In the ongoing legal tussle between the U.S. Securities and Exchange Commission (SEC) and Ripple Labs over the motion to compel remedies-related discovery, Ripple is urging the court for a sur-reply to rectify a substantial misrepresentation of facts put forth by the securities regulator.

This move comes in response to the SEC’s supporting reply for its motion to compel, where the regulatory body seeks Ripple’s audited financial statements for the last two years, post-complaint contracts related to XRP transfers to “non-employee counterparties,” and specifics regarding the “XRP Institutional Sales proceeds.”

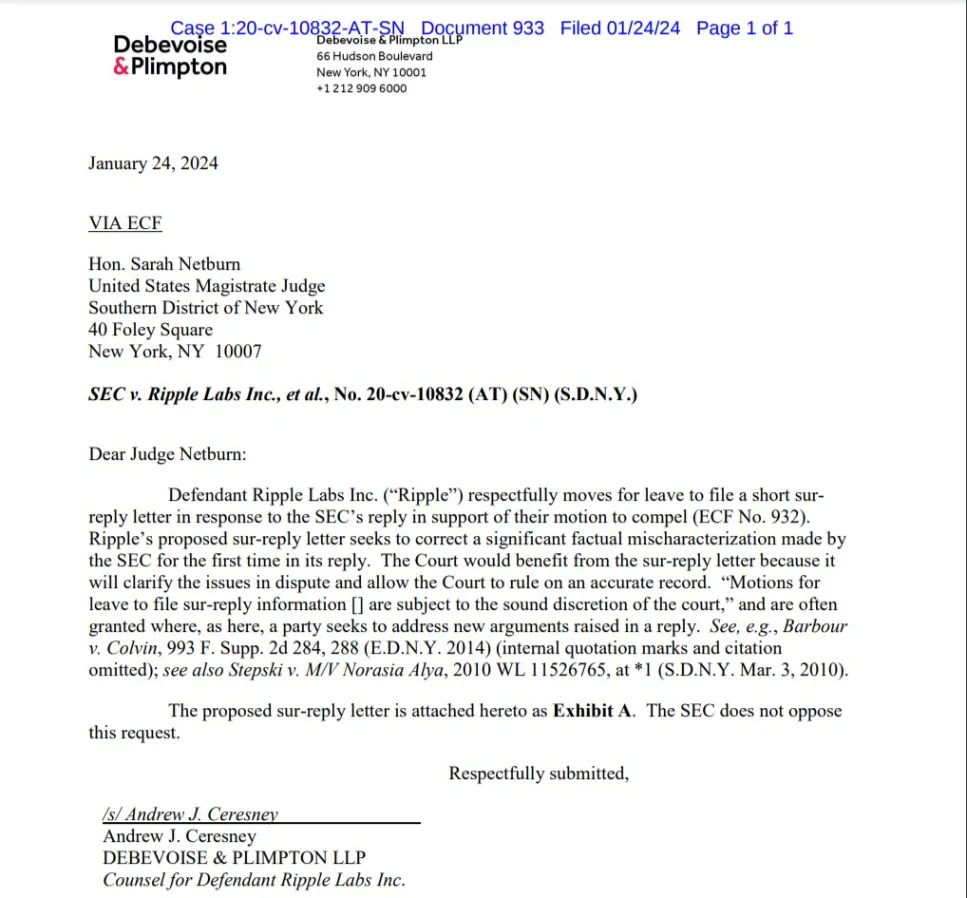

Addressing what it terms as false misstatements by the SEC, Ripple dispatches a letter to Magistrate Judge Sarah Netburn to rectify the factual mischaracterization present in the SEC’s reply supporting its motion to compel, according to court filings on January 24. Ripple emphasizes the significance of the sur-reply, asserting that it will help clarify the points in dispute, enabling the court to make decisions based on an accurate record.

Included in the request for a sur-reply is an exhibit where Ripple Labs’ attorneys express disagreement with various contentions in the SEC’s reply. However, Ripple underscores that its primary aim is to correct a substantial misstatement of fact made by the SEC in this instance.

Ripple has refuted the SEC’s claim that it “does not … argue that it would be burdened in producing” post-complaint contracts, labeling it as false. In its objection, Ripple explicitly highlighted that the SEC’s request is “overly burdensome” and would necessitate an entirely new trial.

Contrary to the SEC’s statement that Ripple has “recently catalogued and presumably produced, in the ongoing class action suit, all of Ripple’s XRP sales contracts from 2020 to June 2023, including determining the identity of the counterparties to those contracts,” Ripple asserts that this is a misstatement.

Related: Gemini Unveils New XRP Trading Product Amid Community Excitement

Additionally, the declaration made by Carolyn Dicharry in Zakinov v. Ripple Labs is also disputed by Ripple, as the company maintains that it has not produced any contracts after December 22, 2020. Pro-XRP attorney Bill Morgan expressed surprise at the significant factual mischaracterization by the SEC regarding the post-complaint contracts disclosed by Ripple in the Zakinov lawsuit, stating, “No way. The SEC wouldn’t do that. Surely not?”