Robinhood Makes Crypto Trading Debut in Europe, Featuring Solana, Polygon, and Cardano

In a strategic move to broaden its reach within the digital asset landscape, Robinhood has officially introduced cryptocurrency trading services in the European Union. This strategic expansion aligns with the company’s earlier announcement of its intentions, as detailed in a recent quarterly earnings report.

This foray into the European market represents a significant milestone for Robinhood, a company that gained prominence through its involvement in the meme-stock trading craze of early 2021.

Robinhood’s venture into Europe encompasses a noteworthy selection of 26 cryptocurrencies. Notable among them are SOL, MATIC, and ADA, representing the tokens associated with the Solana, Polygon, and Cardano blockchains. Intriguingly, these specific cryptocurrencies had previously faced delisting from Robinhood’s U.S. platform in June, citing regulatory hurdles as the primary cause.

Johann Kerbrat, Robinhood’s Head of Crypto, emphasized the robust regulatory framework within the European Union as a pivotal factor influencing their decision. He articulated, “The EU has developed one of the world’s most comprehensive policies for crypto asset regulation, which is why we chose the region to anchor Robinhood Crypto’s international expansion plans.”

Since its inception, Robinhood has demonstrated a pronounced interest in the cryptocurrency market. Commencing with the introduction of Bitcoin and Ethereum trading options in 2018, the platform has consistently diversified its crypto offerings, integrating them as a fundamental component of its business model.

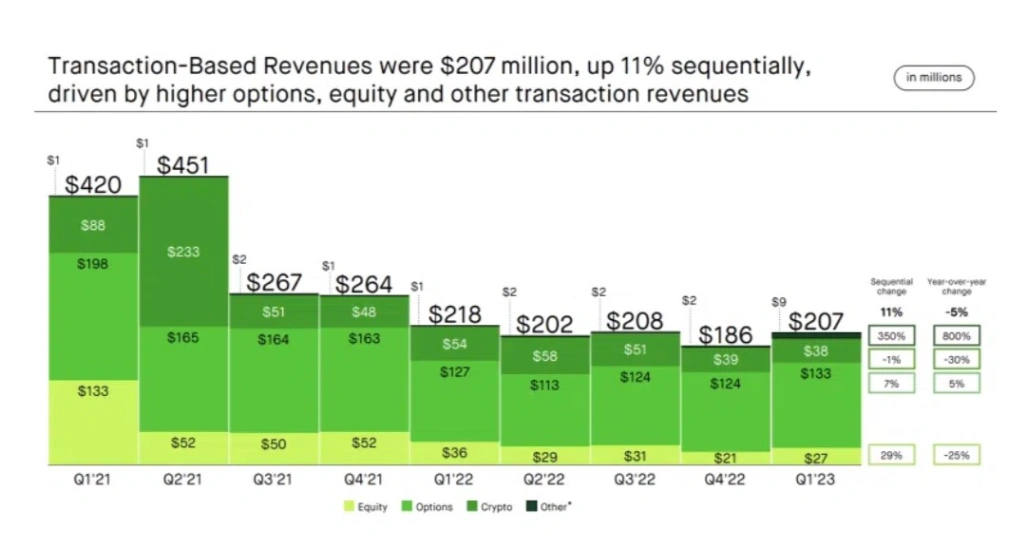

Despite encountering regulatory scrutiny and facing challenges such as reduced crypto transaction revenues, Robinhood remains steadfast in its commitment to the cryptocurrency sector. This latest move to enter the European market underscores the company’s determination to navigate and thrive in the evolving landscape of digital assets.

Expanding Presence: Robinhood Sets Sights on UK Market

Simultaneously with its crypto services in Europe, Robinhood is gearing up for its entry into the UK market in early 2024, marking the company’s third foray into international expansion.

The forthcoming UK platform by Robinhood aims to provide access to a diverse range of 6,000 US stocks and the flexibility of 24-hour trading across five days each week. Jordan Sinclair, Robinhood’s UK chief, accentuated the platform’s adaptability to the dynamic nature of modern trading, stating, “Customers can actively make trades, choose their investment strategy, and respond to market news promptly.”

Despite facing challenges in its previous attempts at UK expansion, including the retraction of plans amid domestic demands during the COVID-19 pandemic, Robinhood exhibits resilience and adaptability in its ongoing pursuit of diversifying offerings and exploring new markets.

Related: FTX Deposits 22 Million Crypto Assets onto Exchanges

As the launch in the UK approaches, Robinhood is poised to introduce distinctive trading opportunities, challenging and redefining the boundaries of retail investing. The company’s licensure from the Financial Conduct Authority serves as a testament to its commitment to stringent regulatory standards, solidifying its position as a dependable and innovative player within the financial services sector.