Top altcoins like Ethereum (ETH) and BNB underperformed last week, as their charts remained in the red. However, a recent analysis suggests a potential trend reversal is on the horizon.

If this prediction holds true, ETH and BNB might experience a significant price surge.

Are altcoins poised for a rally? According to CoinMarketCap data, ETH saw a 7% price correction last week. At the time of reporting, the leading altcoin was trading at $3,230 with a market capitalization exceeding $388 billion.

Similarly, BNB short-sellers dominated the market last week, driving its price down by over 2% in the past seven days. As of the latest update, BNB was trading at $578 with a market cap surpassing $84 billion.

Despite this, the overall trend for these altcoins could shift dramatically in the coming days.

Moustache, a renowned crypto analyst, recently tweeted about a significant development. According to the tweet, altcoins have been forming a textbook cup and handle pattern over the past few years. This pattern indicates that altcoins, including ETH and BNB, are likely to enter a bullish phase soon.

#Altcoins

Altcoins have formed a textbook cup & handle pattern over the last few years.

The most exciting phase of this cycle is just around the corner.

New ATH’s next. pic.twitter.com/GxbMNfZNzo

— 𝕄𝕠𝕦𝕤𝕥𝕒𝕔ⓗ𝕖 🧲 (@el_crypto_prof) July 27, 2024

Thus, plans have been made to closely examine the status of these coins to determine if they suggest an impending price surge.

Status of ETH and BNB

An analysis of CryptoQuant data reveals that BTC’s exchange reserves are rising, indicating significant selling pressure on the token. However, the derivatives market outlook appears quite optimistic.

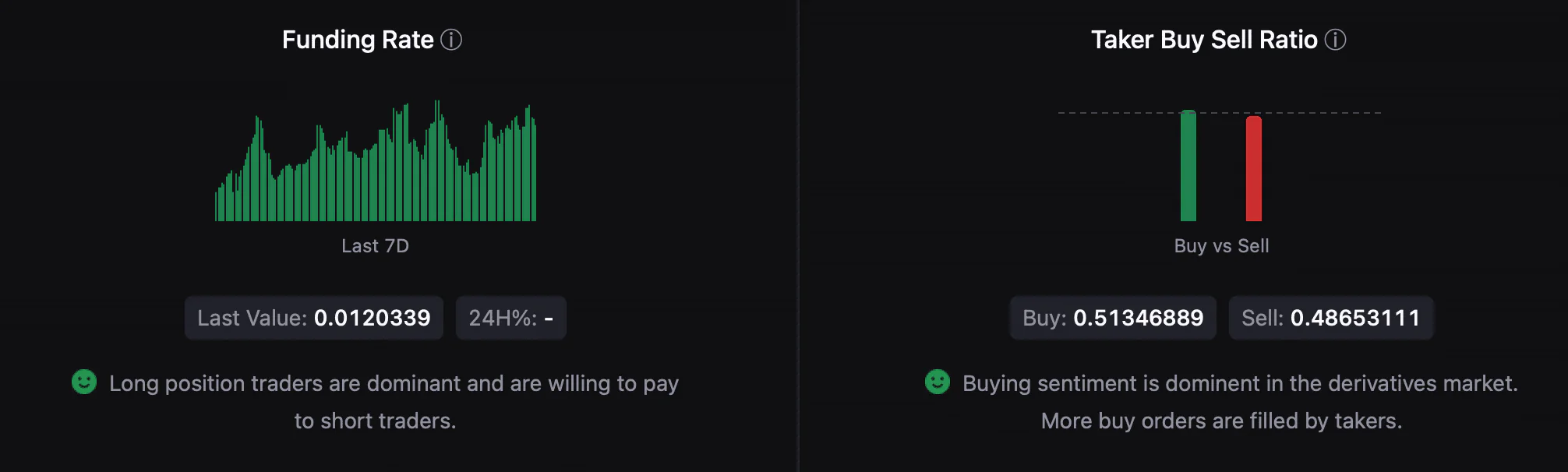

The token’s funding rate is in the green, meaning long position traders are dominant and willing to pay for short position traders. Additionally, the buy/sell ratio indicates that buying sentiment prevails in the futures market.

Examining Ethereum’s daily chart, we observe that the MACD technical indicator shows a bearish crossover.

ETH’s Relative Strength Index (RSI) also recorded a decline, suggesting that investors might have to wait longer for ETH to shift back to an uptrend.

Next, we check on BNB’s performance. The coin’s social trading volume increased last week, reflecting its popularity.

However, its weighted sentiment remains in negative territory, clearly indicating that bearish sentiment dominates the market for BNB.

Similar to Ethereum, BNB’s technical indicators also appear pessimistic. For instance, the MACD suggests a potential price correction. Moreover, the Relative Strength Index (RSI) is also trending slightly downward.