Ripple Issues Over 13 Million RLUSD Ahead of Launch

According to data from Ripple’s stablecoin tracker, the company has issued a total of 13.9 million RLUSD tokens across two blockchain networks, the XRP Ledger and the Ethereum Network.

On the XRP Ledger, Ripple issued 2.6 million RLUSD, along with three other issuances of 100,000, 160,000, and 640,000 RLUSD tokens, respectively. Meanwhile, on the Ethereum Network, Ripple issued 10.4 million and 640,000 RLUSD tokens.

Stablecoin RLUSD, which is fully backed by US domestic assets, has undergone rigorous testing involving issuance and transfer on these blockchain networks. Ripple claims that these tests are to ensure the stability and efficiency of the stablecoin before its official launch.

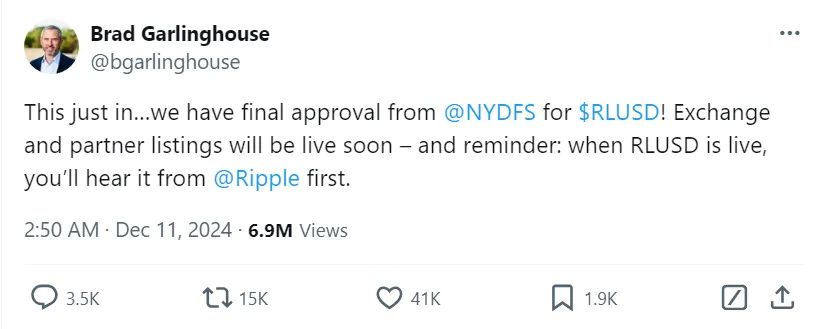

In addition, Ripple CEO Brad Garlinghouse shared on X (formerly Twitter): “When RLUSD officially launches, Ripple will be the first to let you know.”

Regulatory approval puts RLUSD ahead of competitors

Ripple has received approval from the New York Department of Financial Services (NYDFS), making RLUSD one of the few stablecoins regulated in the United States. Unlike competitors such as USDT and USDC, RLUSD meets the strict requirements of US financial regulations, including the Dodd-Frank Act and Basel III standards.

Read more: Bitcoin Continues to Rally as Whales Accumulate

The RLUSD stablecoin is fully backed by US government bonds and held in regulated institutions, ensuring compliance with Federal Reserve and FDIC guidelines. This approval positions RLUSD as a trusted asset for financial institutions. Ripple emphasizes that transparent operations, including real-time auditing, differentiate RLUSD from other stablecoins. USDT, for example, has been criticized for inconsistent audits, while USDC operates partly overseas, making it difficult to comply with some US standards.