What is Rocket Pool?

-

Rocket Pool is a decentralized staking network on Ethereum. Allows users to stake ETH with a minimum amount of 0.01 ETH.

-

It aims to make participating in Ethereum 2.0 staking more accessible. Especially for those who own small amounts of ETH.

-

Rocket Pool operates as a network with node operators pooling ETH from users and managing the staking process.

Featured

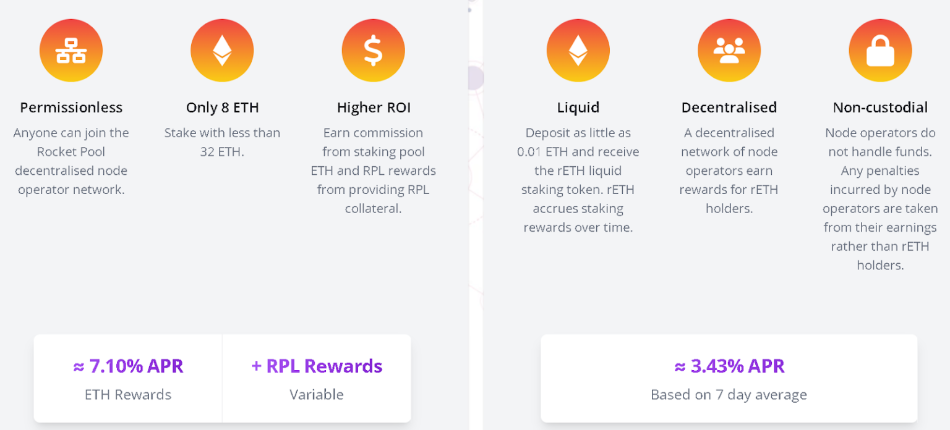

Rocket Pool is a decentralized staking network that stands out for its inclusivity. It allows users to start staking from as little as 8 ETH, and with less than 32 ETH. They can participate in creating new authenticators. This helps create widespread outreach. Suitable for both large and small ETH holders.

Owning rETH tokens provides staking rewards. And this token can be purchased on Uniswap or other platforms. Or even borrow from Aave. This is especially beneficial for those who do not need 32 ETH to participate. Includes non-node operators.

Rocket Pool operates as a decentralized network with node operators responsible for running validator nodes. And maintain network performance and security. Using smart contracts, Rocket Pool manages nodes, rewards, and penalties. To ensure the betting process is transparent and safe.

Node operators earn commissions from rewards. Created when 16 or 24 ETH are pooled from stakers who are not node operators. With the commission level always at 14%. The annual percentage rate (APR) is currently 3.50%. For individuals who own at least 8 ETH. They can participate in staking and run a node. Offers an APR of 7.48%, surpassing the staking-only model and variable RPL bonuses.

What is Lido?

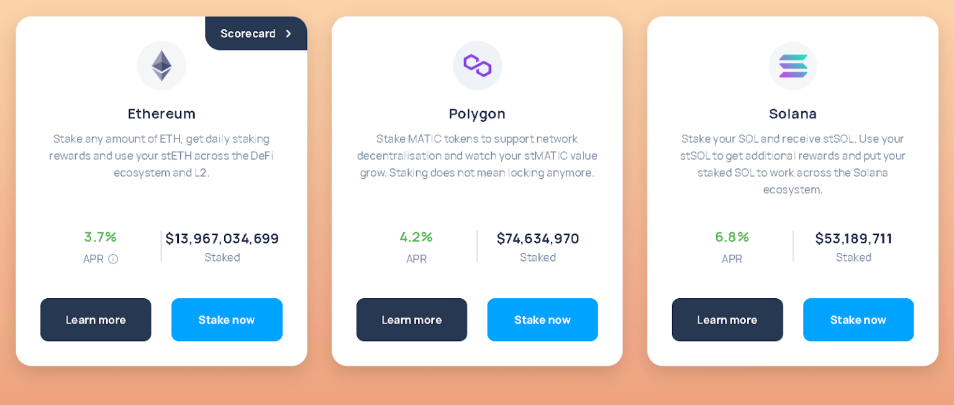

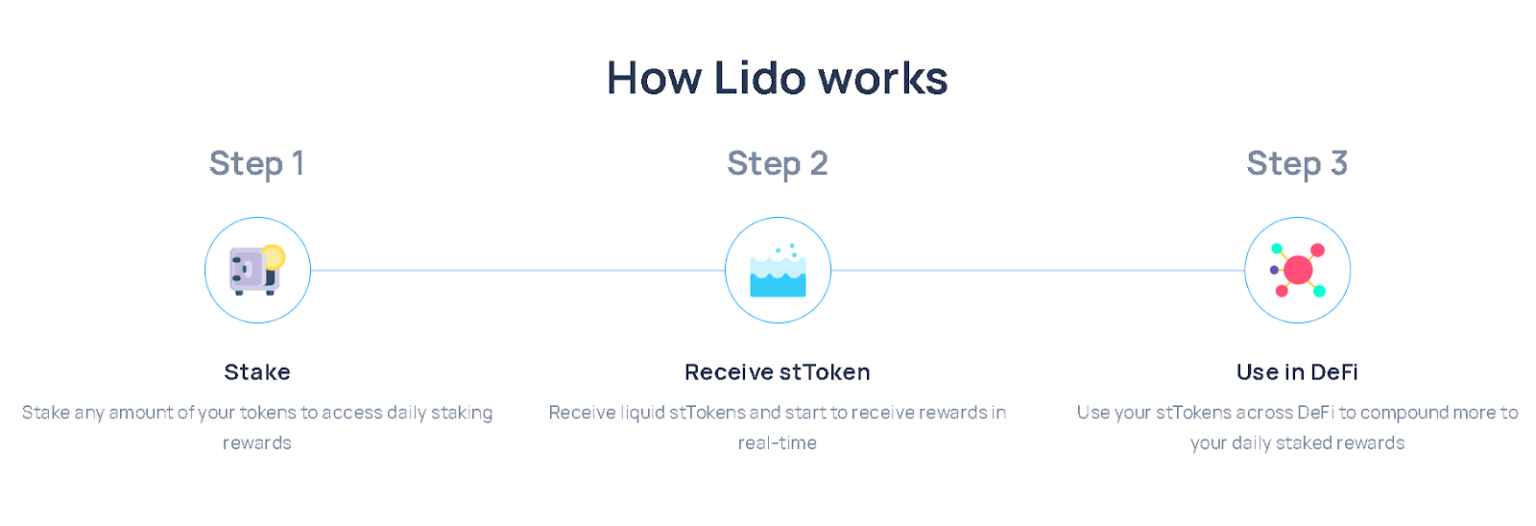

Lido is a decentralized platform that allows users to stake ETH in Liquid form. Helps them maintain flexibility and liquidity while earning staking rewards. The platform is an open source software toolkit that operates on the Ethereum, Solana, and Polygon blockchains.

Lido users receive stETH tokens in exchange for their staked ETH. Can be easily traded or used in DeFi applications. Additionally, Lido involves a governance token, LDO. Allows token holders to participate in decision-making within the community.

Featured

Lido allows you to stake your ETH while maintaining liquidity. The stETH token is freely tradable on multiple decentralized exchanges (DEX). Lido’s smart contracts are designed to be secure and trustless. Ensuring the safety of users’ assets and rewards.

Lido acts as a liquidity staking pool that aggregates ETH from users and represents them in staking on Ethereum 2.0. A team of professional node operators manages this pool. Lido uses LDO tokens for governance. LDO holders can vote on proposals and decisions related to the operation of the platform.

Lido cooperates with professional node operators. To ensure the highest level of betting performance and security. The platform taxes a 10% fee on staking rewards. Lido allows users to stake native tokens from the Ethereum, Polygon, and Solana networks without restrictions.

stETH is a non-rebased token, meaning its value does not change over time. The number of stETH tokens held by users remains the same. Regardless of any fluctuations in the value of the underlying asset. wstETH is a token that represents a user’s stake in the Ethereum 2.0 Beacon Chain. The amount of wstETH tokens a user holds may change over time as the value of the underlying asset increases or decreases.

Comparative Analysis

Rocket Pool and Lido: Minimum wagering requirements

Rocket Pool has a minimum staking requirement of 0.01 ETH. Helps accommodate all ETH holders.

Lido has no minimum wagering requirements. Could eliminate smaller ETH holders.

Rocket Pool and Lido: Liquidity and Flexibility

Rocket Pool provides liquidity through the rETH token. Represents staked ETH usable in DeFi applications.

Lido DAO provides liquidity through the stETH token. Allows trading of staked ETH without waiting for the lockup period to end.

Rocket Pool and Lido: Node Complexity

On Rocket Pool, users can become node operators. But requires technical expertise, which may limit the number of available nodes.

Lido DAO cooperates with professional node operators. Guaranteed expertise for reliable betting.

Related: What Is Lido DAO? What Is An LDO Used For?

Rocket Pool and Lido: Governance

Rocket Pool uses RPL tokens for governance. Helps token holders participate in network decisions.

Lido DAO uses LDO tokens for governance. Allows token holders to participate in the decision-making process.

Rocket Pool and Lido: Concentration risk

Rocket Pool operates as a decentralized network of node operators. Minimize concentration risk.

Lido DAO cooperates with professional node operators. May increase risk of concentration.

Rocket Pool and Lido: Token volatility

The value of RPL tokens on Rocket Pool may be unstable. Influences users’ income and administrative participation.

The LDO token on Lido DAO may also experience volatility. Influences user administrative participation.

Rocket Pool and Lido: Performance dependence

Rocket Pool depends on the uptime and performance of node operators. Any downtime can impact network performance.

Lido DAO cooperates with professional node operators to ensure high-performance staking.

Conclusion

To conclude the comparative analysis between Rocket Pool and Lido. Rocket Pool offers inclusivity with a minimum staking requirement of 0.01 ETH.

However, technical expertise is required for the node operator. And face the volatility of the RPL token. In contrast, Lido DAO focuses on liquidity through the stETH token.

Cooperate with professional node operators. There are no minimum wagering requirements as well as minimal concerns about concentration. Users need to weigh their priorities to choose between inclusivity. And the flexibility of Rocket Pool or the liquidity and professionalism of Lido DAO. When participating in decentralized staking in the rapidly growing DeFi landscape.