the Market

-

The move comes as Bitcoin consolidates around $110,000, following a sharp drop from its recent all-time high of $126,000.

-

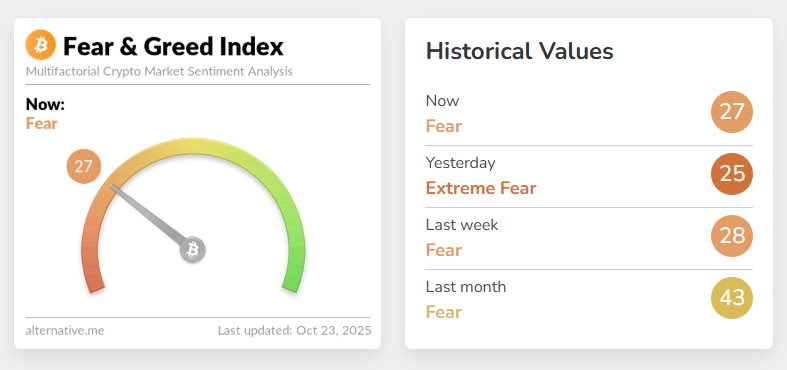

The crypto market is recovering from the largest liquidation event in history, with over $19 billion in leveraged positions wiped out.

-

In such a fragile environment, any sign of potential selling pressure from dormant wallets can easily amplify investor caution.

Likely Just Digital Housekeeping

-

Analysts suggest the owner might be migrating coins to a modern secure wallet, executing estate planning, or simply testing a transaction.

-

Unless these coins are later traced to exchange-linked addresses, it’s highly unlikely they were sold.

Bottom Line

The awakening of this 14-year-old Bitcoin wallet is a rare historical event rather than a signal of major market movement. It underscores Bitcoin’s longevity and enduring value since its inception — more a case of digital housekeeping than an omen of mass selling.