In a December 15 post on social media platform X, Schwartz predicted that RLUSD would experience significant volatility immediately after its launch, with large buy orders placed for the token, despite RLUSD being designed to maintain a 1:1 ratio with the US dollar.

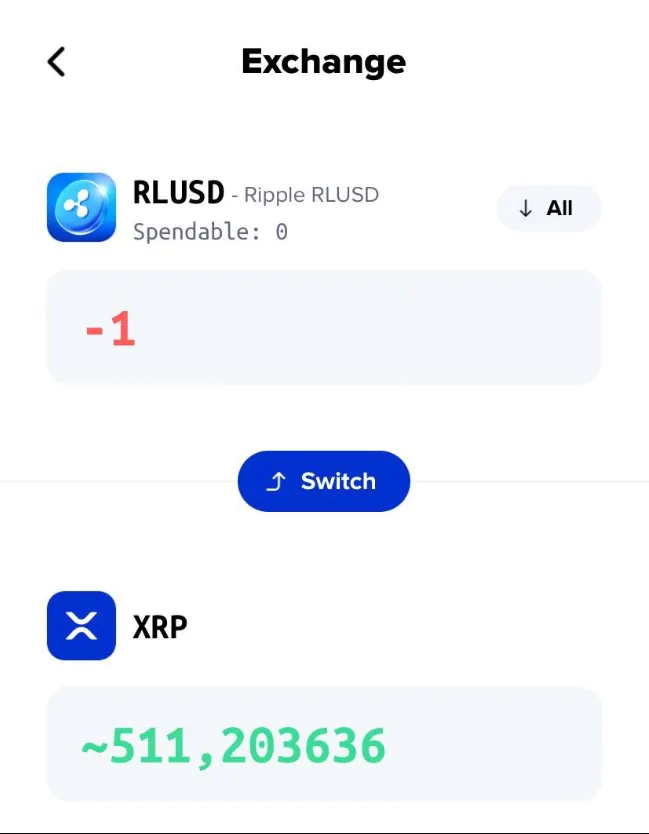

He also pointed out that some of the initial small buy orders in the market, before the stablecoin was officially launched, had artificially inflated its value. Specifically, he responded to a post on X that showed 1 RLUSD was valued at around 511 XRP (XRP), equivalent to $1,244 at current prices, on a Ripple wallet called Xaman.

“The reality is that someone is willing to pay $1,200 for a fraction of a RLUSD,” Schwartz said. He noted that the purchase order appears to be someone who wants the “honor” of being the first to own RLUSD when it launches.

“But rest assured, the price will quickly return to near $1 as soon as the supply stabilizes. If not, there is a very serious problem,” he said. “Don’t FOMO on a stablecoin! This is not a get-rich-quick opportunity,” Schwartz asserted.

On December 11, Ripple CEO Brad Garlinghouse announced that RLUSD had received final approval from the New York Department of Financial Services (NYDFS). Ripple’s official account on the X platform also confirmed that the stablecoin will launch soon.

Once RLUSD goes live, Ripple plans to use both RLUSD and XRP in its cross-border payments solution to serve global customers, according to an announcement about the beta testing phase of RLUSD.

Read more: Bitcoin Hits New All-Time High, Target Set at 900K USD

In June, Ripple President Monica Long said that RLUSD is designed to “complement and enhance” XRP. According to some sources, Ripple sees RLUSD as an advantage for XRP as the two coins will be combined.

XRP will help increase liquidity for RLUSD thanks to its high popularity on exchanges, while the value of the RLUSD stablecoin will be stabilized through this combination, avoiding loss of pegging. Ripple Labs CEO Brad Garlinghouse emphasized that RLUSD will primarily focus on serving large financial institutions.