Real World Assets have taken the blockchain world by storm

Real-world assets have taken the blockchain world by storm, emerging as one of the hottest trends in the field. At the time of writing, Real-World Assets (RWA) represent the eighth-largest DeFi subsector, boasting a total locked value (TVL) of $1.46 billion.

RWA, known more commonly in the blockchain space, is a unique blend of traditional finance (TradFi) and digital assets, offering immense potential and numerous opportunities for both industries to harness in the near future.

So, what’s the buzz about RWAs? As the name suggests, RWAs exist in the physical world and constitute a vital component of the TradFi market. Examples include real estate, commodities, bonds, artworks, currencies, and more.

Through tokenization, these off-chain assets find their way onto the blockchain, creating new investment opportunities for DeFi enthusiasts. The next question that might come to mind is, why tokenize in the first place?

Well, tokenizing RWAs brings similar benefits that any decentralized setup aims to provide. Notable among these are the elimination of intermediaries, the ability to trade 24/7 as opposed to the “business hours” of TradFi, while enhancing transparency and trust.

Furthermore, RWA investments may be less affected by the notorious volatility of cryptocurrencies, making it no surprise that many TradFi giants are increasingly showing interest in these new assets.

Current Market Status

Binance recently published a blog delving into the state of the market and emerging trends in the appropriate ecosystem.

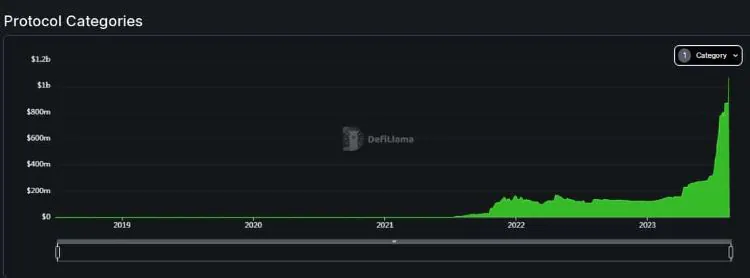

According to DeFiLlama, RWA ranks as the eighth-largest DeFi subsector, with a TVL of $1.46 billion at the time of writing. This surpasses the locked liquidity on decentralized derivative exchanges.

As evident from the chart, RWA has experienced explosive growth in Q3 of 2023. Starting from a TVL of just $316 million at the end of Q2, this sector has quadrupled in size as of the time of writing. Year-to-date (YTD), this growth equates to a staggering 1,100%, a remarkable feat for a market believed to be in its early development stages.

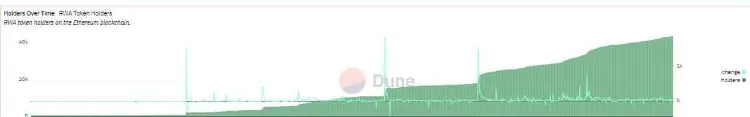

The increasing adoption is also reflected in the steady rise of token holders. According to Dune, approximately 43,518 RWA token holders have joined the Ethereum blockchain as of the time of writing, representing a 75% growth compared to the previous year.

Tokenizing the U.S. Treasury on the Blockchain

One of the biggest success stories in the RWA space is the tokenization of the U.S. Treasury. The U.S. Treasury, or government-issued debt, remains one of the safest and most reliable havens in times of turmoil in the TradFi market.

Moreover, yields from these investments have recently risen consistently as investors bet on the Federal Reserve to continue raising interest rates. Higher bond yields typically have a negative impact on riskier assets like stocks and DeFi, as capital flows to higher-yielding instruments are a natural move.

However, with the tokenization of the U.S. Treasury, DeFi investors can enjoy real yields through blockchain technology.

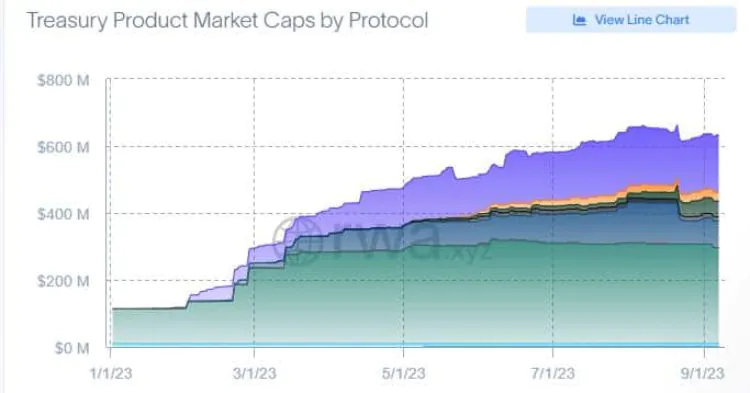

According to rwa.xyz, the total value of all tokenized Treasury-backed assets stands at $632 million at the time of writing, with an appealing average yield of 5.25%.

Ondo Finance and Franklin Templeton have emerged as major RWA protocols providing liquidity for short-term U.S. securities.

Most of these projects are built on Ethereum, which currently boasts the largest market capitalization at around $315 million USD. However, Stellar [XLM] is also a significant contender as it hosts the Franklin Templeton protocol.

Related: What is Real World Asset?

Maker’s RWA Push Strategy

Lately, MakerDAO, a decentralized central bank, has been working to assign a larger role to real-world assets (RWA) in the collateral reserve of the stablecoin DAI. It has allocated a portion of its earnings through U.S. Treasury Bonds to provide high yields to stablecoin holders, resulting in a significant increase in DAI’s circulating supply.

The long-term potential of RWA seems promising. Binance has declared that the tokenized asset market is expected to grow to $16 trillion USD by 2030.