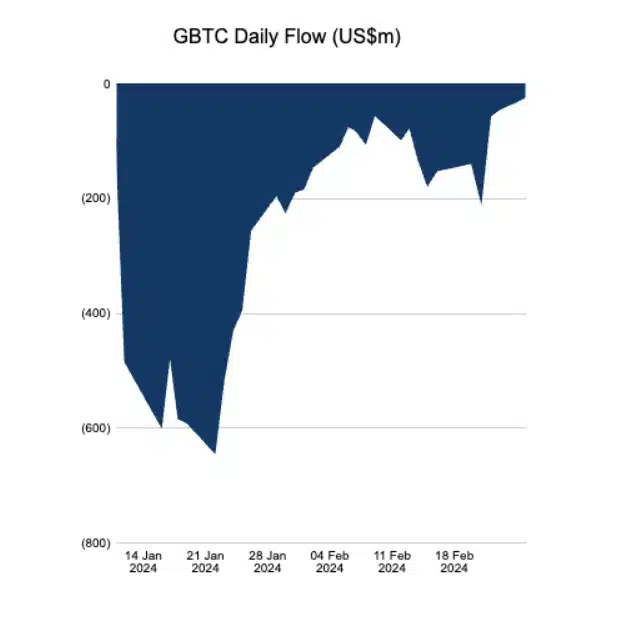

Grayscale’s Bitcoin exchange-traded fund (ETF) has experienced a notable decline in net outflows for the third consecutive trading day, reaching a historic low of $22.4 million. This decrease coincides with a broader trend in the ETF market, which has observed a two-week high in net inflows.

According to data from Farside Investor on February 26, the Grayscale Bitcoin Trust (GBTC) exhibited a consistent reduction in net outflows on February 22, 23, and 26. The trading week concluded with a daily net outflow of $44.2 million, and this trend continued with outflows being halved on February 26.

It is worth noting that Grayscale has encountered 31 consecutive trading days of outflows since transitioning to an ETF on January 11, resulting in a total depletion of $7.47 billion from the ETF.

On February 26, Blockstream CEO Adam Back expressed optimism, stating that he anticipates the day when GBTC registers an inflow. Back acknowledged the possibility, suggesting that it would require a “just enough premium” to motivate traders to engage in arbitrage with the ETF.

Henrik Andersson, Chief Investment Officer at Apollo Crypto, echoed a similar sentiment in a separate post on X, emphasizing that the first occurrence of a net inflow in Grayscale’s fund would send a powerful signal to the market.

First time $GBTC post a black number will be a mega signal to the market. https://t.co/LaRyaSU7WG

— Henrik Andersson (@phenrikand) February 26, 2024

Meanwhile, according to Farside’s data for February 26, the collective net inflows of all Bitcoin ETFs, excluding Invesco and Galaxy, reached $515.5 million – marking the highest figure in the past two weeks.

Despite a peak combined net inflow of $631.3 million on February 13, the ETFs struggled to sustain momentum. On February 21, there was a net outflow of $35.6 million, attributed to a comparatively larger outflow from GBTC and smaller inflows into other funds.

Related: Analyst Forecasts Bitcoin to Reach $100,000 by 2024

Fidelity’s ETF experienced the majority of inflows on February 26, totaling over $243 million and constituting nearly half of the day’s net total. This marks the second-highest inflow day for FBTC, surpassed only by January 17.

The remaining portion of the net inflow came from BlackRock’s ETF, along with contributions from ARK Invest and the 21Shares fund, garnering respective inflows of nearly $112 million and over $130.5 million.