The Sandbox (SAND) continued its uptrend, reaching a yearly high of $0.86 on November 25. However, the price has since fallen nearly 30%, trading at $0.63 at press time. Despite the impressive rally, technical indicators and on-chain data suggest that a $1 price target remains unlikely at this point.

The Sandbox’s Long-Term Investors Take Profits

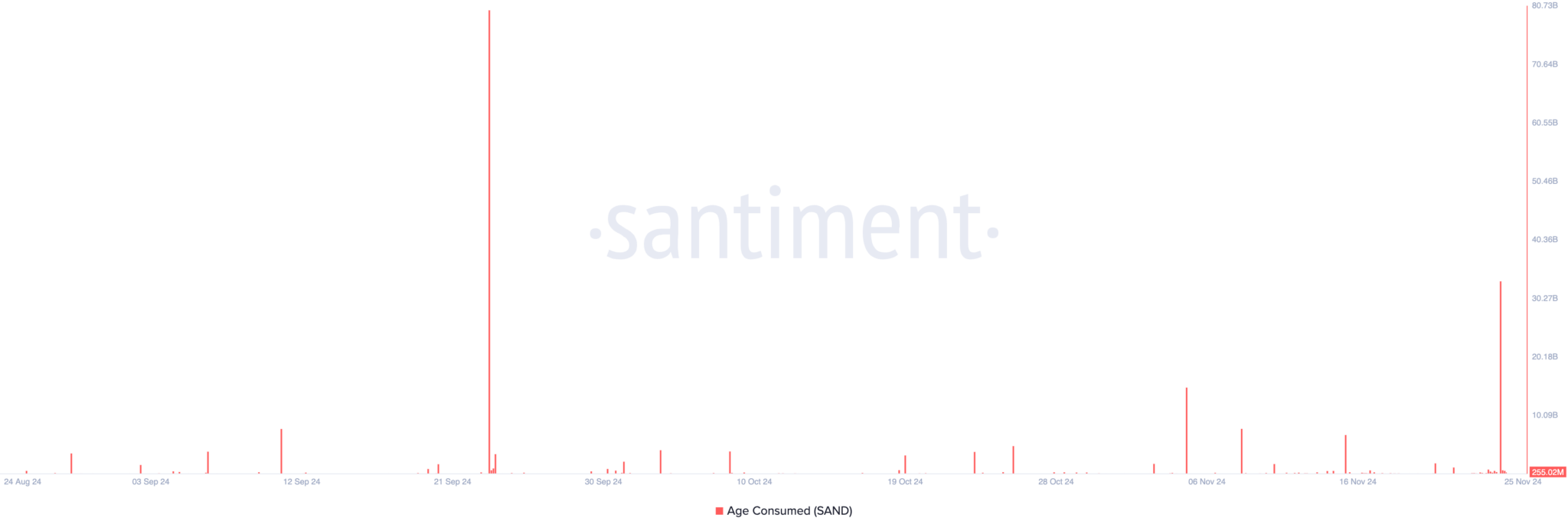

SAND’s rally over the past week has prompted long-term investors to move their previously “frozen” tokens. This is reflected in a spike in the “age-consumed” index, which reflects the movement of long-held coins. According to data from Santiment, the index hit a two-month high of 33.19 billion on Sunday.

This spike is notable, as long-term investors are less likely to move their coins. Therefore, when this happens, especially during a bull run, it signals a change in market sentiment. Sharp increases in the age-consumed indicator during such a bull run indicate that long-term investors are selling, which could put more selling pressure on the market.

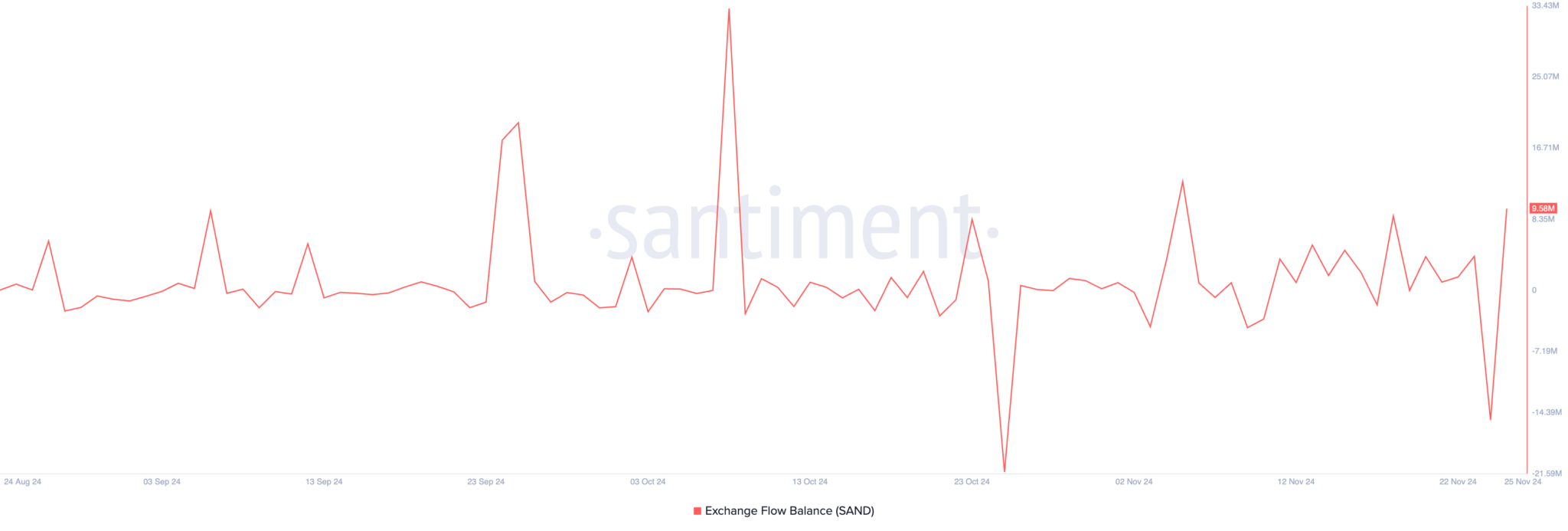

Notably, the increase in SAND’s Exchange Flow Balance over the past 24 hours confirms the selling activity. According to data from Santiment, the metric – which measures the net difference between the amount of assets deposited to exchanges and the amount withdrawn over a given period – has increased by 162%.

This suggests that a large amount of SAND tokens are being deposited to exchanges, suggesting that investors are preparing to sell, which could put downward pressure on the price.

SAND Price Forecast: Metaverse Token Is Overbought

On the daily chart, SAND’s Relative Strength Index (RSI) is at 87.18, indicating overbought conditions. RSI is an indicator that measures how overbought or oversold an asset is, ranging from 0 to 100. A reading above 70 indicates that the asset is overbought and could potentially decline, while a reading below 30 indicates oversold conditions and a potential price recovery.

Read more: Will Donald Trump Appoint Ripple’s CEO to a Crucial Role?

With RSI at 87.18, SAND is in overbought conditions, increasing the risk of a short-term downside correction. If the price declines, SAND could fall to $0.72. If selling pressure continues to increase at this level, SAND could fall further to $0.61, making the $1 target even more distant.

Conversely, if the selling pressure eases, SAND price could recover and reach this year’s high of $0.86, thereby rejecting the aforementioned bearish scenario.